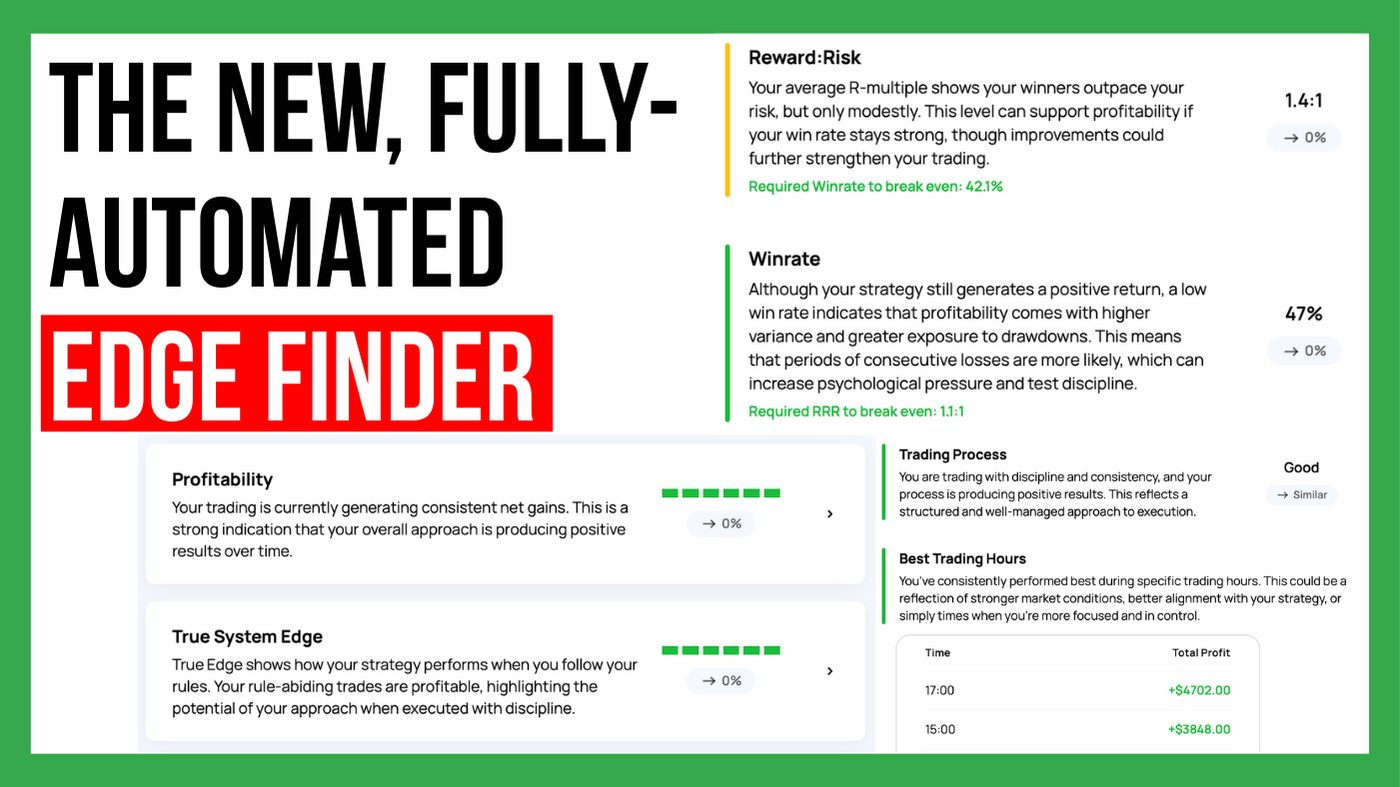

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

3 min read

Rolf May 16, 2024 9:21:25 AM

Imagine you just closed out a winning trade. Feeling like a market wizard, you jump right back into the next trade, eager to repeat the success. But this time, the trade goes against you, leaving you frustrated and questioning your skills. Sound familiar? We've all been there. In trading, getting caught up in the emotional roller coaster of wins and losses is easy - and damaging to your trading account.

But what if there was a better way to trade with more focus and less stress? That's where the difference between a process-oriented mindset and a results-oriented mindset comes in.

Think of a process-oriented mindset as a well-defined roadmap for your trades. It helps you focus on making good decisions based on your plan, not just on the final outcome (win or lose). This approach is key to achieving long-term success in the markets.

Have you ever gotten so excited about a win that you jumped right into another trade without much thought? Or maybe a losing streak made you completely abandon your strategy, feeling discouraged and lost?

