The all-in-one stock trading journal for performance and psychology

Analyze stock tickers, track your own setups, trade management behavior, and psychology in one place, so you can improve faster and trade with confidence.

![]() Supports all stock markets world-wide

Supports all stock markets world-wide

![]() Automated Imports

Automated Imports

![]() Track psychology and performance

Track psychology and performance

What is a stock trading journal?

![]() A stock trading journal is a structured way to record every trade you take.

A stock trading journal is a structured way to record every trade you take.

![]() It turns your trading history into clear data so you can spot what’s working, what’s hurting performance, and which habits lead to your best results.

It turns your trading history into clear data so you can spot what’s working, what’s hurting performance, and which habits lead to your best results.

![]() Instead of relying on memory or gut feel, you review patterns across setups, market conditions, and execution quality to improve your process trade by trade.

Instead of relying on memory or gut feel, you review patterns across setups, market conditions, and execution quality to improve your process trade by trade.

![]() Over time, a good stock trading journal helps you trade with more consistency, discipline, and confidence because your decisions are backed by evidence.

Over time, a good stock trading journal helps you trade with more consistency, discipline, and confidence because your decisions are backed by evidence.

Perfect fit for all stock traders

Trade the stocks you want, with the broker you already use.

Below you’ll find the supported stock brokers and the exchanges/markets you can journal.

Stock brokers supported

Works with all stock brokers.

Import your trades automatically in seconds and keep your journal up to date with minimal effort.

Easily import your trades from:

-

Interactive Brokers

-

Saxo Bank

-

Charles Schwab

-

Fidelity

-

Tradestation

-

thinkorswim

-

TD Ameritrade

-

TradingView

-

e-Trade

-

Tradezero

-

DAS Trader

-

CMC Markets

-

Webull

and many more: all supported brokers

All stock markets supported

Track trades from any stock market worldwide.

No matter which exchange you trade, your positions, performance, and stats stay in one place.

-

US

-

UK

-

Australia

-

Austria

-

Belgium

-

Brazil

-

Canada

-

France

-

Germany

-

Hong Kong

-

India

-

Indonesia

-

Italy

-

Japan

-

Malaysia

-

Mexico

-

Netherlands

-

Nigeria

-

Philippines

-

Poland

-

Singapore

-

South Africa

-

Spain

-

Sweden

-

Switzerland

-

Thailand

-

Vietnam

all other countries supported as well. Edgewonk works for all stock markets world-wide.

All trading styles supported

No matter how you trade stocks, Edgewonk fits your workflow.

Edgewonk supports:

-

Day trading

-

Swing trading

-

Long-term investing

You can also journal multiple trading accounts while keeping performance data clearly separated.

