The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

2 min read

Edgewonk News Nov 18, 2025 11:24:59 AM

Many traders know how to enter a position but become uncertain once the trade is active. This is the moment when emotions influence decisions, exits lose consistency, and performance suffers. The trade management feature in Edgewonk brings clarity to this important part of the process. It evaluates how well traders let winners run, whether profits are taken too early, and where potential gains are missed. By analysing real trading behaviour, it shows when trade management strengthens a system and when it holds a trader back.

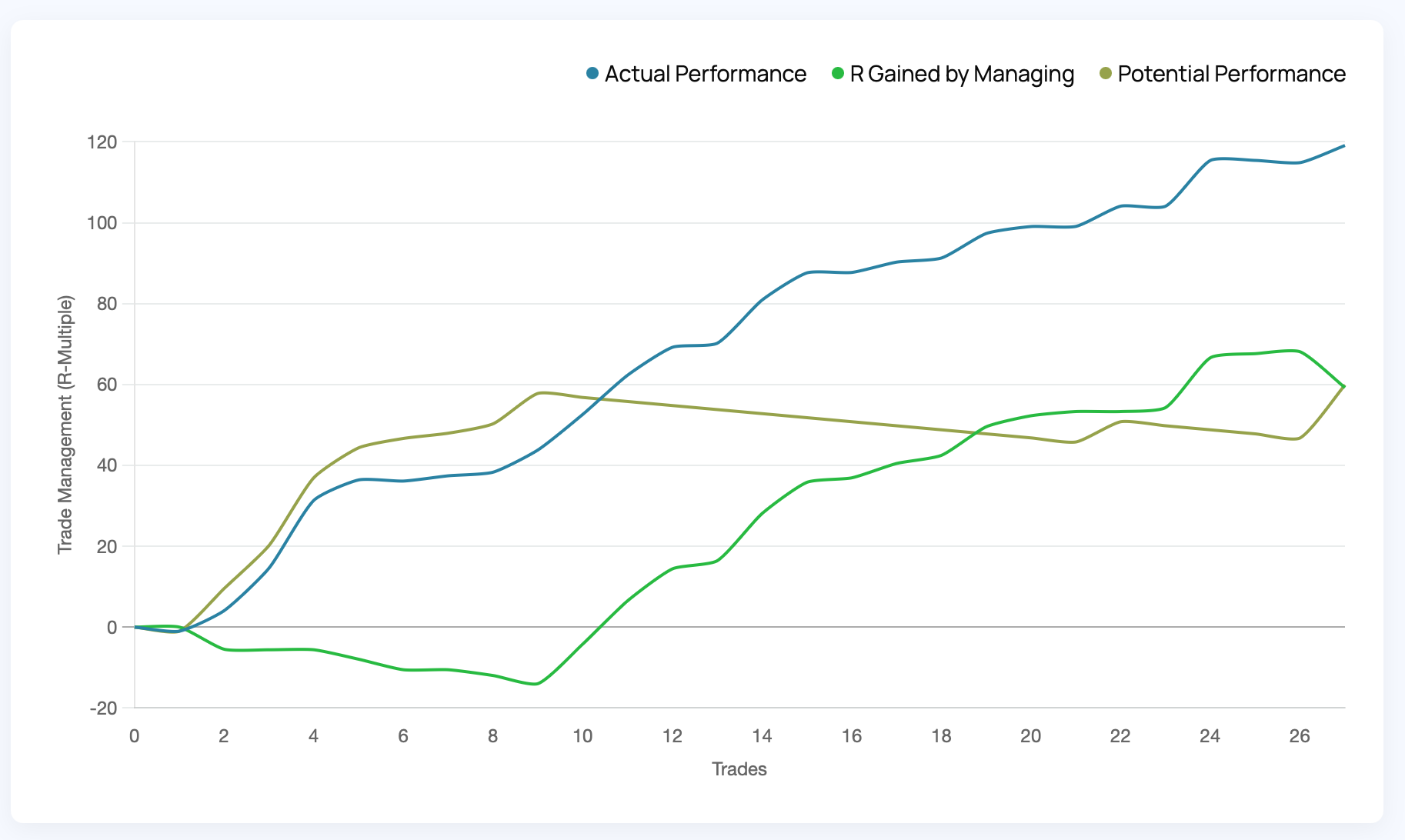

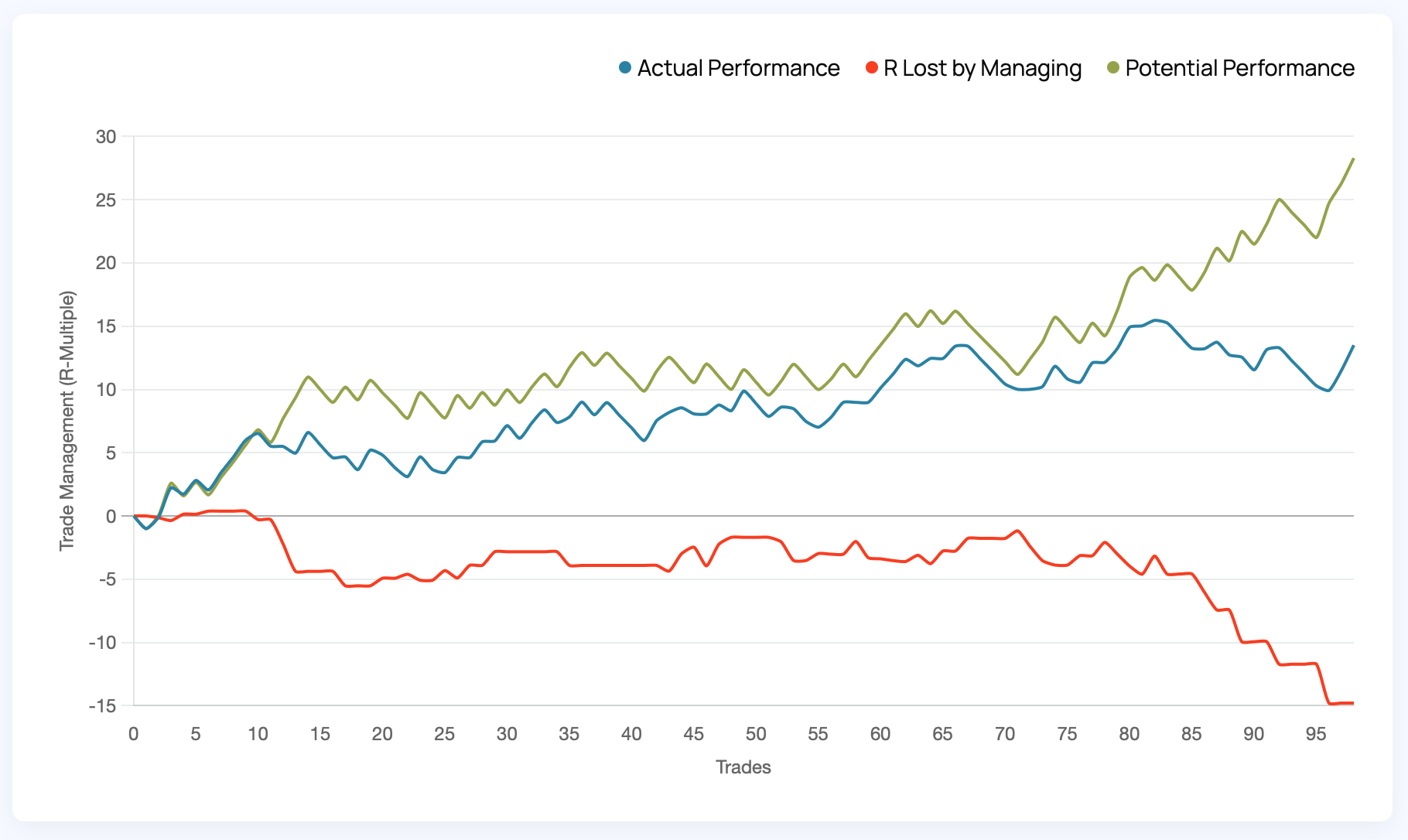

Before reviewing the positive and negative states of the trade management feature, it helps to understand the three lines in the trade management graph. Each line highlights a different view of trade outcomes and shows how decisions after entry affect results.

The actual performance line reflects the real outcome of the trades based on your broker's trading data. It shows exactly how much was earned or lost after all management actions were taken.

