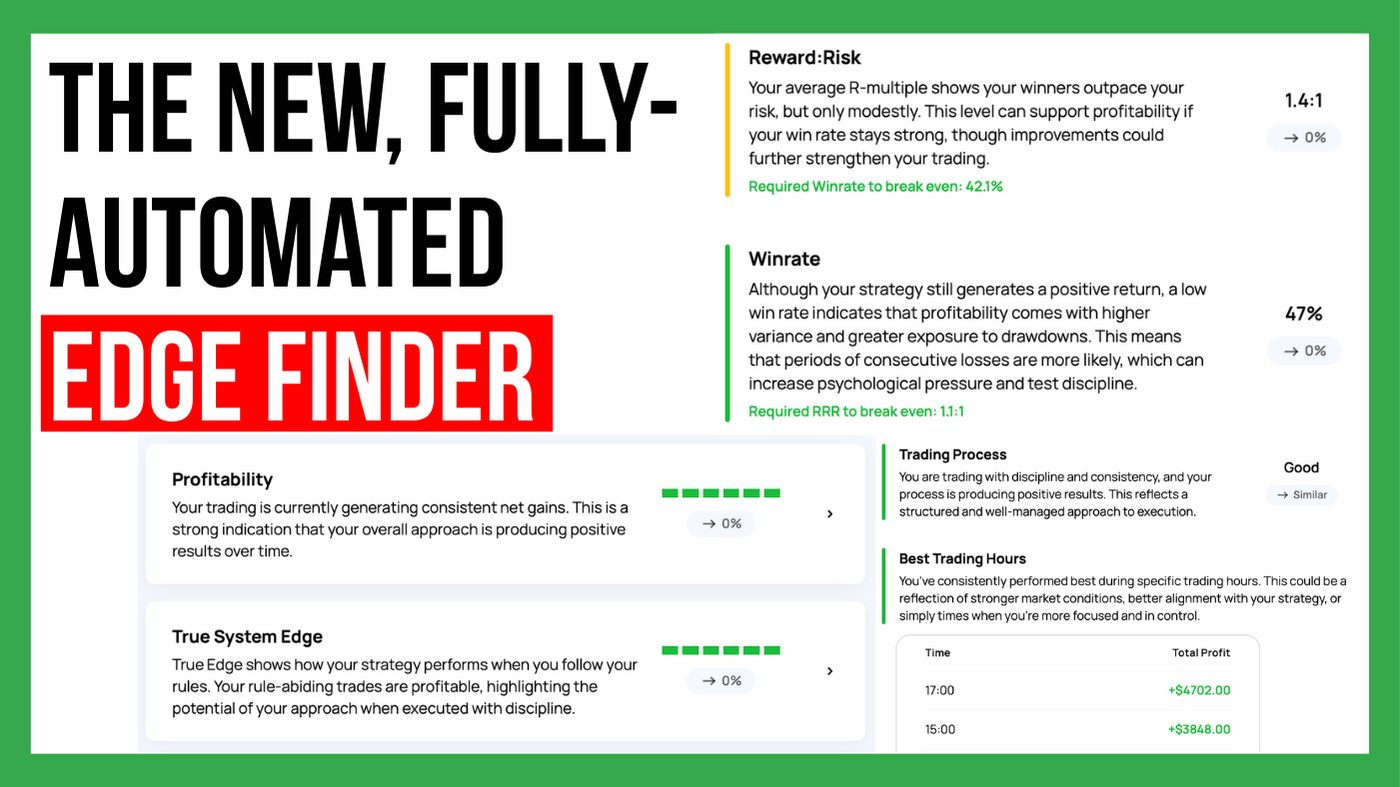

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

5 min read

Rolf Oct 2, 2024 11:50:48 AM

.png)

In financial markets, economic news is one of the key drivers of price movement – or rather, how traders and institutions react to these news. For traders, knowing which economic reports to follow can significantly enhance your ability to anticipate market volatility and make informed trading decisions. Whether you’re trading stocks, forex, or commodities, understanding how major economic indicators impact the market is essential to success.

This guide breaks down the most important economic news for traders, helping you understand what to watch for and how these reports can influence trading strategies.

While there are many economic indicators released regularly, not all news impacts the markets equally. Here are some of the most important reports that online traders should keep an eye on.

Central banks, such as the Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of England, play a pivotal role in financial markets. Their decisions on interest rates and monetary policy can create significant market volatility, particularly in the forex and bond markets.

Why It Matters:

Interest rate changes can have immediate and profound effects on currencies, bonds, and stocks. A higher interest rate tends to strengthen a country’s currency, as it attracts foreign investment seeking higher returns. Conversely, lower rates can weaken the currency and potentially boost stock markets as borrowing becomes cheaper for companies.

