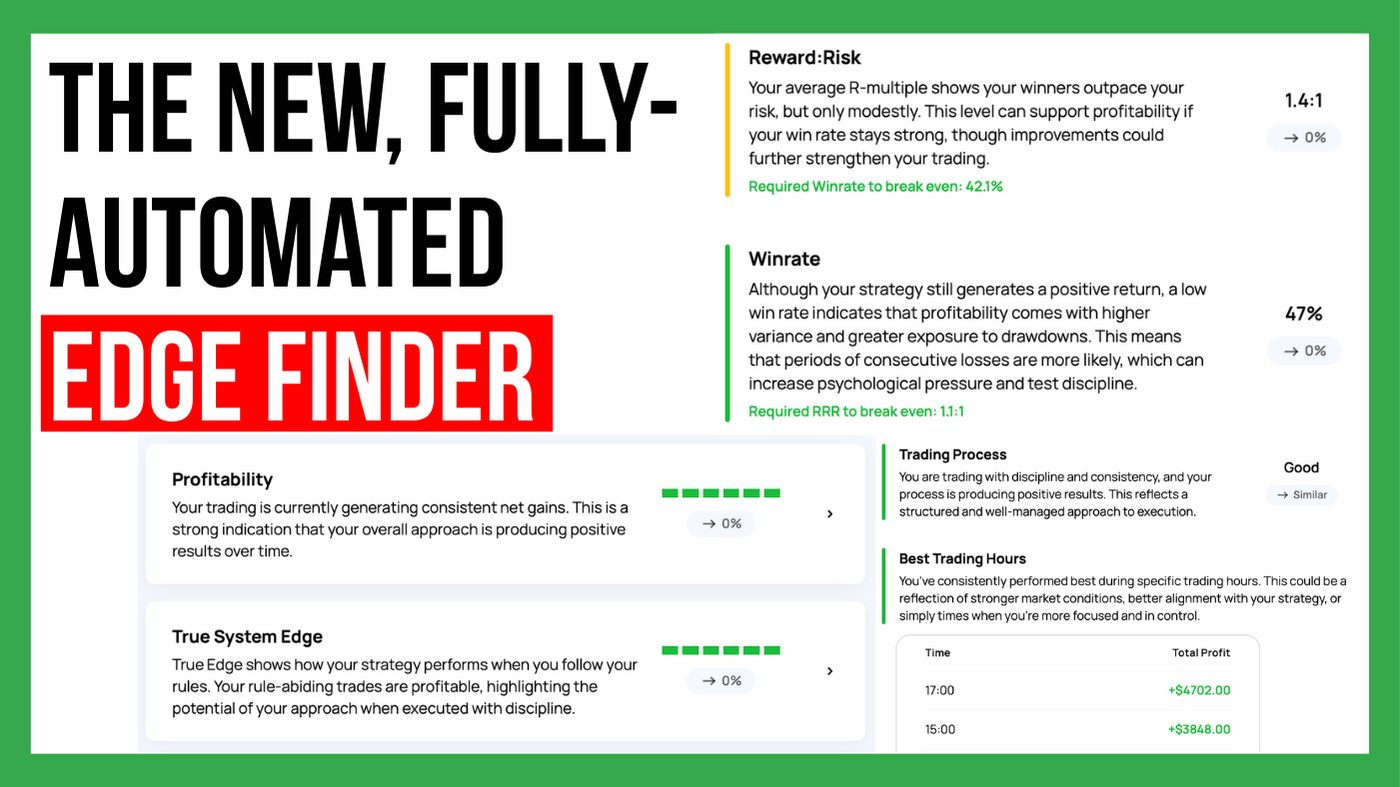

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Emotions play a critical role in the success or failure of traders and many professionals see emotional management at one of the most important traits of successful trading. The ability to manage these emotions is just as crucial as mastering technical analysis or risk management. Without proper emotional control, even the most technically skilled traders can make irrational decisions that lead to significant setbacks. Therefore, developing emotional intelligence and resilience is fundamental for anyone looking to achieve long-term success in trading.

In this article, we’ll dive into the seven most important emotions in trading, how they can affect your performance, and what you can do to manage them.

Emotional control and trading success are closely linked. The highs and lows of the market can provoke powerful emotional responses, leading to irrational decisions, impulsive trades, or missed trades. Most traders, especially those just starting out, make the mistake of trying to suppress their emotions. However, emotions are not to be ignored. They can serve as useful guides, signaling when something is wrong with your trading plan or strategy. Rather than trying to eliminate emotions altogether, the key is learning to recognize them and manage them effectively.

Now, let’s explore the seven most important trading emotions and how they affect your decision-making.

