The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

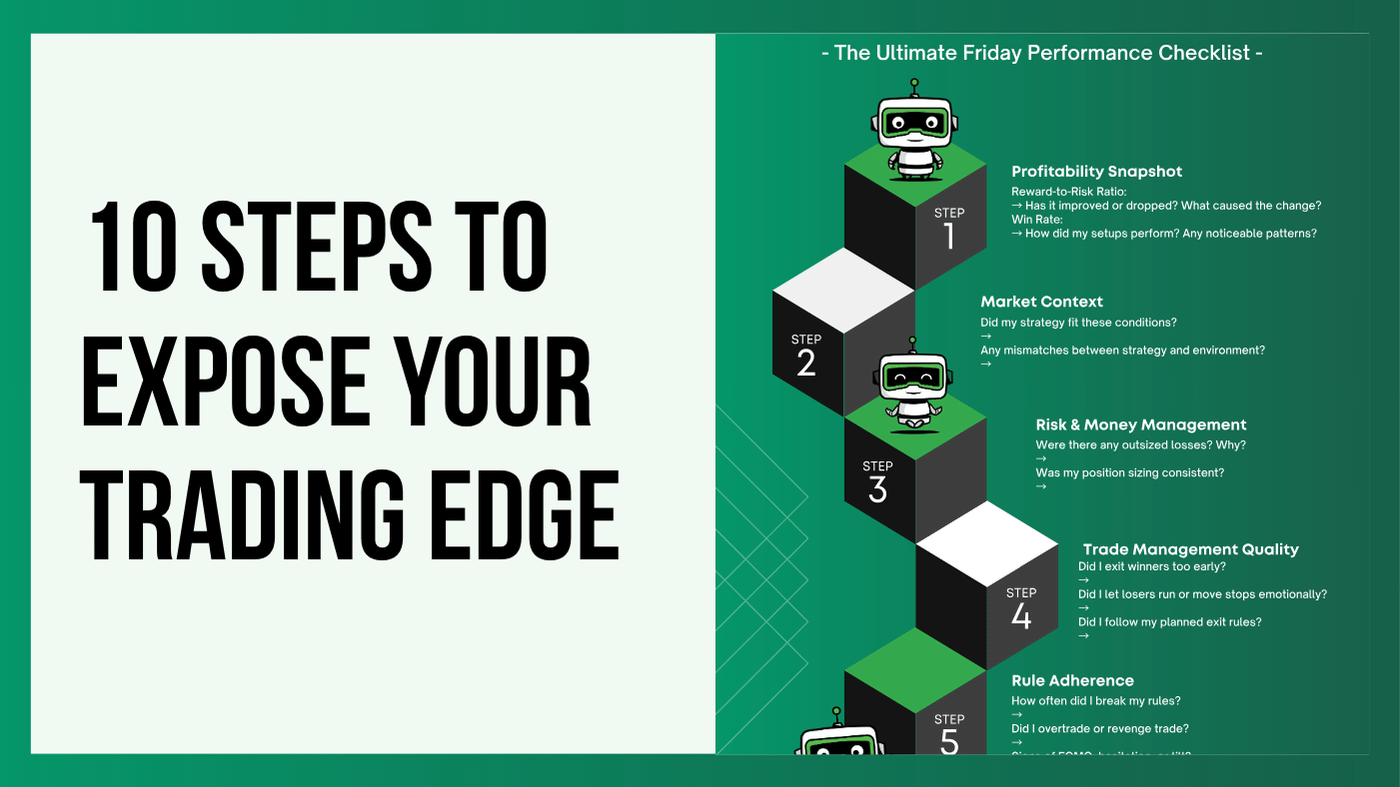

Most traders finish the week with a mix of feelings. They have a few good trades, a few frustrating ones, and usually a sense that things could have gone a little smoother. That’s normal. What actually makes the difference over the long run is taking a few minutes at the end of the week to really understand what happened. Not in a heavy, complicated way, but in a simple, structured way that helps you see what worked, what didn’t, and where your edge is moving.

This 10-step end-of-week checklist gives you exactly that: a clear routine you can follow every Friday to stay grounded, stay honest, and steadily move toward more consistent, confident trading.

Start with the metric that matters most:

If PF signals concern, diagnose the underlying drivers:

This top-down method prevents getting lost in details.

In Edgewonk: The home tab will provide you with all three metrics at once.

A poor week isn’t always the trader’s fault. Markets change.

Write down:

This avoids false blame and keeps expectations realistic.

In Edgewonk: Use Custom Statistics to track the general state of the market. Over time, you will gain insights into when your strategy performs best.

Look for breakdowns in risk discipline:

This section quickly exposes structural problems.

In Edgewonk: Go to Chart Lab > Risk Distribution and look for outlier bars on the left, indicating large losses.

The goal: evaluate how well you captured potential.

Check:

This highlights one of the biggest performance leaks.

In Edgewonk: Go to Chart Lab > Trade Management and analyze your Trade Management Feedback box at the bottom of the screen.

Here we examine behavioral consistency:

This separates strategy issues from self-control issues.

In Edgewonk: Go to Chart Lab > Trade Comments and go through your different comment categories, looking for outliers that show your biggest weaknesses.

Missed opportunities reveal workflow or mindset blindspots.

Ask:

This section helps refine execution discipline.

In Edgewonk: Go to your Missed Trades journal section and analyze your trades there.

Clean data = reliable insights.

Verify:

This ensures the next week’s analysis is built on solid information.

Reinforce strengths:

This boosts confidence and direction.

A focused look at what hurt performance:

This anchors where improvement is needed.

Carry intentionality forward:

Not five goals. One powerful, achievable focus.

A good week or a rough one, each Friday gives you a chance to reset and realign. Use this checklist to stay aware, stay consistent, and keep moving in the right direction. Small improvements add up quickly — and your future self will thank you for taking this time.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...