How to Trade It:

Monitor central bank meetings and speeches from top officials. Look out for hints of future policy changes, especially shifts from a hawkish (favoring rate hikes) to a dovish (favoring rate cuts) stance. Even a subtle change in tone can trigger market reactions.

Keep in mind that you are not trading the news but the reaction of the market to the news. Sometimes, the numbers are already priced into the market and there will be no reaction at all, and sometimes, the market will go up on bad news or vice versa. Always observe price action first before making trading decisions.

The U.S. Non-Farm Payrolls (NFP) report is released on the first Friday of every month and is one of the most highly anticipated economic data releases. This report provides a snapshot of job growth in the U.S., excluding the agricultural sector.

Why It Matters:

The NFP is a key indicator of economic health. A robust job market usually indicates a growing economy, which can increase investor confidence and support stock prices. Conversely, a weak report may suggest economic trouble, leading to market uncertainty and potential sell-offs.

How to Trade It:

The NFP report often leads to sharp market movements, especially in currency pairs like EUR/USD and GBP/USD. Traders should compare the actual data with expectations. If the report surprises significantly, it can create opportunities for short-term trades based on market reactions.

Gross Domestic Product (GDP) measures the total value of goods and services produced by a country and is a key indicator of economic growth. Most major economies release GDP figures quarterly.

Why It Matters:

GDP is often seen as the broadest indicator of economic activity. A growing GDP signals a strong economy, which can boost stock markets and attract foreign investment, strengthening the domestic currency. On the other hand, a declining GDP may cause investors to move away from riskier assets, leading to lower stock prices and weaker currencies.

How to Trade It:

When GDP figures are released, compare them to market expectations. If GDP growth exceeds expectations, it often leads to bullish sentiment in the stock market. Conversely, if GDP underperforms, it can trigger a more cautious or bearish outlook.

Inflation data, usually represented by the Consumer Price Index (CPI) and Producer Price Index (PPI), plays a critical role in shaping central bank policies. The CPI tracks changes in the price of goods and services from the consumer's perspective, while the PPI focuses on wholesale price changes from producers.

Why It Matters:

Inflation data can directly influence central banks’ decisions on interest rates. Rising inflation may prompt a central bank to raise rates to prevent the economy from overheating. This can strengthen the currency but may have a cooling effect on stock markets. Conversely, low inflation might lead to rate cuts, encouraging economic growth and stock market gains.

How to Trade It:

Inflation surprises—when the actual data differs significantly from market expectations—can lead to sudden market movements. It is always advisable to be flat before the news release, especially as a day trader, then wait for the dust to settle, and get into the market once a direction has been chosen and the market showed its hand. These trades can easily turn into some of the best trend trades of the month.

Retail sales data provides insight into consumer spending, which drives a significant portion of economic activity in most developed economies. Retail sales reports are released monthly and give an idea of how much consumers are spending in stores and online.

Why It Matters:

Strong retail sales typically indicate healthy consumer demand, which can support economic growth and push stock prices higher. Weak sales may signal a potential slowdown, which could lead to declines in the stock market as investors worry about future economic prospects.

How to Trade It:

Retail sales data can move markets, particularly stock indices and currency pairs linked to consumer-driven economies like the U.S. and the U.K. Positive data often boosts investor sentiment, while negative figures can prompt sell-offs.

Understanding the importance of economic news is only the first step. To succeed as a trader, you need to develop a strategy for how to use this information effectively. Here are some practical tips to incorporate economic news into your trading routine:

An economic calendar is an essential tool for traders. It lists the dates and times of major economic data releases and central bank events, allowing you to prepare ahead of time. Most trading platforms provide an integrated calendar with alerts, so you never miss an important announcement.

Popular news calendars:

It’s not just the economic data itself that matters—how the data compares to market expectations is crucial. If a report comes in better or worse than anticipated, markets may react strongly. Keeping an eye on analysts’ forecasts before a release can help you gauge potential market reactions.

Economic news doesn’t exist in a vacuum. Traders should also pay attention to the broader market sentiment. For example, even strong data might not lead to a market rally if investors are concerned about geopolitical risks or other external factors. Understanding the context in which news is released is critical for making informed trades.

Economic news often leads to increased volatility, which can present opportunities but also risks. Use stop-loss orders to protect your trades, and avoid over-leveraging. Even the best news traders can experience losses, so managing risk is essential.

Another strategy is to avoid trading news events altogether and simply only trade a couple of minutes (usually 5-10 minutes) after the event. You will still be able to capture good chunks of price movement after the volatility has subsided.

Timing is crucial when it comes to trading economic news. Markets often experience heightened volatility around data releases, with prices moving rapidly in the minutes following an announcement.

Before the News

Some traders enter trades in anticipation of economic releases, particularly when they have a strong view on the outcome. However, this can be risky if the data deviates from expectations. Spread and trading costs also typically increase just before a news release.

