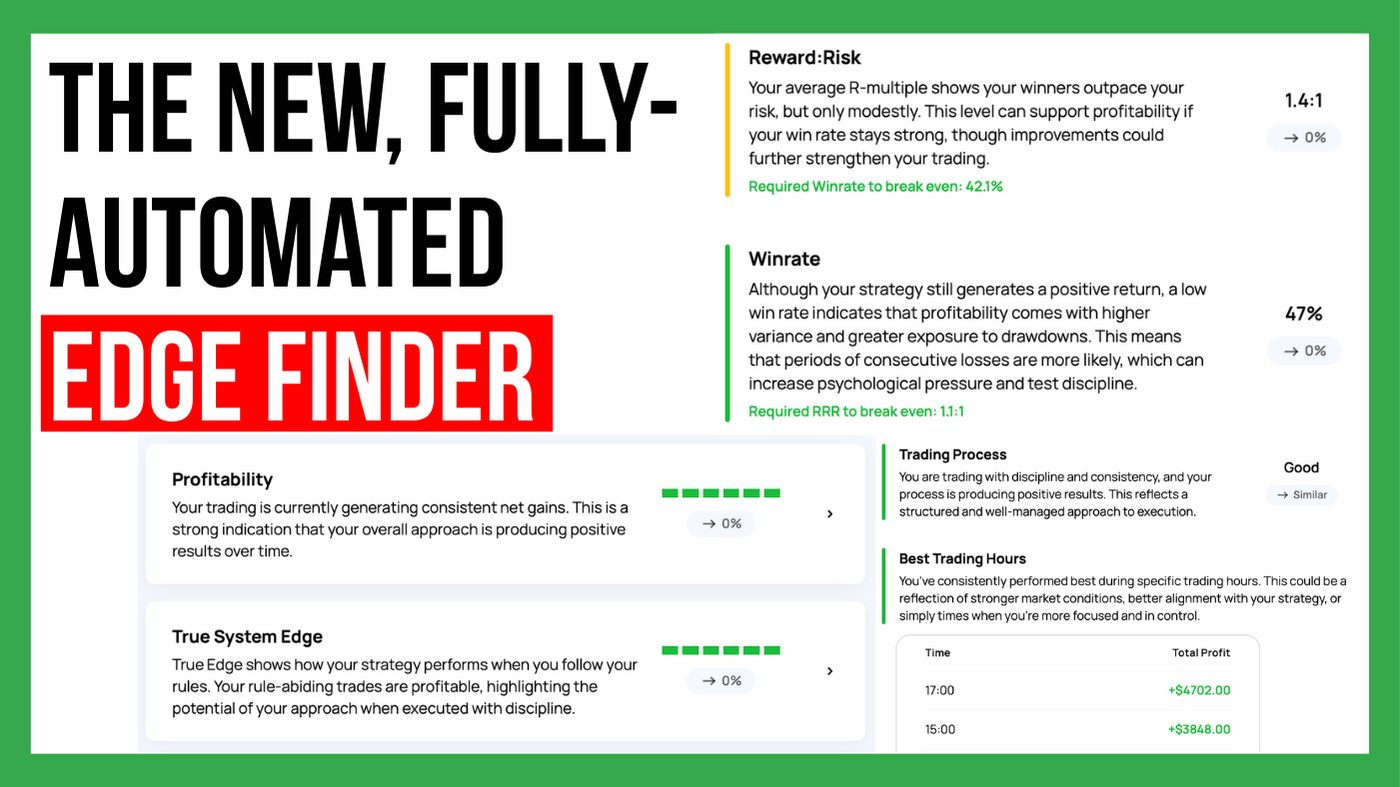

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

7 min read

Rolf Aug 13, 2024 1:00:50 PM

As a trader, you’ve likely encountered various asset classes, each offering unique opportunities and risks. But how do you decide which market suits your trading style and requirements? Understanding the differences between forex, futures, and stocks is crucial for making informed decisions and developing a profitable trading strategy for the right market.

This guide will break down these markets, helping you grasp their distinct features and nuances.

Stocks trading is the buying and selling of shares in publicly traded companies. When you purchase a stock, you’re buying a piece of ownership in that company. The value of individual stocks fluctuates based on the company’s performance, market conditions, and broader economic factors, and of course, traders’ reactions to all these events.