The potential performance line shows how the trades would have developed with a completely passive set-and-forget approach. It provides an objective reference that is free from any in-trade decision making.

The difference between these two values is shown as R lost/gained by managing. It reveals whether trade management improved performance or reduced it.

All values are expressed in R-multiple for clear comparison.

When the trade management graph displays a positive state, it indicates that the trader handles open positions with discipline and consistency. The green feedback box beneath the graph confirms this state and offers immediate clarity. This simple indicator was added to help traders quickly understand whether their current trade management strengthens their system.

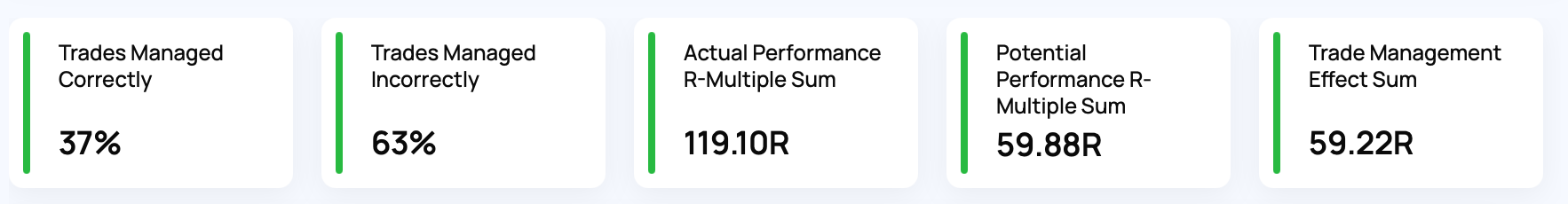

For the positive state, the actual trade management graph shows the actual performance line clearly above the potential performance line. This means the trader is making effective decisions once the trade is active. Winners are allowed to develop, exits are well timed, and losses are kept within planned boundaries. In practical terms, the trader could not have improved the outcome of these trades through different management choices.