After the News

Most traders prefer to wait until after the news is released to see the market’s reaction. This strategy can help avoid the initial volatility and allow you to follow the new trend as it develops. We personally strongly encourage this strategy behavior. It is far less risky and still has the chance for good gains.

Economic news plays a critical role in shaping financial markets, and traders who understand the impact of key reports like central bank announcements, Non-Farm Payrolls, GDP, and inflation data can gain an edge. By staying informed, using an economic calendar, and managing risk effectively, traders can turn economic news into profitable opportunities.

As you refine your trading strategy, always keep an eye on the bigger picture. While individual data points matter, broader economic trends and market sentiment can also have a significant impact on price movements. On days with big announcements later in the day, typically the price action will be very stale and untradeable until the event hits the wires. It is important to be aware of this, as well, and not get sucked into trading ranges. With the right approach, economic news can be a powerful tool in your trading arsenal.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

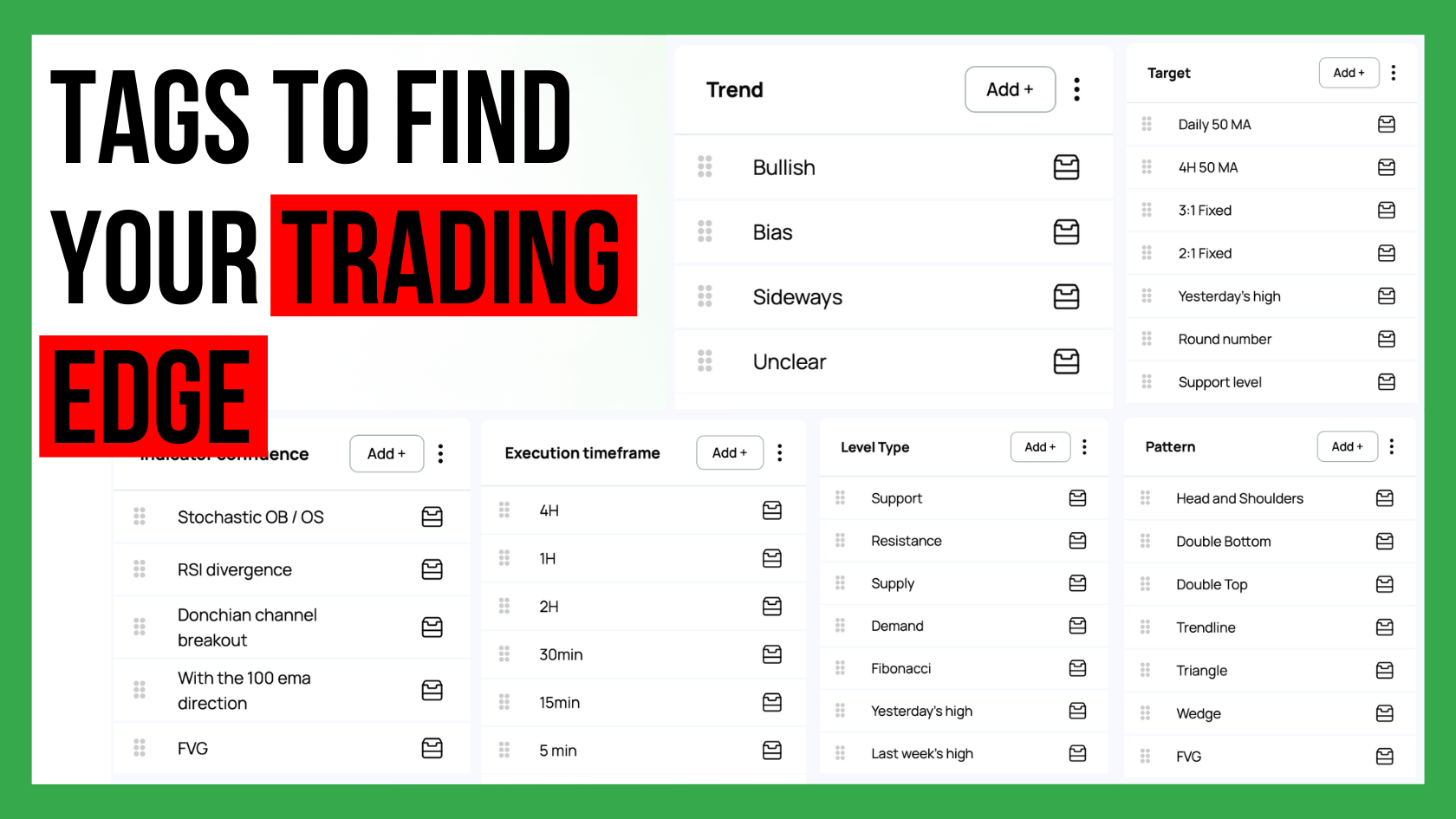

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...