Investing in stocks is often seen as a way to build wealth over time. By holding shares of successful companies, investors can benefit from capital appreciation and dividends. However, stock trading can also be highly speculative, with prices moving dramatically based on news, earnings reports, and market sentiment – this is the volatility that day traders love, on the other hand!

Forex trading refers to the buying and selling of currencies on the foreign exchange market. The forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. In forex trading, you trade currency pairs, such as the EUR/USD, where you speculate on the price movement of one currency relative to another.

The forex market’s high liquidity and continuous operation (24 hours, 5 days a week) make it an attractive option for traders looking for flexibility and opportunities to trade around the clock.

Futures trading involves buying and selling contracts that obligate the trader to purchase or sell an asset at a predetermined price on a future date. These contracts can be based on various underlying assets, including commodities (like oil and gold), financial instruments (like stock indices), or currencies.

Traders use futures for hedging or speculation, aiming to profit from price movements in the underlying asset.

Each of these markets has a distinct structure and attracts different participants.

Stocks are traded on exchanges, either through direct buying and selling on platforms like the NYSE or through over-the-counter (OTC) markets. The participants in the stock market range from individual retail investors to large institutional investors, such as mutual funds and pension funds. The stock market is highly regulated, providing a level of security for investors.

Forex operates in a decentralized manner, meaning there’s no central exchange. Instead, trading occurs over the counter, with transactions facilitated by a global network of banks, brokers, and financial institutions. The key participants in the forex market include central banks, commercial banks, hedge funds, and retail traders. The decentralized nature of forex contributes to its liquidity and continuous operation but also means there’s less regulation compared to the stock market.

Futures trading happens on centralized exchanges where contracts are standardized. These exchanges, like the CME, provide a transparent and regulated environment. The primary participants in the futures market include hedgers, who use futures to manage risk, and speculators, who seek to profit from price movements. Clearinghouses play a vital role in the futures market by ensuring that trades are settled and that both parties in a contract meet their obligations.

The trading hours and liquidity of each market vary significantly, impacting how and when you can trade.

Stocks typically trade during the regular market hours of the exchange where they’re listed. For example, the NYSE operates from 9:30 AM to 4:00 PM Eastern Time. Liquidity in the stock market is usually highest during these hours, with the most significant activity occurring at the market open and close.

Forex, being a global market, operates 24 hours a day, five days a week. This continuous trading environment allows for flexibility, enabling traders to participate in different sessions, such as the Asian, European, and North American sessions. Liquidity in the forex market is generally very high, especially during overlapping session times, which is a key advantage for traders looking for quick executions and tight spreads.

Futures markets also have specific trading hours, though they can vary depending on the contract and exchange. For instance, futures on the CME often trade for nearly 24 hours, with short breaks during the day. Liquidity in the futures market can be high, particularly in popular contracts like the E-mini S&P 500 or crude oil. However, liquidity can decrease significantly outside of peak trading hours, which can lead to wider spreads and increased volatility.

Leverage is a significant factor that differentiates these markets and influences trading strategies.

In stock trading, leverage is typically lower compared to forex and futures. U.S. regulations allow for a maximum of 2:1 leverage, meaning you can control $2 of stock with $1 of your capital. While leverage can amplify gains, it also increases the potential for losses, so managing risk is crucial.

Forex trading offers much higher leverage, often up to 50:1 or even higher, depending on the broker and jurisdiction. This means that with a small amount of capital, traders can control large positions. However, this high leverage also makes forex trading risky, as small market movements can lead to significant gains or losses.

Futures trading uses a margin system, where traders are required to deposit a performance bond (initial margin) to enter a position. Unlike forex, futures contracts are highly leveraged, allowing traders to control large amounts of the underlying asset with relatively small margin deposits. However, futures traders must also maintain a minimum margin level (maintenance margin) to keep positions open, adding another layer of risk management.

All three markets carry risks, but the nature of these risks can vary.

Stocks are often perceived as less volatile compared to forex and futures, particularly when investing in large, established companies. However, individual stocks can still experience sharp price swings due to company-specific news, earnings reports, or broader market trends.

Forex is known for its low volatility, overall, where a 1-2% price move on a single day would mean a significant event in most currency pairs. However, as we get higher leverage, we can still make money comfortably in Forex even in a low volatility environment.

Futures can be extremely volatile, particularly in contracts tied to commodities or financial instruments sensitive to economic data or geopolitical events. The leverage used in futures trading can magnify these price swings, leading to large gains or losses in a short period.