Stock trading journal features that help you find your edge

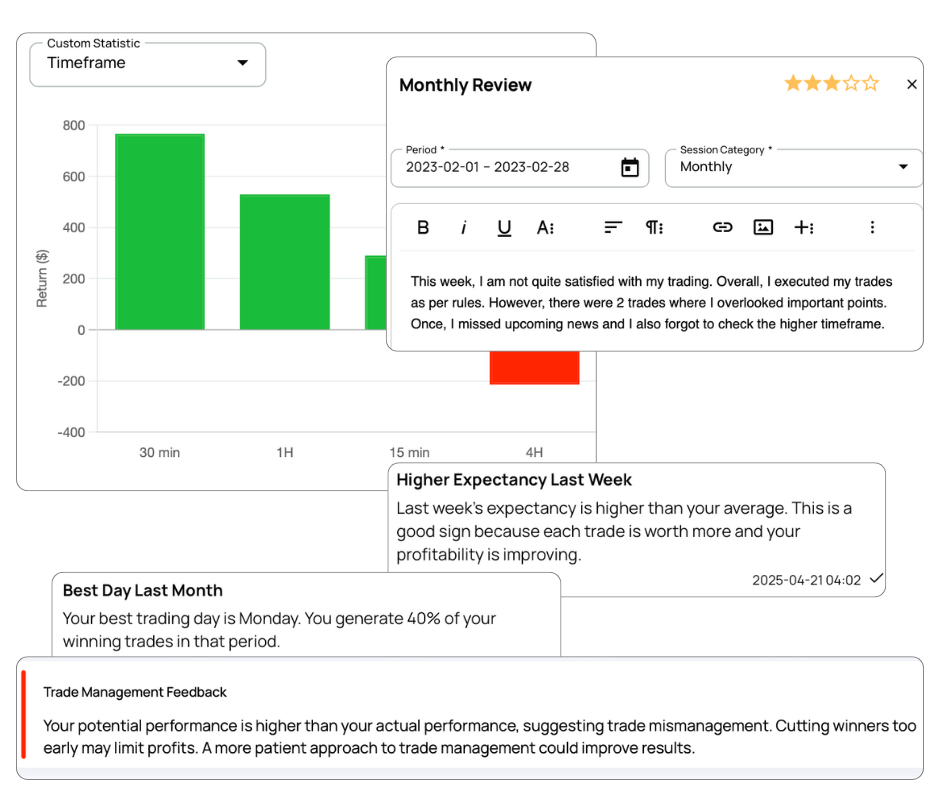

A stock trading journal should do more than store trades. Edgewonk helps you analyze performance, refine execution, and understand the behaviors behind your biggest wins and losses.

Find your best tickers

After importing your trades, Edgewonk instantly breaks down performance by ticker.

Spot your true winners and consistent losers, then use Edgewonk's features to refine your process and improve results.

Your best stock play

From earnings trades to news-driven moves and technical entries, Edgewonk helps you analyze every stock play the same way: with clarity and stats.

Track performance by strategy type, spot what’s profitable, and improve the setups that drive your best results.

Long, short or both?

In stocks, long and short trades often produce very different outcomes depending on market regime.

Edgewonk breaks results down by direction, helping you identify strengths, weaknesses, and the conditions where each performs best.

Most profitable market condition

Track which market conditions fit your strategy best, whether it is a bull or a bear market, high or low volatility, risk-on or risk-off.

Edgewonk links your results to the environment, so you can trade more when conditions favor you and step aside when they don’t.

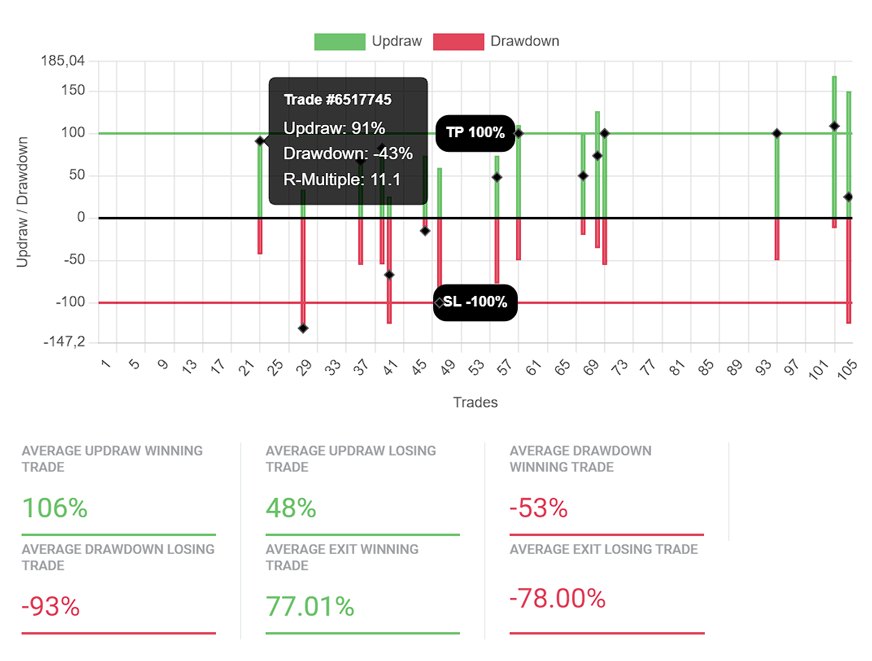

Best way to manage stock trades

Edgewonk measures the impact of your stock trade management, not just the strategy.

See how different exit choices affect profit and risk, then follow clear guidance to manage trades more effectively.

Psychology and emotions as a stock trader

Track your mental state and emotions alongside every stock trade.

Edgewonk reveals how psychology affects your decisions, so you can spot when you deviate from your plan and fix your most common behavior patterns.

The stock trading journal that turns data into progress

Your trade history already contains the answers, you just need the right system to uncover them.

Edgewonk turns every trade into clear feedback you can use to improve.

Identify winning strategies

Many stock traders struggle with confidence because they are not sure what truly works in their own approach.

Edgewonk highlights your true top-performing strategies by separating signal from noise across many trades.

The result is simple: you get a precise roadmap for what to trade more, what to adjust, and what to drop.

Turn losses into lessons

Most traders either avoid looking at losses or overanalyze them without finding the real driver.