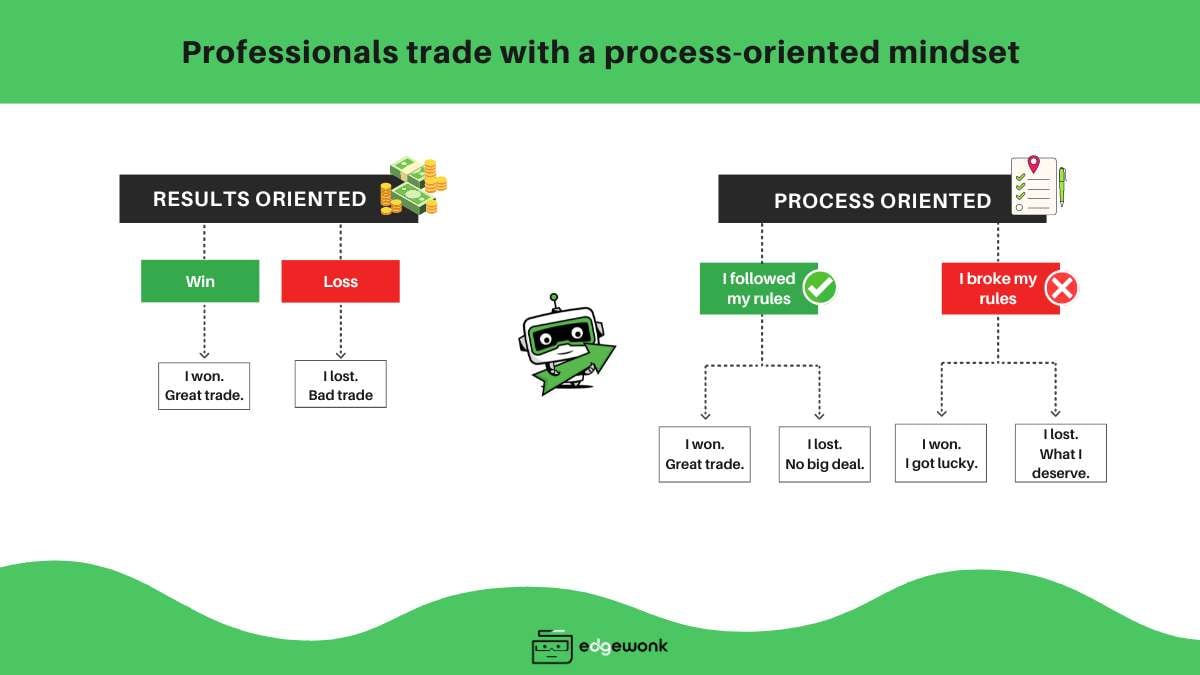

It's where you judge your every move based solely on the final outcome - a win feels like a good trade, and a loss feels like a bad one.

The problem? The market doesn't care about your emotions. There will be times when you follow your strategy perfectly, and the trade goes against you. Likewise, you might make a risky impulse trade that happens to pay off.

Results-oriented thinking can lead you down a dangerous path. You might chase wins by taking on trades that don't fit your strategy, or overtrade to try and recoup losses. This can quickly spiral out of control and hurt your long-term results.

On the flip side, losing streaks can be brutal. But here's the thing: a loss doesn't always mean you made a bad decision and many traders abandon potentially profitable trading strategies too early. We'll explore why focusing on the process is a much more sustainable approach in the next section.

The key to getting into the process-orient mindset is that you only focus on following your pre-defined trading plan. This plan should have clear rules for entering and exiting trades, based on your research and strategy. It also involves disciplined risk management, meaning you only risk a small portion of your capital on each trade.

The important thing to remember is that losses are a natural part of trading. Even the best plans can go awry sometimes. However, if you stick to your plan and execute the trade well (following your entry and exit rules), then it's still considered a good trade. It might not have produced the desired outcome, but the decision-making process was sound.

"The goal of a good trader is to make the best trades possible. Making money is secondary"

- Alexander Elder

With a process-oriented mindset, you take a long-term view. By consistently following your plan and managing risk, you increase your chances of statistically favorable outcomes over time, even if individual trades don't always go your way.

Ready to take control and become a process-oriented trader? Here's a roadmap to get you started:

