The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

.png)

Edgewonk’s simulator is a powerful feature that allows traders to forecast potential future account growth based on their actual trading performance. By using real data from your trading journal, the simulator provides insights into your risk and return dynamics. This can help you develop a better understanding of your trading, manage expectations, and refine your risk management strategies for more consistent success.

How Does It Work?

The simulator takes the trades you’ve entered into Edgewonk and runs various simulations to predict different outcomes. You can adjust key metrics like your win rate, average gain, and average loss. This lets you explore how slight changes in your performance could impact your account over time.

Why Does It Matter?

The first thing you’ll want to look at is how far apart the lines are on the graph. If the lines are very far apart, it means there’s a lot of uncertainty in your trading approach. The more tightly clustered the lines, the more consistent and profitable your results are likely to be.

Win rate is one of the biggest drivers of these outcomes. The higher your win rate, the closer together the lines will be, keeping everything else fixed. For instance, if you have a 70% win rate instead of 60%, your simulations will show a much more consistent and profitable outcome. This effect occurs because a higher winrate leads to a better expectancy, which means that your trading approach is more profitable.

On the other hand, a lower win rate, like 50% instead of 60%, results in wider spreads between the highest and lowest outcomes in the simulator. This indicates more uncertainty because of a lower expectancy and worse performing trading strategy. While it’s possible to achieve a positive result, the chances of underperforming or even losing are also higher. This helps you understand the risks involved in your current strategy.

Short-Term vs. Long-Term Performance

It’s important to remember that short-term trading results are often much more uncertain than long-term results. When simulating over a shorter horizon, like 50 trades (instead of 500), the differences between the best and worst outcomes are larger. This shows that trading performance can be highly unpredictable in the short term.

However, over the long term, these variations tend to even out. If your win rate and R-multiple (the ratio of your average gain to your average loss) remain consistent, you are likely to see more stable growth in your account. The simulator can help you visualize this and prepare for the ups and downs along the way.

How This Helps You

The simulator can be a valuable tool in managing your mindset. For instance, if you experience a losing streak of six or seven trades in a row, the simulator can show you that this is normal and even expected. This knowledge helps you stay confident and avoid making rash decisions during tough periods.

Additionally, the simulator can give you realistic expectations for your trading. You might not always hit the highest performance outcomes, but even the middle or lower-range results could still lead to a profitable trading strategy in the long run.

Final Thoughts

Edgewonk’s simulator allows you to test different scenarios and see how your trading performance might evolve over time. By adjusting key factors like win rate and R-multiple, you can gain valuable insights into your trading approach. This helps you better understand the risks, prepare for both losing and winning streaks, and refine your strategy for long-term success.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

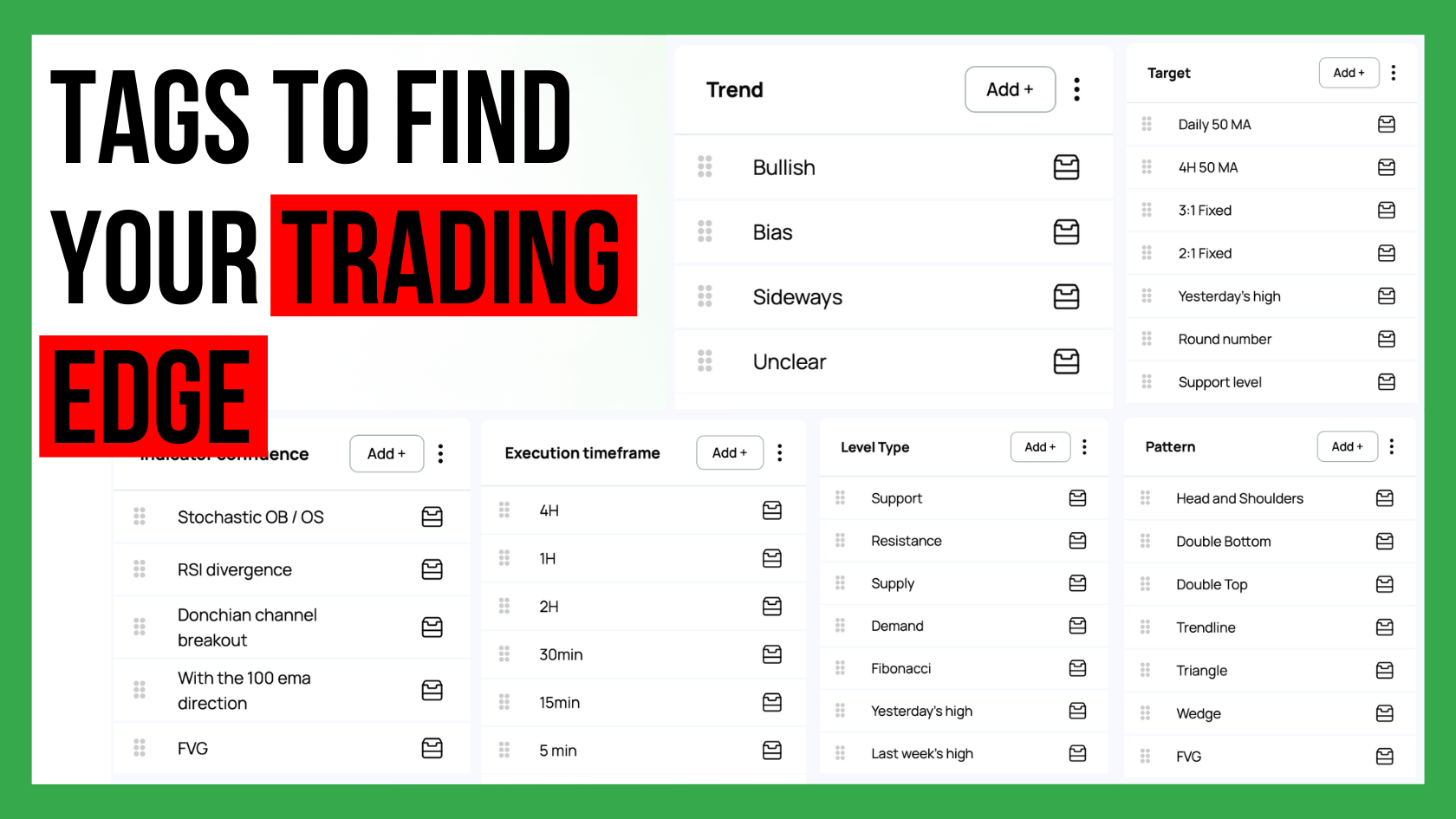

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...