The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Most day traders obsess over price action and entries - but the real breakthroughs happen when you start analyzing your own performance. In this article, we’ll walk you through seven powerful insights that can instantly highlight where your trading is working, where it’s falling apart, and how to fix it. These aren’t vague tips—they’re data-backed discoveries we see again and again in our Edgewonk journal reviews. Whether you’re trading stocks, futures, forex, or crypto, this guide will show you how to cut screen time, improve results, and build discipline—one trade at a time.

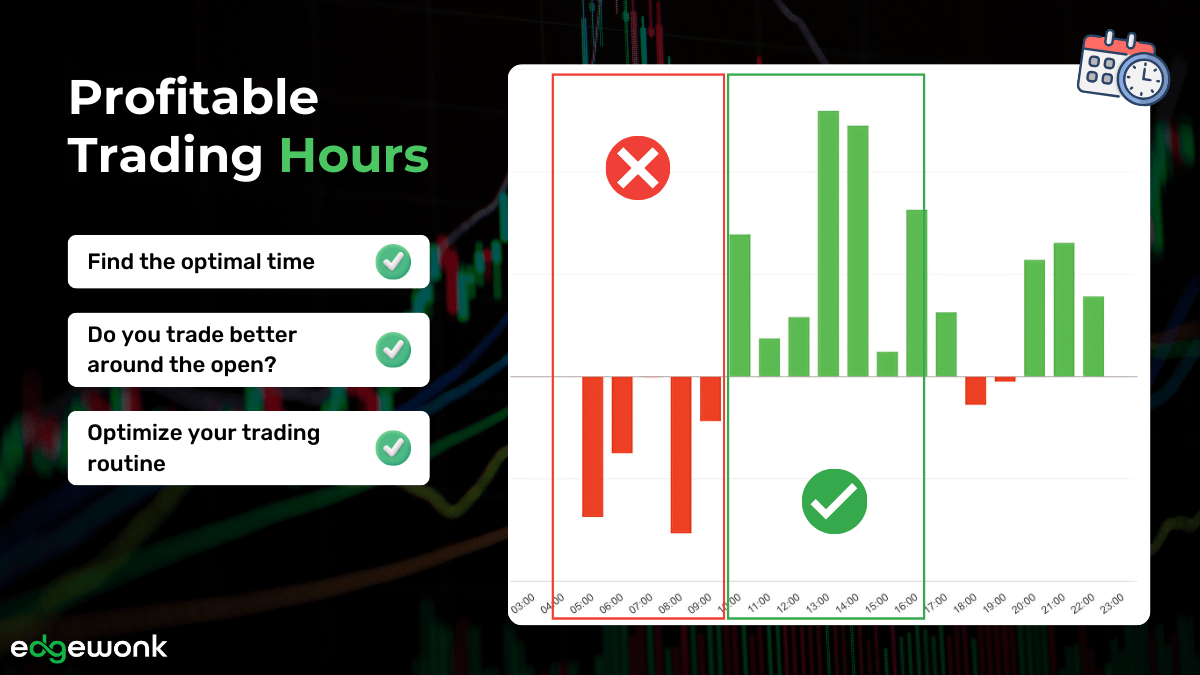

Day traders typically thrive on volatility. And volatility reliably kicks in around the market open or around news releases, whereas before the open or a big news release, price often just meanders and goes nowhere.

In our journal reviews we often see this pattern – a trader is quite profitable around open – but then loses momentum later into the session, giving back all profits.

This is not bad news; this is great news. You can trade less, have less screen time and improve your results!

And it does not matter whether you trade the stock market, the futures, crypto or the forex market – this is a pattern that is true for all traders!

Especially newer traders struggle with trading too many setups. In our reviews, we have seen time and again that many traders trade 7, 8, or even more trading strategies at the same time. This typically leads to inconsistencies, confusion, and underperformance.

The best traders we have seen trade a maximum of three strategies simultaneously. This allows them to fully understand the nuances of the setups, reduce noise, miss fewer trades, and overall improve the quality of their trading.

Do you still think entries are the most important thing in trading? While most traders focus solely on entries their entire career, they could get much better results by improving their trade exits and stop loss placement to increase the size of their winners and boost their reward:risk ratio.

Our alternative strategies feature lets you test any stop loss, any take profit setting, any position trailing idea you have, to find the best trading approach for your entries – no need to back test for hours and days on end.

Just go over your old trades, see how different trading approaches would have performed, and make your adjustments based on hard, cold facts.

Just like the time of day, many traders have profitable and not-so profitable days, as well.

For most, either Mondays or Fridays stand out. Whether it is that Monday has typically a lower volatility or whether the trader is over-eager to get into the market after the weekend.

On the other hand, an underperformance on Fridays is often due to a lack of focus after a tiring week, or because traders want to hit their performance goals, pushing their risk beyond reasonable levels.

Day trading is a fast-paced game. Often, trades come one after the other – and losing or winning streaks can happen within hours or even minutes sometimes.

This takes a toll on our emotional control. As a day trader, it is easier to go on tilt and break your rules, than as a swing trader, where you have a lot of time to think about each decision.

Our efficiency measures how well you execute your trades and whether you stick to your rules. An efficiency reading of 90% or higher is what you ideally want to achieve – meaning out of 10 trades, you only make a mistake on one of them.

If you drop below that number, you know what you need to work on - your execution and behavioral skills. Focusing on keeping your efficiency level high is a great performance-goal that will help you improve the quality of your trading.

In the spirit of efficiency, the Edgewonk trading journal tells you how you are doing after a winning or losing streak.

Knowing when your performance deteriorates is incredibly important especially as a day trader because you can undo weeks and months of work in a single bad day if you let it happen.

If you perform badly after 3 losing trades in a row – make that your stop loss limit for the day! Close the charts and come back tomorrow to fight another day.

Conversely, if euphoria sets in after a streak of winners, and you tend to give back a lot to the market after that, you can put mechanisms in place, i.e. halving your position size after x winners in a row.

Edgewonk helps you make that decision based on data – so you can add those rules to your trade plan with confidence.

One of the biggest problems traders have is not being able to let their winning trades run long enough, leaving a lot of performance on the table. That is why we built the Trade Management analytics into Edgewonk.

The Trade Management graph shows you immediately if you could have made more money by not interfering with your trades while they are running. If your potential performance is above your actual performance in your Edgewonk, it means you should stop managing your trades actively and trust in your initial analysis and target.

It’s a first easy and quick fix that can boost your bottom line before you ever do a deep dive with our alternative strategies. For many traders, this even makes the difference between losing and profitable.

If you want to improve your day trading within the shortest amount of time, there is no way around our day trading journal.

And, of course, you can import your trades from hundreds of brokers trading platforms within seconds and then edit them further in Edgewonk to get deeper insights into your performance.

The 7 stats mentioned will bring your trading to a whole new level quickly and, of course, we have many other stats and tools on top of that. You can go even deeper with the help of our custom statistics, personalize Edgewonk to your needs and keep improving your trading one step at a time.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...