The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

3 min read

Rolf Sep 12, 2024 2:10:26 PM

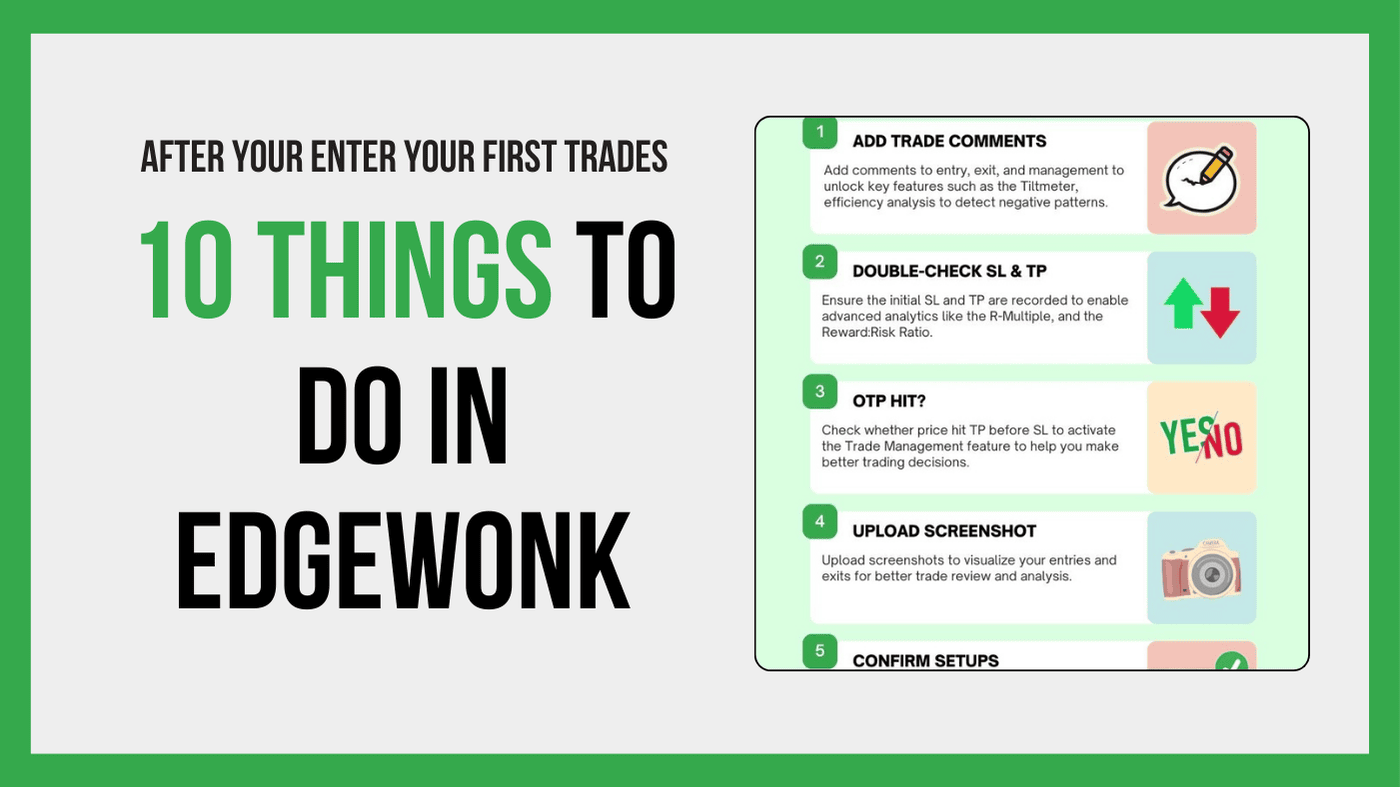

So, you've just entered (or imported) your first trades into Edgewonk—now what? How do you make the most of this powerful trading journal? In this guide, we'll walk you through 10 simple steps to complete your trade input and unlock Edgewonk's full potential, helping you gain valuable insights and improve your trading.

Spending a little extra time adding more detailed inputs will really pay off, as the better and more complete your data is, the more insightful and valuable your analysis will be.

Click the image below to download the full infographic

First, review your newly added trades and add comments for the entry, exit, and management. These comments will unlock features like the Tiltmeter and efficiency analysis, helping you spot strengths and weaknesses in your trading, and identify negative patterns easily.