Fear is one of the most common trading emotions, often leading to early trade exits or missed opportunities. When market volatility spikes or you experience a few losing trades, fear can quickly set in. This emotion manifests as hesitation or excessive risk aversion, leading you to sell too early or avoid potentially profitable trades.

Common triggers for fear include sudden market downturns, large losses, or even the fear of losing gains. To manage fear, traders can use strategies like implementing checklists with all their strategy rules, or reducing position sizes to minimize risk. Additionally, developing a solid trading plan can help alleviate fear by providing a structured approach to decision-making. As you gain more experience, the effect of fear on your trading diminishes.

Greed is another powerful trading emotion that can cloud judgment. Driven by the desire for greater profits, and unrealistic expectations, greed can push traders to overextend their positions or hold on to winning trades for too long, hoping for an even higher return. This desire for more can lead to reckless decisions, such as chasing after overambitious return goals or over-trading.

To manage greed, it’s essential to establish a disciplined trading plan that includes clear profit-taking strategies and fixed position sizing rules. By setting predetermined exit points and adhering to them, you can avoid the pitfalls of overextending your trades and chasing elusive gains.

Inexperienced traders are particularly prone to overconfidence because they are unaware of the extent of their knowledge gaps. After a series of successful trades, it’s easy to start believing you're invincible. This emotion can lead to risky behaviors, such as taking on larger positions without sufficient analysis or ignoring key risk factors.

The danger of overconfidence lies in underestimating market risks and ignoring the probabilistic nature of trading. Even the most seasoned traders can fall prey to this emotion, particularly after a winning streak. To combat overconfidence, it’s essential to remain grounded. Regularly review your trades and remind yourself that the market can turn at any moment. Maintaining humility and sticking to your trading plan will keep you on a stable path.

In trading, it’s easy to want quick results, but this often leads to poor decision-making and taking suboptimal trades that are outside the scope of your trading strategy. Impatient traders may enter trades too early, exit too soon, or even chase markets, hoping to catch up on missed opportunities.

Another issue that impatient traders encounter is taking excessive risks due to their lack of patience in growing their trading account. Greed and impatience often go together, and when combined with unrealistic expectations, they can result in over-trading and taking too much risk in an attempt to accelerate account growth.

To cultivate patience, it’s important to stick to your trading schedule and plan. Allow your strategies the time to play out and use waiting periods where there are no trading opportunities productively by updating your trading journal, backtesting, or reading a trading book.

Regret is a destructive emotion that can take hold after missed opportunities or losing trades. Traders often look back on what they “should have” done and allow regret to affect their future decision-making. This emotion can lead to overcompensation in future trades, where traders take unnecessary risks to "make up" for past mistakes.

It’s crucial to distinguish between healthy reflection and destructive regret. While it’s important to learn from past trades, dwelling on them too much can cloud your judgment. Acknowledge your mistakes, but move forward without letting regret weigh you down.

Hope is a double-edged sword in trading. While maintaining hope can keep you motivated and confident, unchecked hope can be a trap. Traders often fall into the cycle of “hoping for a turnaround” in a losing trade, holding onto a position for far too long in the belief that the market will eventually swing in their favor.

Balancing optimism with realism is essential. A good way to manage hope is by setting firm exit points—whether for profit or loss. By sticking to these points, you’ll avoid the dangerous trap of “hoping” for a recovery in a position that’s unlikely to rebound.

Edgewonk's exit analysis tool assists in refining your exit strategy by providing insights on how to optimally set your target orders, taking into account your past trading results and the price movements during your trades. This way, you can reduce the impact of hope and instead implement an objective trading approach.

Desperation is perhaps the most damaging emotion in trading. It often leads to high-risk decisions made in an attempt to recover from significant losses and to get back to break even. This state of mind can drive behaviors like revenge trading, doubling down on losing trades, or taking on excessive risk in a last-ditch effort to recover previous losses.

Desperation clouds judgment and often amplifies losses instead of reversing them. The best way to avoid desperate trading is by taking breaks after major losses and reevaluating your strategies. Remember that recovery in trading should be gradual, not the result of one high-risk move.

Mastering trading emotions is crucial for long-term success. Here are some practical tips to help you manage your emotions and make more rational trading decisions:

Acknowledge your emotions: Instead of treating emotions like the enemy, recognize them. They can serve as signals that something is wrong with your trading strategy.

Journaling: Keep a trading journal where you record your trades and your emotional state during those trades. This can help you identify emotional patterns and avoid making the same mistakes repeatedly.

Meditation and mindfulness: Practices like meditation can help you stay calm and focused, reducing the intensity of emotional reactions during volatile market conditions.

Stick to a trading plan: A well-defined trading plan that includes entry and exit strategies, risk management rules, and position sizing will reduce the chances of making emotional decisions.

