The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

For most struggling traders, everything in trading revolves around the entry. They believe that once they find the perfect signal, everything else will fall into place. The entry becomes the entire identity of their trading. Every thought, every tweak, every backtest focuses on finding that one setup that finally makes money.

With Edgewonk we see time again, the entry doesn't matter. This has been a universal truth we keep seeing even after hundreds of trading journal reviews.

So when results disappoint, they naturally assume the entry is to blame. They switch indicators, change timeframes, or start testing a new setup, convinced that the next entry will be the breakthrough. But this cycle never ends because the problem was never the entry in the first place.

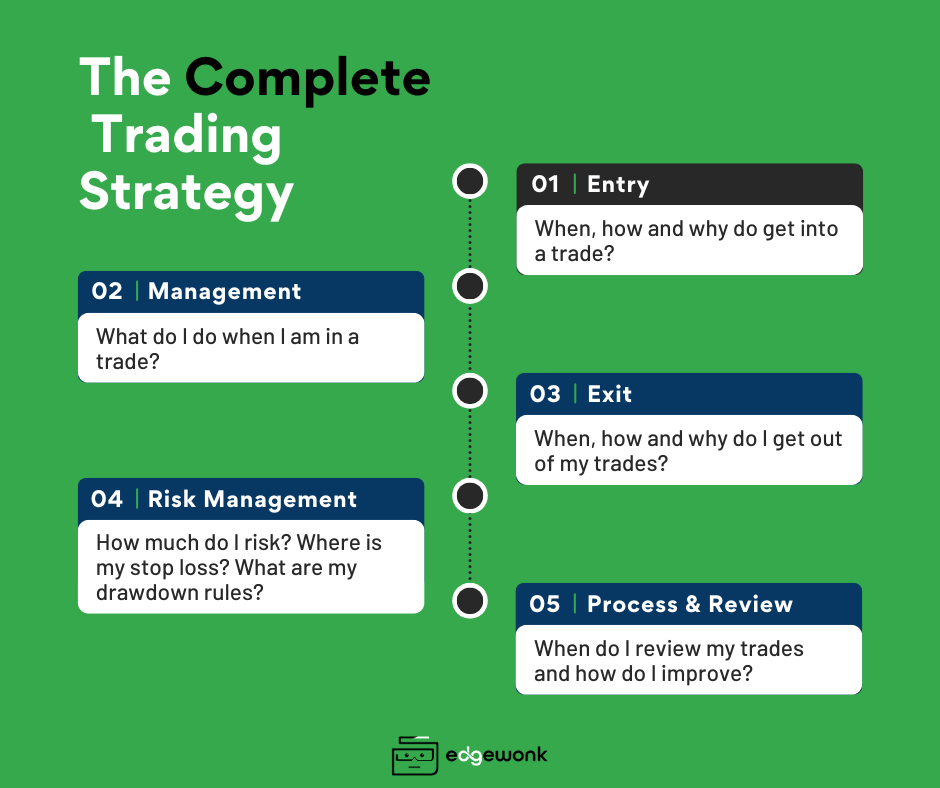

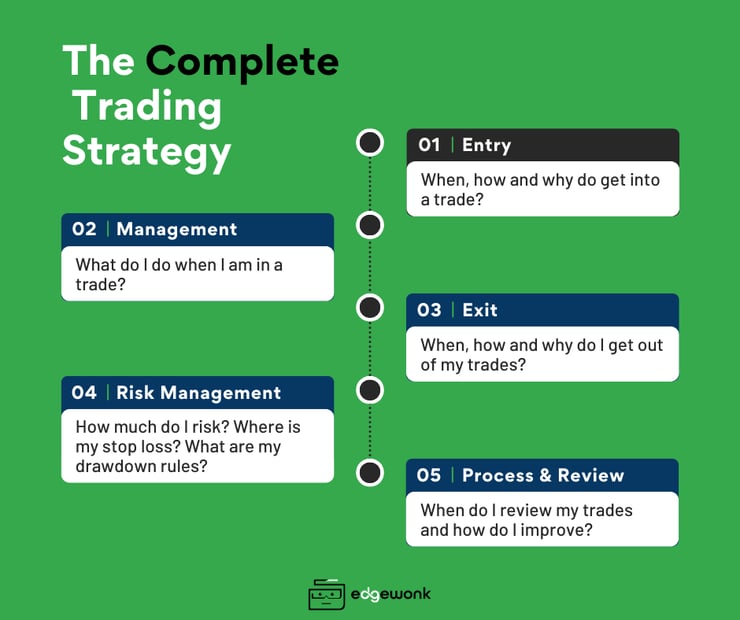

Profitable trading begins when you look beyond the entry. A strategy is not a single signal, it’s a complete system made of entries, exits, trade management, risk management, and a repeatable process. Only when all these elements work together under clear, written rules can you achieve consistency.

Without rules, every trade is random, and random trades cannot be improved. Rules turn randomness into structure, structure into discipline, and discipline into progress. That’s the real foundation of trading success.

Not all rules are created equal. Good rules share four qualities:

Specific – They remove uncertainty. Instead of “exit when price looks weak,” a good rule defines exactly what “weak” means in measurable terms.

Actionable – The trading rules should tell you exactly when to get into a trade and when to stay out.

Repeatable – A rule should lead to the same decision every time, no matter the day or your mood.

Balanced discretion – A rule should guide decisions without being so rigid that it only works in one perfect market condition.

The simplest test is this: if you can’t write your rules into a checklist you could actually follow in real time, then the rules aren’t clear enough.

