The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

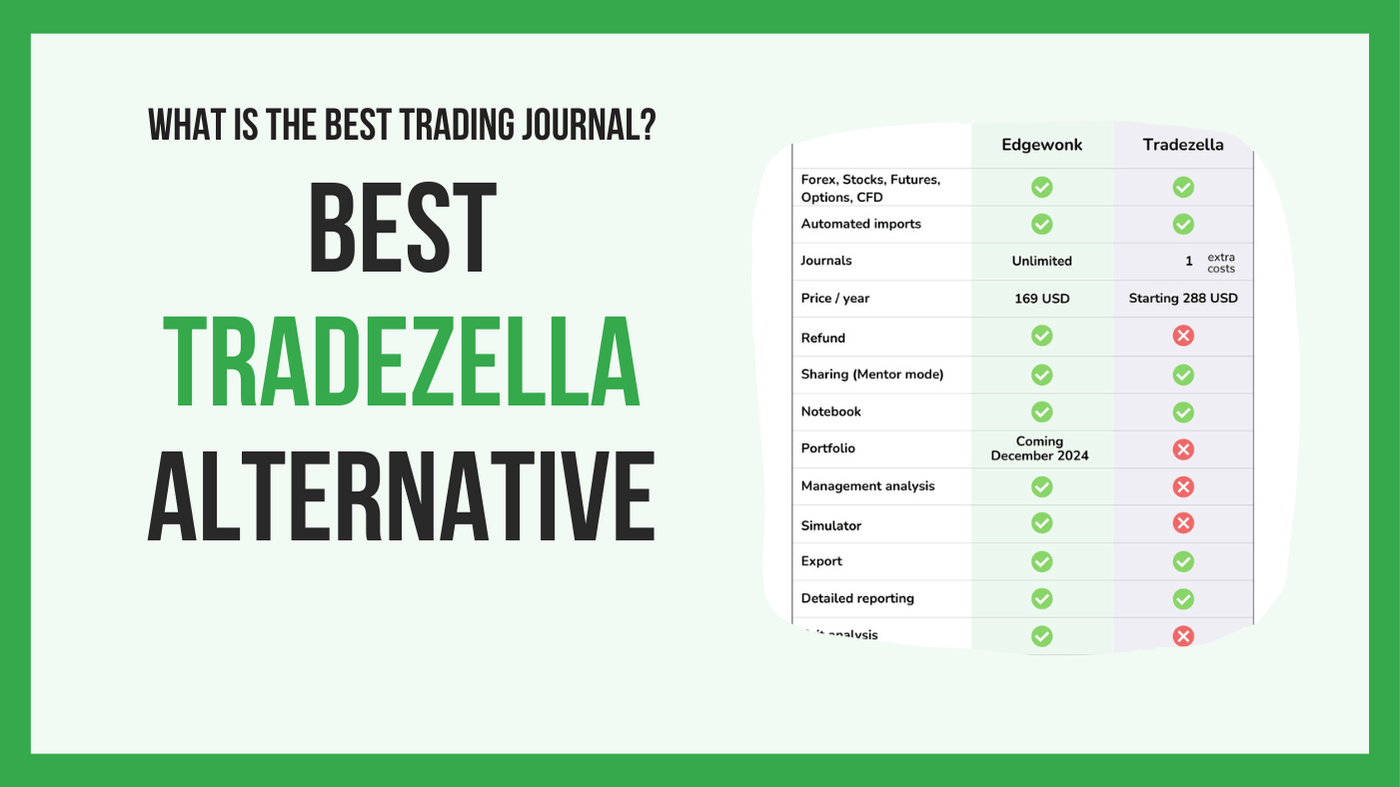

In today’s trading landscape, there’s no shortage of powerful trading journals designed to help traders enhance their performance and achieve their goals. However, with so many options available, it can be challenging to determine which platform best suits your needs. Each tool offers its own unique features and benefits, so finding the right fit requires a closer look at what each has to offer. In this comparison, we’ll explore the features of two popular trading journals, Edgewonk and Tradezella, to help you make an informed decision.