Automation: Consider automating parts of your trading system, such as position sizing, setting up stop-losses and profit targets. This can minimize the influence of emotions on your trades.

Seek professional guidance: Some traders benefit from working with a trading coach or therapist to help them manage their emotions more effectively.

You can also download amd print our emotions cheat sheet to help you improve your decision making and develop better coping mechanisms in your trading.

To download the cheat sheet, click on the image snippet below.

Mastering trading emotions is key to becoming a successful trader in the long run, as emotional control can separate profitable traders from the rest. Fear, greed, overconfidence, impatience, regret, hope, and desperation are emotions that every trader will encounter at some point in their journey. Recognizing these emotions and implementing strategies to manage them will help you make better trading decisions, ultimately improving your performance. Start paying attention to your emotional state and work on developing emotional resilience—your trading success may depend on it.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

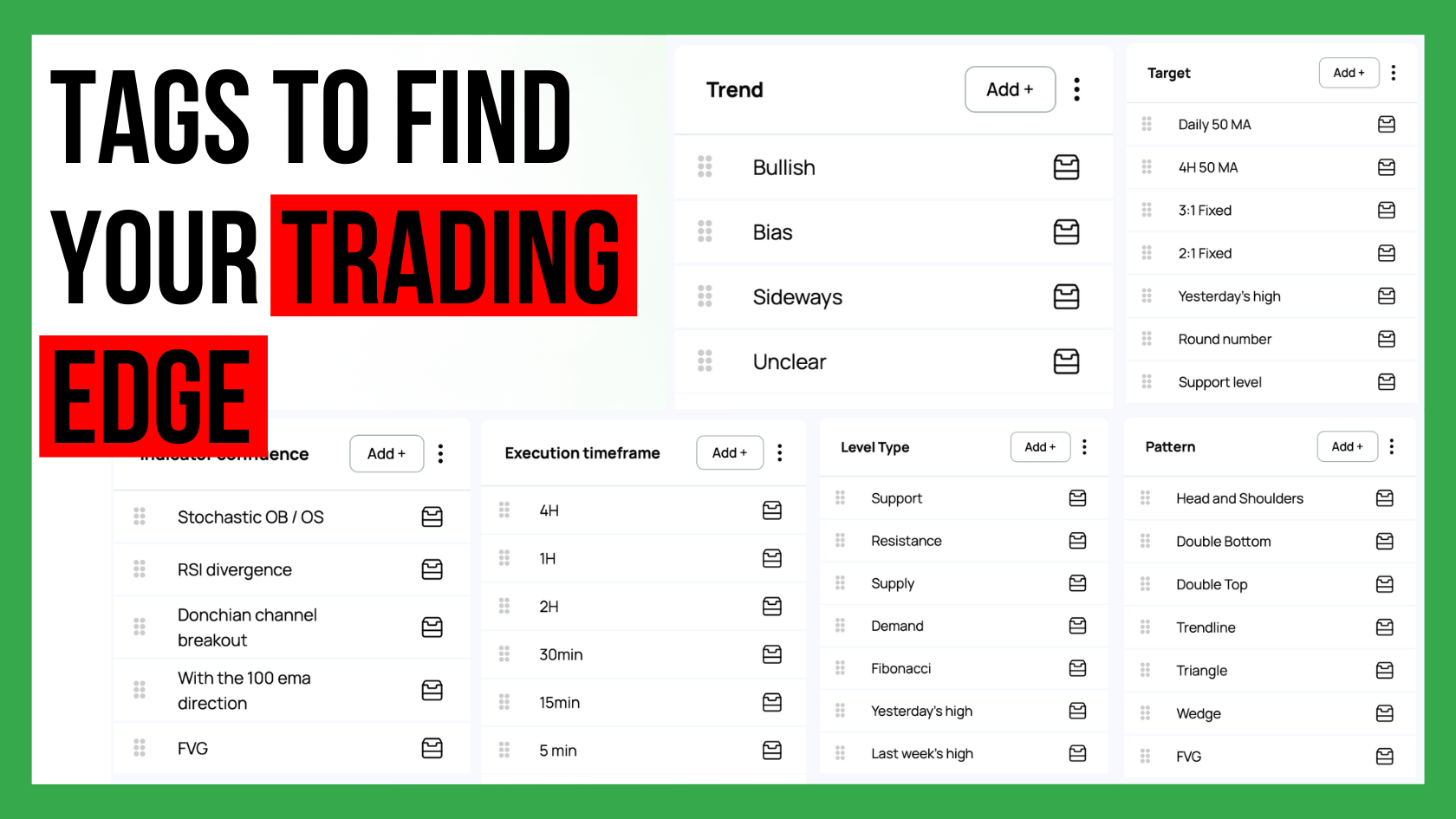

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...