The regulatory environment is an essential consideration for traders, as it affects the safety and transparency of the markets.

Stocks are heavily regulated by government bodies like the U.S. Securities and Exchange Commission (SEC) in the United States. These regulations are designed to protect investors by ensuring transparency, preventing fraud, and maintaining fair trading practices.

Forex regulation varies significantly by country. In the U.S., for example, forex brokers must be registered with the Commodity Futures Trading Commission (CFTC) and be members of the National Futures Association (NFA). However, the decentralized nature of forex means that regulations can be less stringent in other jurisdictions, making it essential for traders to choose reputable brokers.

Futures trading is also highly regulated, with oversight provided by agencies like the CFTC in the United States. Futures exchanges enforce strict rules regarding margin requirements, contract specifications, and clearinghouse operations, providing a layer of protection for traders.

Understanding the costs associated with trading in each market is vital for managing profitability.

Stock trading costs typically include commissions, spreads, and other fees, such as exchange fees or account maintenance charges. With the rise of commission-free trading platforms, the cost of trading stocks has decreased but spreads and other hidden costs still exist.

Forex trading costs primarily revolve around spreads, the difference between the bid and ask price. Some brokers also charge commissions on trades, but many offer commission-free trading with slightly wider spreads. Traders should also be aware of potential hidden costs, such as swap rates on overnight positions.

Futures trading involves commission fees, which can vary depending on the broker and the contract being traded. Additionally, traders may incur exchange fees and costs related to the clearinghouse. While futures contracts often have lower spreads due to high liquidity, these other costs can add up, especially for active traders.

Each market offers unique advantages and is suitable for different types of traders.

Stocks are generally more suitable for long-term investors or those looking to build wealth over time. However, day traders can also benefit from trading stocks, especially when focusing on high-volume small-cap stocks with sufficient liquidity.

Forex appeals to traders who prefer a slower, flexible trading environment. Its 24-hour nature and high leverage make it ideal for those who can closely monitor the markets over longer periods.

Futures are often favored by traders looking for exposure to commodities, indices, or other financial instruments with high leverage and liquidity. Futures trading is suitable for those with a solid understanding of the underlying markets and a willingness to manage the higher risk levels associated with leveraged trading.

Understanding the differences between forex, futures, and stocks is essential for any trader looking to navigate these markets successfully. Each market has its unique characteristics, risks, and opportunities.

By recognizing these differences, you can choose the market that aligns best with your trading style, risk tolerance, and financial goals.

Whether you're drawn to the ownership aspect of stocks, the global scope of forex, or the leverage and diversity of futures, informed trading decisions are key to achieving long-term profitability – first, you need a solid process, then you need to follow that diligently, and you will start to see some nice results!

|

Feature |

Stocks |

Futures |

Forex |

|

Definition |

Buying and selling shares in publicly traded companies. |

Buying and selling contracts to purchase/sell an asset at a predetermined future date. |

Buying and selling of currencies in pairs on the foreign exchange market. |

|

Market Structure |

Traded on centralized exchanges (e.g., NYSE). |

Traded on centralized exchanges with standardized contracts (e.g., CME). |

Decentralized market with trading facilitated by global networks of banks and brokers. |

|

Participants |

Retail investors, institutional investors (e.g., mutual funds, pension funds). |

Hedgers and speculators. |

Central banks, commercial banks, hedge funds, retail traders. |

|

Trading Hours |

Limited to regular market hours (e.g., NYSE: 9:30 AM to 4:00 PM ET). |

Varies by contract/exchange; some futures trade for nearly 24 hours. |

Operates 24 hours a day, 5 days a week, across different global sessions. |

|

Liquidity |

High during market hours, especially at open and close. |

High in popular contracts but can decrease outside peak hours. |

Generally very high, especially during overlapping session times. |

|

Leverage |

Typically low (up to 2:1 in the U.S.). |

High leverage through margin system, controlling large amounts of the underlying asset. |

Very high (up to 50:1 or more depending on broker and jurisdiction). |

|

Risk Factors and Volatility |

Generally lower volatility with exceptions; prices are influenced by company-specific news and market trends. |

High volatility, especially in contracts tied to commodities or financial instruments. |

