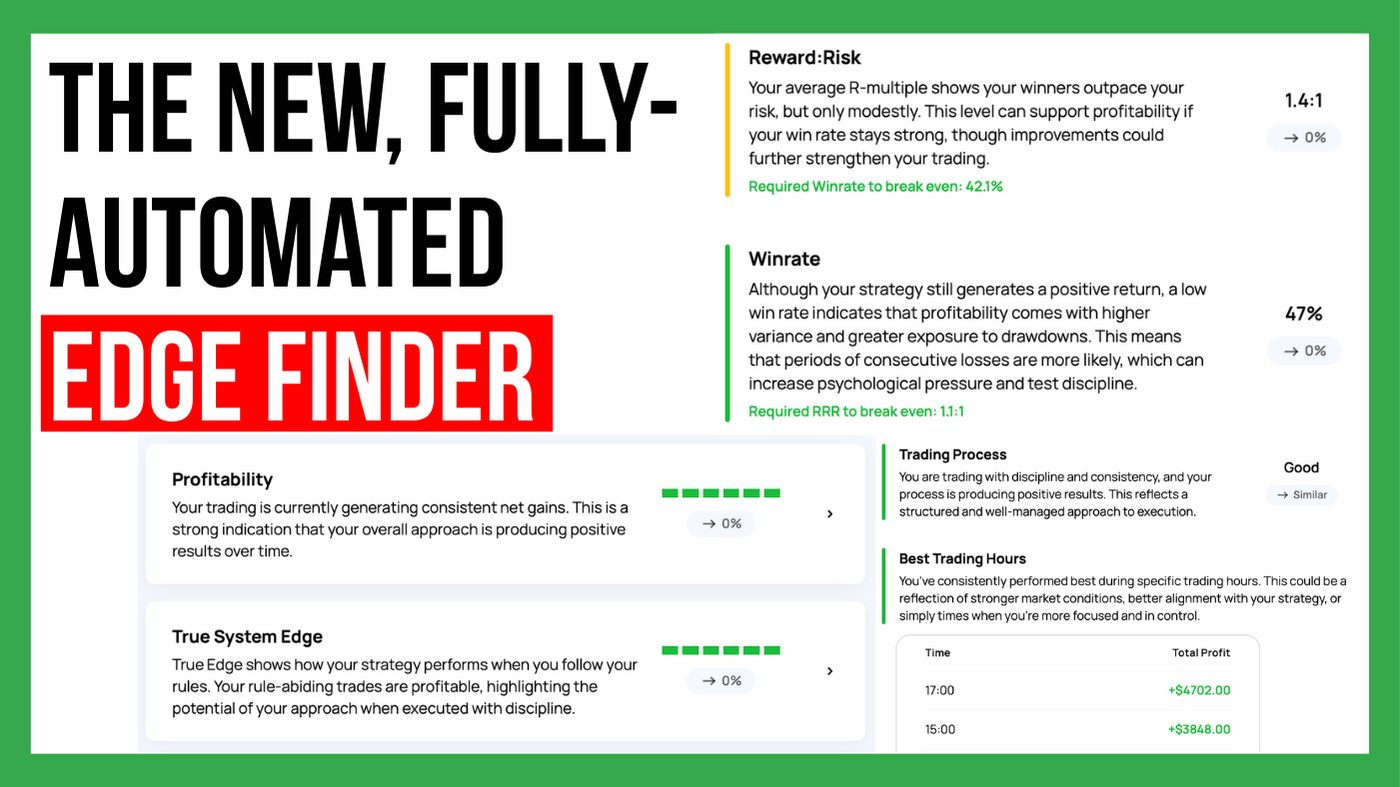

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

.png)

A trading strategy is a carefully thought-out plan for buying and selling assets. It outlines specific rules and criteria for making trading decisions from the entry over trade management to the final exit of your trade. A trading strategy is a systematic method for making consistent trading decisions, based on specific rules and criteria.

Why are trading strategies so crucial? They provide structure, help manage risks, and improve decision-making. By sticking to a strategy, traders can avoid emotional decisions and stay focused on their long-term goals. It transforms trading from gambling into a calculated process.

In this guide, we'll explore what a trading strategy is, different types of strategies, and how to create your own. Whether you're new to trading or looking to refine your approach, understanding trading strategies is crucial for long-term success in the markets.

The primary goal of a trading strategy is to create a structured approach to trading that maximizes potential returns while minimizing risks. Key components of a trading strategy include entry and exit points, which determine when to get in or get out of your trades. These points are often based on specific criteria such as price levels, technical indicators, or fundamental analysis.