Entry rules are often the first thing traders write down, but also the part where lack of clarity causes the most damage. A strong entry rule doesn’t just tell you when to trade — it also tells you when not to trade.

Timeframes

Be specific about the timeframes you trade on. If you use a multi-timeframe approach, define exactly what the role of each chart is. The higher timeframe provides context — trend direction, structure, or key support and resistance zones. The lower timeframe provides execution — the signal that triggers your entry.

Know what you want to see in each timeframe, what confirms alignment between them, and when conditions are not valid.

Tools, indicators, or patterns

Whether you use indicators, price action concepts, or chart patterns, define them precisely. Know what each tool is supposed to tell you, the exact signal you’re looking for, and the market context in which it applies. If you trade with moving averages, specify what crossover or position you need to see. If you trade patterns, define how they must form before you act. Tools should serve a clear, rule-based purpose that supports your entry decisions.

Trading times

Set clear boundaries for when you trade. Don’t sit in front of the charts all day hoping for setups to appear. Define the times when you can focus at your best and when the market offers the most reliable opportunities. Trading during low-volatility hours or when you’re mentally exhausted leads to poor decisions. By limiting your trading to a defined window — based on your market’s active sessions and your personal energy levels — you protect your focus and improve your consistency.

Exits often matter more than entries because they define the final outcome of your trade. A poor entry with disciplined exits can still work, but a strong entry with a bad exit will turn a winning system into a losing one.

There are three main types of exit methods: fixed take profit, trailing stop loss, and exits based on chart context. Whichever you choose, be clear about your rules and apply them consistently.

Fixed take profit

If you use fixed targets, define precisely how they are set. Do you use a predefined reward-to-risk ratio such as 2:1, or do you place targets at specific support or resistance levels? On which timeframe do you identify those targets, and what tools do you use to confirm them?

Trailing stop loss

Trailing stops allow you to lock in profits as the trade moves in your favor, but only if you have a structured method. Define the exact conditions for moving your stop: what triggers the adjustment, by how much you move it, and how often. Are you trailing based on a moving average, swing structure, or percentage move? Avoid improvising after price moves. Instead, know when, how, and why you trail — and stick to it.

Exits based on chart context

Some traders prefer to exit when the chart itself signals that conditions have changed — for example, when price reaches a key zone, shows reversal signs, or breaks structure. If you use this approach, define what exactly qualifies as a change in context. Which patterns, candles, or structural breaks signal that the market environment is no longer valid for your trade? On which timeframe do you assess that context?

Even with clear entries and exits, many traders still lose money because they mismanage trades once they’re open. The most common mistake is cutting winners too soon. Watching the P&L fluctuate during your trade creates stress, and without predefined rules, traders act on fear or impulse instead of their plan.

Trade management rules remove this uncertainty. They define what to do after entering:

In Edgewonk, the trade management feature shows whether a trader is realizing the full potential of their trades or leaving profits on the table. Rules turn emotional guesswork into a structured process and that structure is what separates consistent traders from inconsistent ones.

If entries decide when you trade and exits decide how you leave, risk rules decide whether you stay in the game at all. Many traders fail not because their setups are bad, but because their risk per trade or overall exposure is unsustainable.

Clear risk rules should cover:

Drawdown rules

Every trader faces losing streaks, yet most are unprepared. Without a plan, streaks trigger revenge trading, hesitation, or reckless over-sizing. With a plan, they become just another part of the process.

Risk rules are about ensuring you can withstand the inevitable rough patches and keep trading long enough for your edge to play out.

Traders often write rules, but they are not written in a way that creates real discipline. Some of the most common mistakes include:

Vagueness: rules that use words like “strong,” “weak,” or “looks good” leave room for hesitation and improvisation.

Too many exceptions: when there is always an “unless” or “but,” rules become easy to break and bad trades are easily justified.

Overly rigid rules: some traders overfit their strategy so much that rules only work in one market condition, or they define rules so narrowly that they barely find any trades at all.

Incomplete rules: focusing only on entries while ignoring exits, trade management, risk, and routines leaves dangerous gaps in the system.

Constant rewriting: changing rules after every losing streak leads to system hopping and prevents real improvement.

Good rules balance clarity with practicality. They are complete enough to guide all trading decisions but flexible enough to work across different market conditions.

Many traders expect that once they write down rules, the strategy will instantly make money. In reality, this almost never happens. The first challenge is not whether the rules are profitable, but whether the trader can follow them consistently.

Most traders deviate from their own plan far more often than they realize. They cut trades early, ignore signals, or improvise when pressure rises. Then they blame the system when results disappoint, even though the problem is rule-breaking, not the rules themselves.

This has severe consequences. Believing the rules do not work, they abandon the system and look for a new one. But because the trader has not changed, the same cycle repeats. The focus stays on finding a “better” entry signal, when in reality the issue is rule-breaking that destroys any edge the system could have provided.

The only way to break this cycle is to measure how well you follow your rules. In Edgewonk you can see patterns of repeated deviations that erode performance. Very often the rules do work, but the trader’s discipline is what needs improvement.

We’ve covered the different building blocks of a complete trading strategy. To bring it all together, here is a checklist that combines the key points. Use it to see whether your rules are clear, complete, and practical, and to spot the areas where you may still need work.

Clear trading rules turn randomness into structure. When every part of your strategy is defined, from entries and exits to trade management, risk, and process, you gain consistency. Consistency is what makes real improvement possible.

The checklist above is your framework. Use it to test your current strategy and to identify the gaps that may be holding you back. Once your rules are in place, the next step is optimizing your rules. This means refining what works, removing what does not, and steadily building a strategy that becomes stronger over time.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...