A set of performance boxes completes the picture. They highlight how many trades were managed correctly, how many were mishandled, and they include several key data points from the feature. Together, these elements provide a clear assessment of how well the trader manages positions and confirm that this part of the trading process is currently functioning as intended.

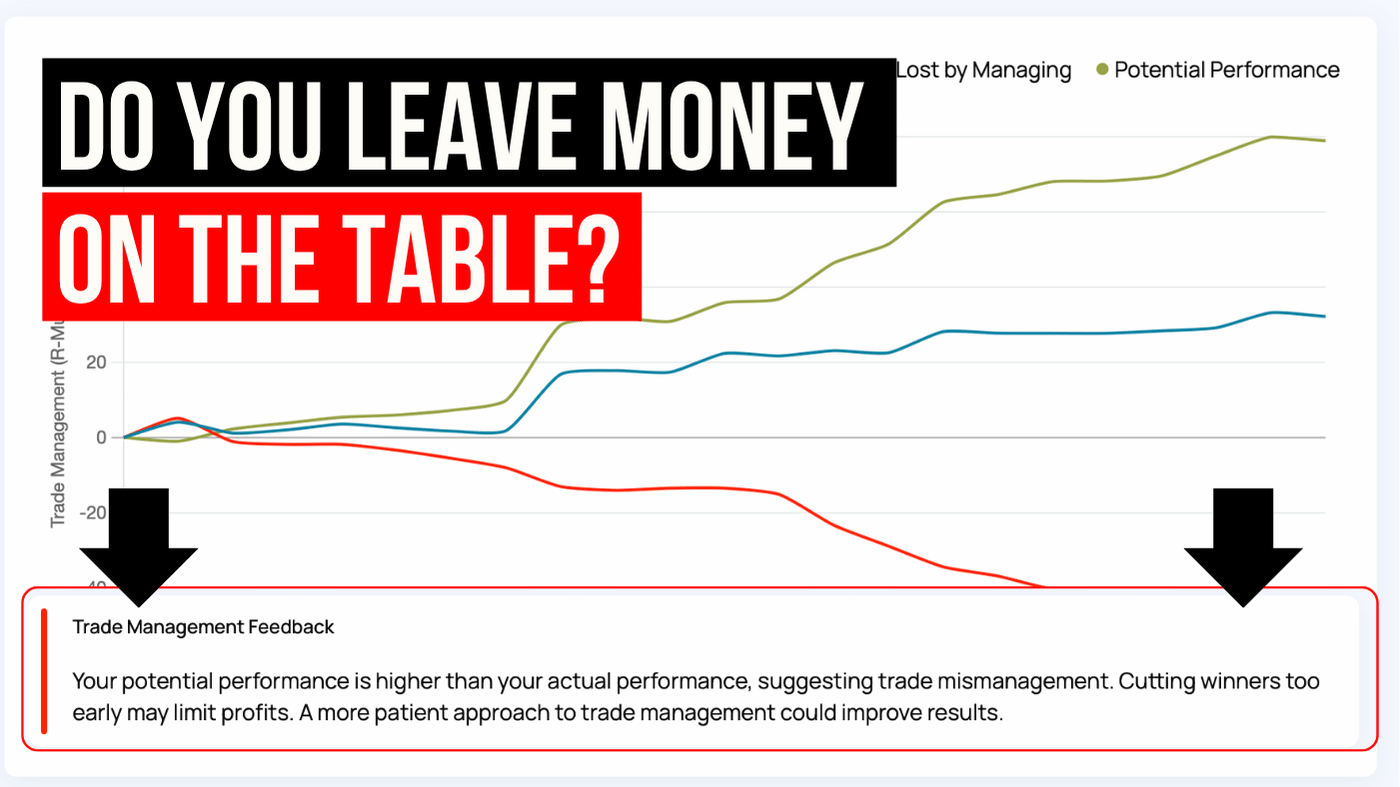

When the trade management feedback box appears in red, it signals that potential performance is higher than actual performance. This means that the trader’s decisions during the trade reduced the overall result. In most cases this happens because winners are cut too early or losing trades are allowed to move beyond the planned exit.

The graph makes this clear. The potential performance line in green stands above the actual performance line, showing that a simple set-and-forget approach would have produced a better outcome. The red line, which represents R lost by managing, moves downward whenever a trade is mishandled. Each drop in this line reflects a specific instance in which trade management weakened the system.

The section concludes with the trade management effect box. This box shows the total R multiple lost through mismanagement and directly corresponds to the movement of the red line.

Effective trade management is one of the strongest performance drivers in any trading approach. By comparing actual outcomes with objective potential outcomes, the Edgewonk trade management feature shows clearly where decisions support the system and where they weaken it. With this insight, traders can adjust their behaviour, strengthen their process, and continue to develop greater consistency in their results.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...