Low volatility in percentage terms, but high leverage makes it risky. |

|

Regulatory Environment |

Heavily regulated (e.g., SEC in the U.S.). |

Highly regulated with strict rules (e.g., CFTC in the U.S.). |

Varies by country; less regulated in some jurisdictions, requires choosing reputable brokers. |

|

Costs and Fees |

Commissions, spreads, exchange fees, account maintenance charges. |

Commissions, exchange fees, clearinghouse costs. |

Primarily spreads; possible commissions and swap rates on overnight positions. |

|

Suitability |

Suitable for long-term investors and day traders. |

Favored by traders seeking exposure to commodities, indices, or high leverage. |

Ideal for traders needing flexibility and high leverage, suitable for those monitoring markets over longer periods. |

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

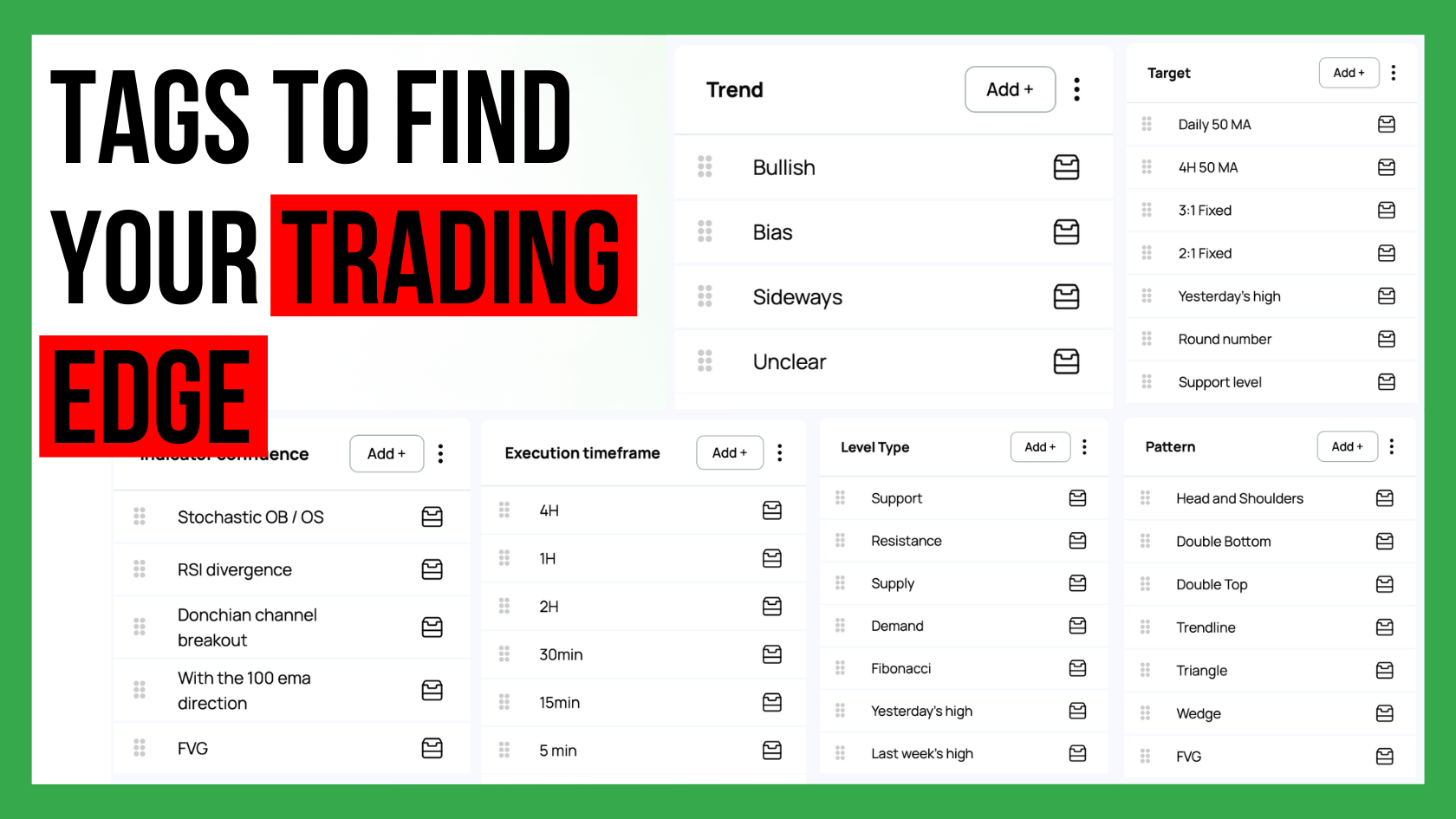

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...