Risk management is another crucial aspect. It involves setting stop-loss orders and position sizes to ensure that no single trade can significantly impact your overall portfolio. This helps protect against large losses and keeps your trading capital intact.

Timeframes and trading frequency also play a vital role. Some strategies focus on short-term gains with frequent trades, like day trading, while others aim for long-term holding times with fewer trades, like position trading.

In essence, a trading strategy is your blueprint for navigating the markets. It provides clarity, reduces emotional trading, and helps you stay focused on your financial goals.

Creating a successful trading strategy involves several key steps. Here's how to get started:

Identify Goals and Risk Tolerance:

Determine your time availability: Does your daily schedule allow for trading specific market sessions as a day trader, or are you short on time and should focus on a long-term strategy, trading a swing-trading method?

Assess your risk tolerance: How much risk are you willing to take on each trade?

Create the Strategy:

Combine price action, indicators, and other signals: Use technical indicators, chart patterns, and fundamental data to develop your criteria.

Apply a multi-timeframe approach: Analyze the overall trend direction on the higher timeframe to time your trade entries into the market direction.

Define entry and exit points: Establish clear rules for when to buy and sell.

Set risk management rules: Determine your position sizes and stop-loss levels to protect your capital.

Determine trade management: Are you actively managing your trades by using a trailing stop loss strategy, or do you let your trades play out without interfering?

Test Your Strategy:

Backtesting: During your backtest you can test your trading rules on historic data, enabling you to get performance results much faster.

Paper trading (Demo): Use a simulated trading environment to practice your strategy without risking real money.

Analyze performance: Track the results of your paper trades to identify strengths and weaknesses.

Refine and Adapt:

Review trades regularly: Look at what worked and what didn’t, and adjust your strategy accordingly.

Going live: Once you can prove that your new trading strategy can generate profits during a backtest and in your demo trading, it is time to take your trading strategy live.

By following these steps, you can develop a robust trading strategy that aligns with your goals and adapts to changing market conditions.

Once you’ve developed a trading strategy that generates profits, the next step is implementation (going live). Here's how to put your plan into action:

Select a reliable trading platform: Ensure it offers the features and tools you need.

Utilize analysis tools: Software that provides real-time data, charting capabilities, and technical indicators is essential.

Follow your plan: Stick to the rules and criteria you’ve set for entering and exiting trades.

Monitor the market: Keep an eye on market conditions and news that might impact your trades.

Stay disciplined: Avoid deviating from your strategy based on emotions or market noise.

Adjust as needed: If market conditions change significantly, be prepared to tweak your strategy accordingly.

Maintain a trading journal: Document each trade, including rationale, your trading decisions, and important risk metrics.

Analyze performance: Regularly review your trades to identify patterns, strengths, and areas for improvement.

Learn from your experiences: Use your trading records to refine your strategy over time.

Stay updated: Keep learning about new trading techniques and market developments.

Implementing your trading strategy effectively means more than just following a set of rules. It involves careful selection of tools, disciplined execution, meticulous record-keeping, and an ongoing commitment to learning and improvement.

Even with a well-crafted strategy, traders can fall into common pitfalls. Here’s how to recognize and avoid them:

Emotional Trading:

Impact: Emotions like fear and greed can lead to impulsive decisions, often resulting in losses.

Solution: Stick to your strategy. Use predetermined rules for entering and exiting trades to reduce emotional influence. In your Edgewonk trading journal, the Tiltmeter visualizes the level of your trading discipline – use the Tiltmeter as your constant reminder to follow your plan.

Overtrading:

Impact: Trading too frequently can lead to higher transaction costs and increased risk exposure.

Solution: Be selective with your trades. Focus on quality over quantity. Ensure each trade aligns with your strategy and offers a favorable risk-reward ratio.

Lack of Discipline:

Impact: Deviating from your plan, whether due to impatience or external pressure, can undermine your strategy’s effectiveness.

Solution: Cultivate discipline by consistently following your trading plan. Set reminders or alarms to reinforce your strategy rules and avoid shortcuts.

Ignoring Risk Management:

Impact: Neglecting risk management can result in significant losses, wiping out profits.

Solution: Always use stop-loss orders and proper position sizing. Never risk more than a small percentage of your trading capital on a single trade.

Failure to Adapt:

Impact: Markets change, and a strategy that once worked might become ineffective.

Solution: Regularly review and update your strategy based on market conditions and performance feedback. Stay informed about market trends and adjust your approach as needed.