The trade comments should describe qualitative trading behavior and mistakes for each part of your trade. In the table below, we provide some examples that you can use in your Edgewonk:

|

Entry |

Exit |

Management |

|

Revenge trading |

Perfect exit |

Managed well |

|

Early entry |

Early – scared |

No management |

|

Impulsive |

Late – greedy |

Moved SL too close |

|

Perfect entry |

End of day |

Forgot to manage |

You can add comments through the settings (Settings > Trade Comments) or directly in the trade entry screen. Then assign them through the dropdown in your journal table.

If you use Stop Loss (SL) and Take Profit (TP) orders, ensure you've added the initial SL and TP values for each trade. Many platforms only show the final values at the time of exit. In Edgewonk, having the initial SL and TP helps unlock key tools like the R-Multiple and Reward Ratio.

Taking a few extra minutes to input these values is well worth it.

This is a simple input, but it’s crucial for activating Edgewonk’s Trade Management feature. For each trade, ask yourself: Did the price hit the initial TP before hitting the initial SL? It doesn’t matter how the trade ended or how you managed it—just note if the initial TP was reached first.

This input is available in the “OTP hit” column of your trade table. Just select Yes or No, and you're done! This is it – and now your Trade Management graph in Edgewonk will work.

You can upload up to six trade screenshots per trade. Ideally, you have four screenshots for each trade:

If you’re short on time, even a single screenshot showing both the entry and exit will work. Reviewing these screenshots in Edgewonk’s Chartbook is an excellent way to detect issues with your execution and better remember trade scenarios during future reviews.

During the import process, you can assign a setup to your trades. If you trade multiple setups, make sure each trade has the correct one assigned. Differentiating between setups helps you track which strategies are most profitable during your reviews. This also allows you to fine-tune your rules for each setup individually.

To check or change the assigned setups, go to the Setup column in your journal tab and use the dropdown menu to make adjustments. You can also add new setups through the settings menu.

Edgewonk’s Custom Statistics (CS) feature allows you to personalize your journaling experience. You can create up to 20 different CS categories, each with multiple individual tags. This helps you track specific factors that matter to your trading style.

Here are some helpful categories:

|

Timeframes |

Chart Confluence |

Market Conditions |

Price Patterns |

Feeling |

Higher Timeframe |

|

Daily |

Support Level |

Index up |

Pinbar |

Rushed |

With the trend |

|

4 H |

Resistance Level |

Index down |

Range breakout |

Prepared well |

Against the trend |

|

1 H |

Round Number |

Volume high |

Fakeout |

Uncertain |

Pullback |

|

15 min |

Supply |

Volume contraction |

Head & Shoulders |

Sick |

Retest |

|

5 min |

Demand |

|

Retest |

|

Neutral |

These are just suggestions—feel free to add categories that are important to your trading approach. Using Edgewonk’s analysis tools, you can then find correlations to improve your strategy.

Each trade in Edgewonk allows for individual notes. We recommend writing a brief note summarizing your thoughts, any mistakes you made, and things you want to improve. Write your notes as soon as possible after the trade while the details are still fresh. Later, these notes will help you remember why you made certain decisions, making it easier to spot patterns in your trading behavior.

Edgewonk sessions are great for doing quick, structured trading reviews. Many traders create weekly sessions to recap their trading week, reflect on lessons learned, and set goals for the upcoming week. Over time, you can build a catalog of reminders, lessons, and helpful insights you’d otherwise forget, improving the learning effect.

Pro tip: Keep your session notes short and use bullet points to make them easy to review later.

This tip is a bit more advanced but worth mentioning. Edgewonk allows you to record the highest and lowest prices observed during a trade’s duration. Doing this will unlock the Exit Analysis feature, which helps you optimize your exits.

With this feature, you’ll be able to see how close the price came to your SL and TP, allowing you to fine-tune your future order placements.

We explain the Exit Analysis in detail here:

Now that your trade input is complete, it’s time for your first performance review. Don’t feel pressured to follow every single step right away. Start by focusing on one or two areas of input. Once you get comfortable with your journaling process and see the positive impact on your trading, you can gradually explore more of Edgewonk’s features. The goal is to get into a routine that works for you.

Click here: Your first performance review

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...