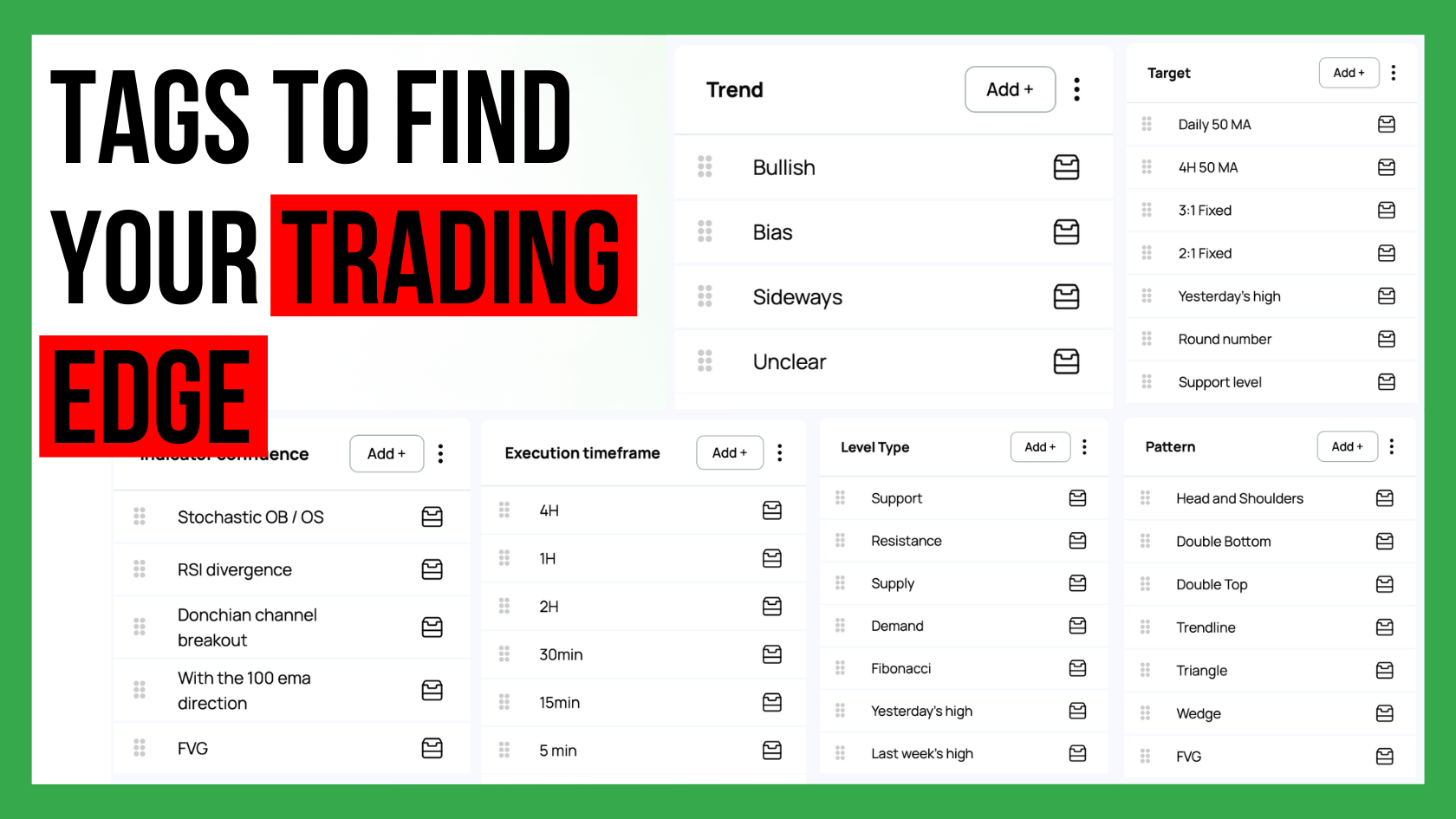

Find Your Trading Style: Not all strategies are created equal. Research different trading approaches and find one that suits your personality and goals. Backtest your chosen strategy using historical data to see how it might have performed in the past. This helps refine your approach before risking real money.

Craft Your Trading Plan: Now comes the blueprint for your success! Develop clear entry rules that tell you exactly when to buy or sell an asset. Likewise, set clear exit rules to define when to take profits or cut your losses. This removes emotions from the equation and keeps you disciplined.

Practice Makes Perfect: Sticking to your plan consistently can be challenging, especially when emotions run high. Practice using a paper trading account or a small amount of real capital to get comfortable with your process before going all-in.

Let's face it, the market can be a wild ride. Prices can swing unexpectedly, and even the most well-thought-out plans can get thrown off course. But here's the good news: you don’t have to control the market's behavior – and you can’t anyway.

What you can control is your trading process and the decisions you make. By focusing on executing your plan flawlessly, you're setting yourself up for success in the long run.

Here's the shift: celebrate good process execution, even if the trade itself doesn't go your way. You stuck to your plan, managed risk, and made a sound decision based on your strategy. That's a win for your trading discipline!

And remember, even losses can be valuable lessons. Analyze what went wrong and use that information to refine your strategy. The market is constantly changing, so be prepared to adapt and learn as you go.

So, ditch the emotional rollercoaster of win-lose trading! Embrace the power of process.

Here's the takeaway: a process-oriented mindset keeps you focused on your trading plan and disciplined decision-making, not the win-or-lose outcome of each trade. Remember, losses are inevitable, but following your plan makes them learning experiences. By consistently applying a well-defined process, you increase your chances of success over the long haul.

Ready to take control? Start by defining your goals and building a trading strategy that suits your style. Refine your process over time, learn from your trades, and focus on making good decisions, not chasing wins.

Take charge of your trading journey. Start building your process today!

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...