By being aware of these common pitfalls and actively working to avoid them, you can improve your trading performance. Remember, successful trading requires not just a solid strategy but also discipline, patience, and continuous learning.

Mastering a trading strategy is key to achieving consistent success in the markets. It provides structure, reduces emotional decision-making, and helps manage risks effectively. From understanding the basics to implementing and refining your strategy, every step is crucial. Remember to stay disciplined, keep detailed records, and continuously adapt to market changes. By avoiding common pitfalls and committing to ongoing learning, you can remain profitable as a trader. With a well-crafted strategy, you’re better equipped to reach your trading goals as a professional trader.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

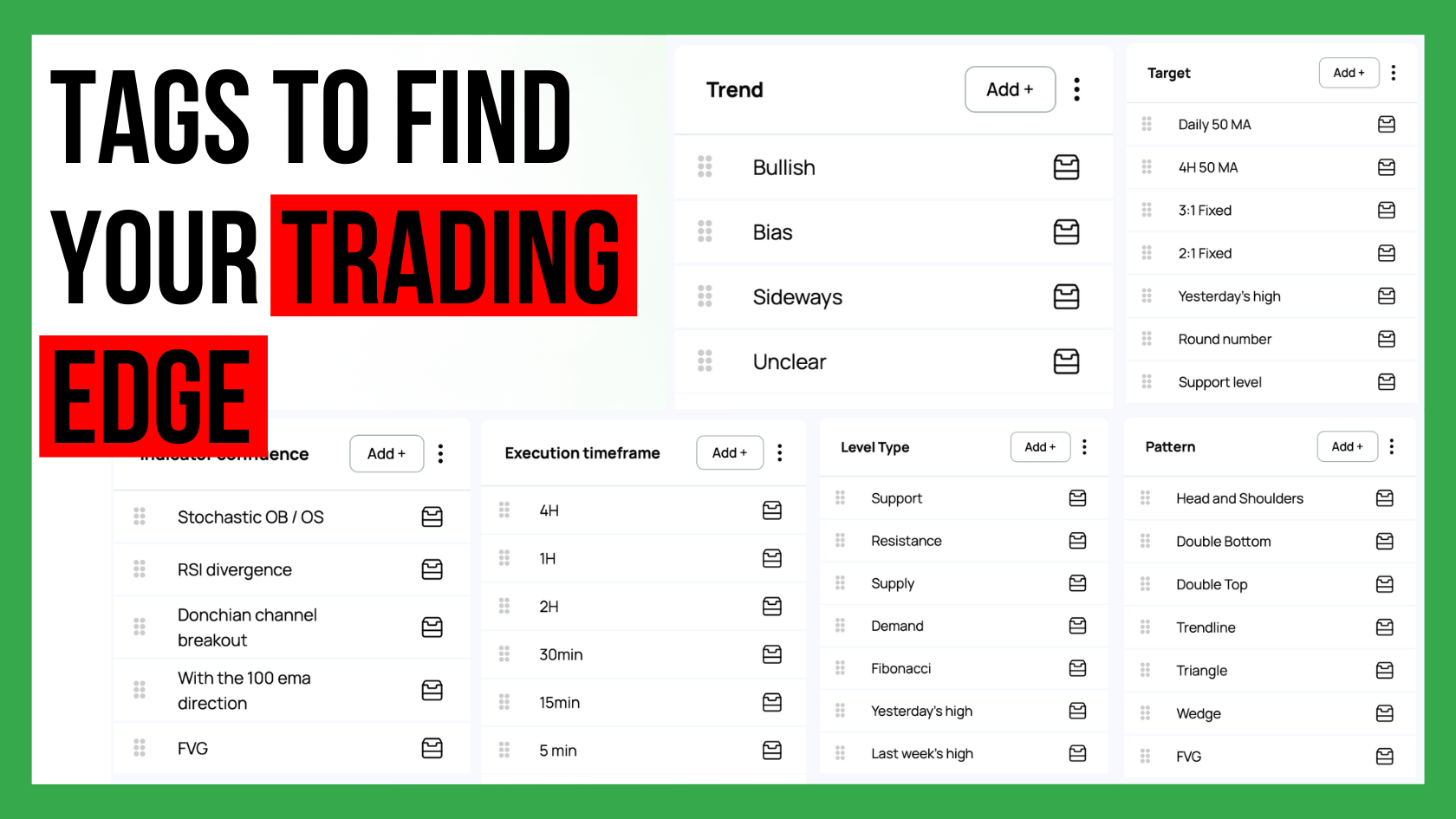

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...