| Edgewonk | Tradezella | |

| Forex, Stocks, Options, Crypto, CFD | ||

| Automated imports | ||

| Journals | Unlimited | 1 (extra costs) |

| Price / year | 148.5 USD - 197 USD | 288 USD - 588 USD |

| Refund |

The core functionality of Tradezella and Edgewonk is quite similar. Both platforms support trade logging across various asset classes, including Forex, stocks, futures, crypto, options, and CFDs, giving traders the flexibility to journal different types of trades. Both platforms also offer importing features that streamline the trade entry process, with automated syncing available for certain platforms to further speed up trade logging.

However, a key difference between the two platforms is the number of journals each allows. Edgewonk provides users with unlimited journal creation, enabling traders to track multiple accounts or create test journals without restrictions. In contrast, Tradezella’s basic plan limits users to a single journal per subscription, which starts at $288 per year which is more than 50% more expensive compared to the cost of Edgewonk’s flat rate of $197 per year. Tradezella users can add more journals, but only for an additional fee.

Another noteworthy distinction is the refund policy. Edgewonk offers a 14-day refund period, allowing users to test the platform with confidence, while Tradezella doesn’t provide a refund policy.

Let’s take a closer look at the journaling features of Edgewonk and Tradezella to see how they stack up. For this comparison, we’ll focus on Tradezella’s basic plan, starting at $288 per year, versus Edgewonk’s $197 annual fee. If a feature upgrade is available in Tradezella’s higher-tier plan, we’ll highlight it.

Both platforms include a mentor mode, which allows users to share their trading journal with others, enabling collaboration and feedback. Each also offers a diary or notebook feature, enabling users to keep detailed notes and reflections on their trading activities.

Edgewonk also provides a portfolio feature, allowing users to analyze their performance across all journals in one consolidated view. This is particularly useful for traders managing multiple accounts or strategies, whereas Tradezella lacks a similar feature.

One of Edgewonk’s standout features is its trade management analytics, which help traders identify patterns of trade mismanagement, providing insights to improve decision-making which is something most traders struggle. Tradezella does not offer a way to analyze in-trade behavior.

Edgewonk also includes a performance simulator that projects a trader’s current performance into future scenarios, helping users understand potential risk and performance metrics over time. This powerful forecasting tool is absent in Tradezella.

| Edgewonk | Tradezella | |

| Sharing (Mentor mode) | ||

| Notebook | ||

| Portfolio | ||

| Trade management analysis | ||

| Simulator | ||

| Automated charts |

In terms of reporting, both Edgewonk and Tradezella offer a variety of analytical tools, covering metrics like holding time, setup analysis, weekday and time-of-day performance, and instrument analysis, among others. These insights provide traders with a comprehensive view of their trading habits and performance.