Edgewonk helps you isolate the patterns behind losing trades, so you can see what consistently leads to red days and what conditions your strategy struggles with.

You learn the right lesson, make the right adjustment, and build real confidence from your own numbers.

Optimize your trades

Edgewonk uncovers the hidden potential in your trading by analyzing entries, exits, trade management, and risk decisions across all your trades.

You will see where you consistently leave profits on the table, take unnecessary losses, or break your own rules.

The result is a tighter process, more consistency, and data-backed improvements you can keep repeating.

The professional stock trading journal for serious traders

![]()

Privacy First

Your data is never sold, analyzed, or used to reverse-engineer your strategies. We only access your journal if you explicitly ask us to.

![]()

Highest Security

We develop with security at the core, ensuring your trading data is always protected. Independent penetration tests confirm that our systems are safe and reliable.

![]()

Decade of Trust

For over 10 years, traders worldwide have relied on Edgewonk to improve their performance, making it one of the most trusted trading journals today.

Frequently asked questions from stock traders

-

What is a stock trading journal, and why should I use one?

A stock trading journal is a software platform like Edgewonk for recording your trades and reviewing them to improve performance.

By tracking entries, exits, risk, trading behavior and decision-making, you can identify what works, reduce repeated mistakes, and build a more consistent trading process.

It removes the guesswork and helps traders see exactly where their edge is and how to improve their approch.

-

What should I track in a stock trading journal for the best results?

The essentials (ticker, date, entry, exit, size, and risk) are provided by your broker and Edgewonk tracks those for you, fullly automated.

In Edgewonk, you can also capture the decision context such as setup type, traded timeframe, market condition, and your emotional state.

The best results come from also tracking execution quality, trade management decisions, and your mindset, so you can improve both strategy and behavior.

-

How does Edgewonk help stock traders improve faster?

Edgewonk turns your trading history into clear performance breakdowns so you can see what truly drives results.

It helps you identify profitable strategies and tickers, learn from losses with data-backed review, and optimize execution and trade management over time.

Such an approach helps stock traders avoid system-hopping and enables them to uncover the true edge of their approach.

-

Can I import stock trades automatically, or do I need to enter trades manually?

Yes, you can import stock trades automatically, which saves time and reduces errors from manual entry.

If you prefer, you can still add or adjust trades manually to keep your stock trading journal complete, personalized and accurate.

-

Can I track different stock strategies like earnings trades, momentum, and technical setups?

Yes, Edgewonk is strategy-agnostic, so you can categorize trades by any approach you use, including earnings, momentum, price action, news-driven, or technical setups.

Once categorized, you can compare performance across strategies and focus on the ones that fit you best.

-

Can I track market conditions like bull and bear markets, volatility, or risk sentiment?

Yes, you can tag and review trades by market condition, such as bull or bear phases, high or low volatility, and broader risk sentiment.

This helps you identify when your strategy performs best so you can filter trades and avoid unfavorable environments.

-

Can I track emotions, mindset, and trading psychology in a stock trading journal?

Yes, Edgewonk lets you track psychological factors alongside trades, such as confidence, stress, patience, or impulsivity.

Over time, you can connect emotions to behaviors like rule-breaking, revenge trading, or overtrading and improve discipline with clear feedback.

-

Is a stock trading journal useful for day trading, swing trading, and longer-term stock trading?

Yes, journaling helps across all time horizons because the core goal is the same: learn what works and repeat it.

A stock trading journal is useful whether you day trade, swing trade, or hold positions longer term, because it reveals performance patterns in strategy, execution, and risk.

-

Is my trading data private and secure, and can I export my journal data anytime?

Your trading journal data remains private at all times. We heavily invest into security to keep your data safe.

You can export your data anytime, which ensures you stay in control and can keep a copy of your full trading history whenever you want.

-

Can I track multiple trading accounts?

Yes. With Edgewonk, you can track multiple trading accounts in one place while keeping the data clearly separated for clean reporting and analysis.

This makes it easy to compare performance across accounts without mixing results or distorting your stock trading journal stats.

-

Can I track multiple asset classes in Edgewonk?

Yes. You can track stocks, futures, forex, and crypto in Edgewonk while keeping each asset class organized in separate journals.

This makes it easy to analyze performance by account and market without mixing results or distorting your statistics.

You’re Only 10 Minutes Away from Taking Control of Your Trading

![]() Start in minutes

Start in minutes ![]() 14-day refund period

14-day refund period