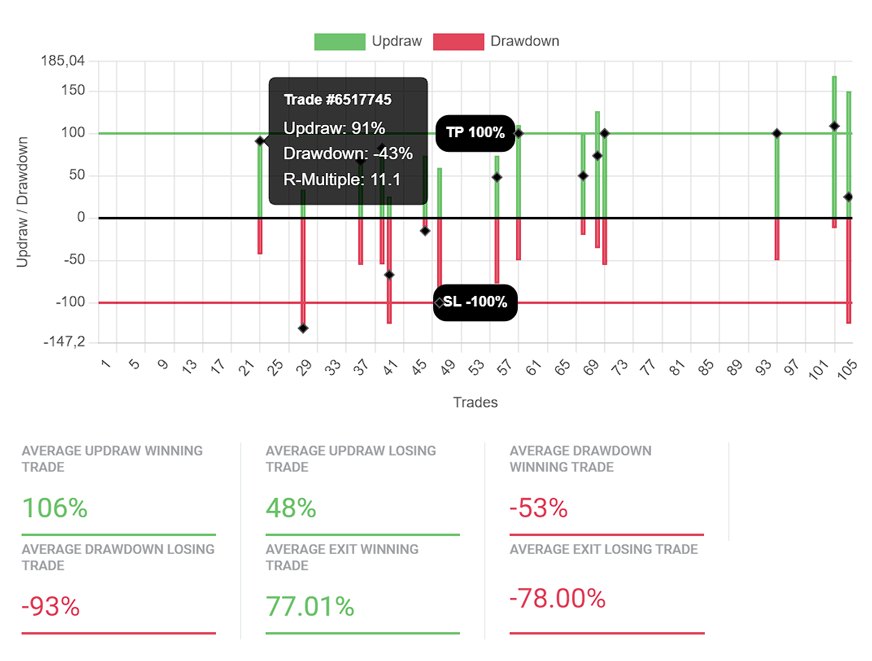

Edgewonk, however, goes a step further with a unique Exit Analysis feature. This tool visualizes the price movement for each trade, helping traders evaluate their stop-loss and take-profit placements. By analyzing how trades developed after the entry, users can fine-tune their exit strategies and improve order placement. Although Tradezella provides standard MAE and MFE tracking, concrete exit analysis is missing, making Edgewonk the better choice for traders focused on optimizing trade exits.

Additionally, Edgewonk includes automated analyses that alert users to important patterns in their trading data, such as prolonged losing streaks, repeated rule violations, or frequent trade mismanagement. Every Monday, Edgewonk users also receive an update highlighting their most profitable setups and optimal trading times, offering regular feedback to enhance their strategies. Tradezella does not provide similar automated insights.

Edgewonk enhances user engagement through gamification with a milestone feature. This feature defines nine key performance areas and allows users to "level up" as they make progress in each area, motivating them to continuously improve. Tradezella, on the other hand, does not include any milestone or gamification element in its platform.

| Edgewonk | Tradezella | |

| Data export | ||

| Detailed reporting | ||

| Exit analysis | ||

| Automated edge analysis | ||

| Milestones | ||

| Missed trades tracking |

Both platforms allow traders to track mistakes, but Edgewonk goes further by categorizing mistakes by entry, exit, and trade management, helping users pinpoint specific areas for improvement. Edgewonk also includes a unique "Tiltmeter," which visually tracks a trader’s discipline level, making it easier to assess trading quality.

Both Edgewonk and Tradezella enable users to create custom tagging categories, allowing for a personalized journaling experience based on individual trading styles. Additionally, both platforms let users attach screenshots to trades, but Edgewonk takes this a step further with a gallery feature that lets traders quickly browse through all trade screenshots—a convenience not available in Tradezella.

Tradezella’s premium plan, starting at $396, includes backtesting and a trade replay function, allowing users to review their trades on price charts.

While generally a good idea, comprehensive backtesting tools are readily available in other software, often at a higher level than Tradezella’s offering. Moreover, we believe that generic trade replays don’t add real value, as traders generally rely on custom chart layouts, tools, and indicators. The screenshot import feature, which is available in both platforms, provides more flexibility, allowing traders to document their setups in a way that best suits their individual needs while keeping the costs low for Edgewonk.

| Edgewonk | Tradezella | |

| Mistake tracking | ||

| Custom tagging | ||

| Chartbook gallery | ||

| Replay function | ||

| Tiltmeter / discipline tracking |

In conclusion, while both Edgewonk and Tradezella offer valuable tools for traders looking to enhance their performance, Edgewonk stands out with its more comprehensive journaling feature set at a more affordable price. Edgewonk provides unlimited journal creation, robust analytics, trade management insights, and unique features like the Tiltmeter and Exit Analysis. Such tools that are not available in Tradezella. For traders seeking an all-in-one journaling solution with advanced analytics and customization options, Edgewonk offers a more versatile and cost-effective choice.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...