The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

We just released a second update for November 2021.

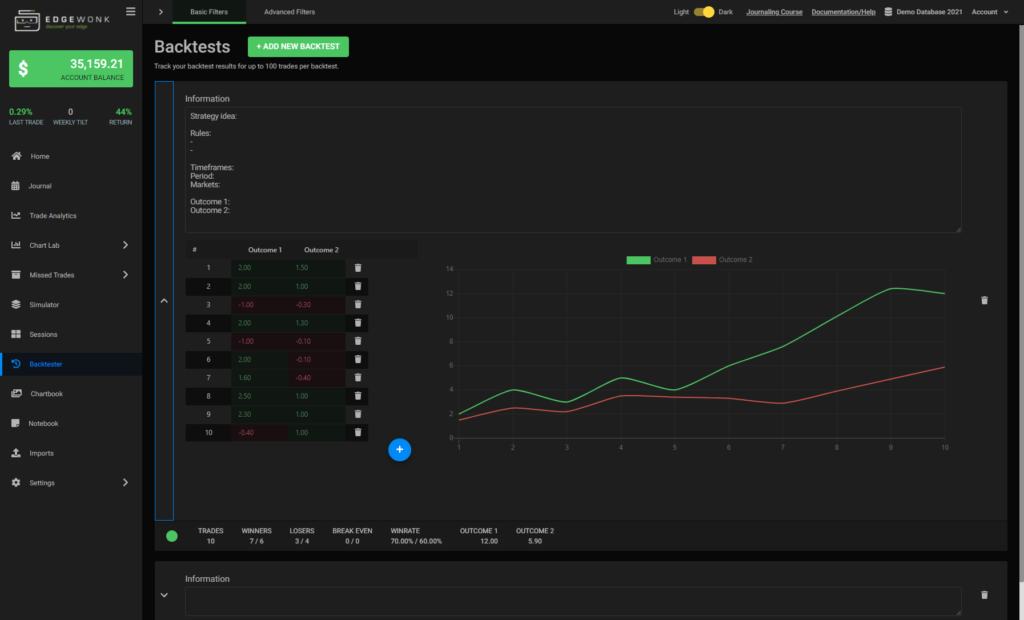

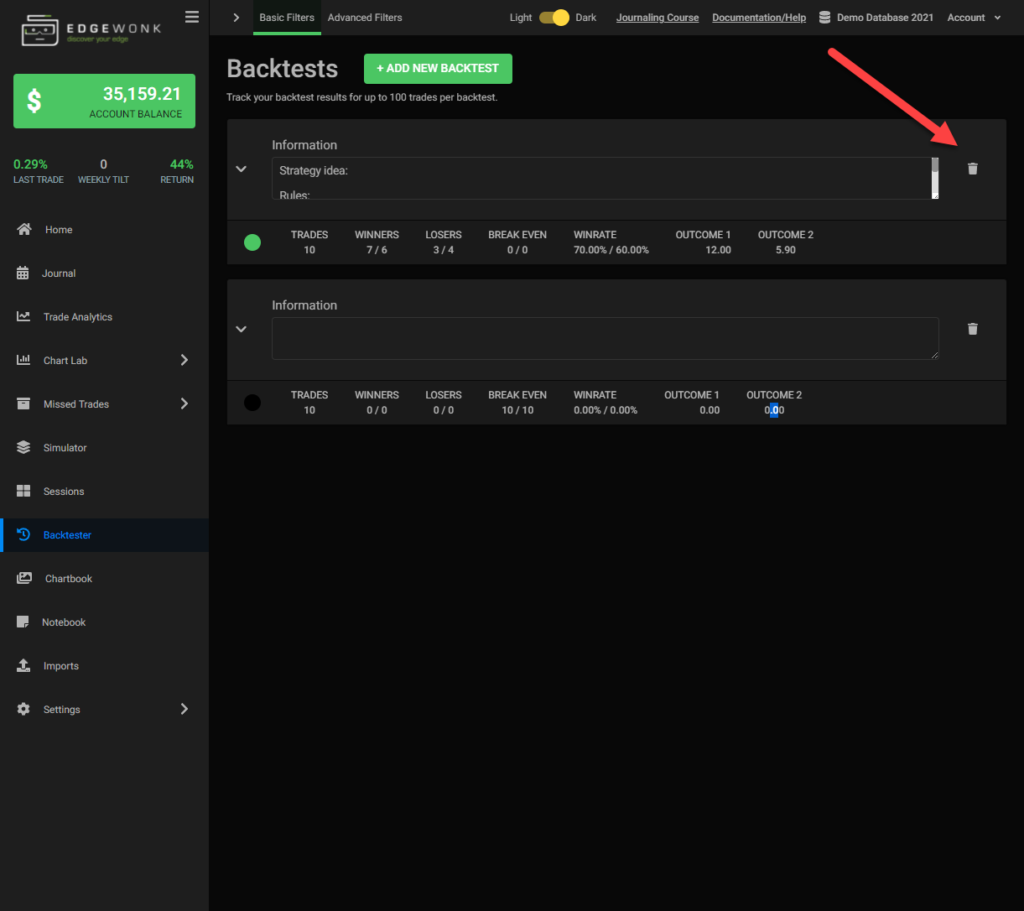

While we are working on the integration of new broker platforms for faster trade import, we want to share our new Backtester tab with you.

With Edgewonk’s Backtester tab, you can easily test new strategy ideas to evaluate their effectiveness.

To open the Backtester tab, select it in the left menu bar.

By clicking the green “+ Add new backtest” button at the top, you create a new backtest.

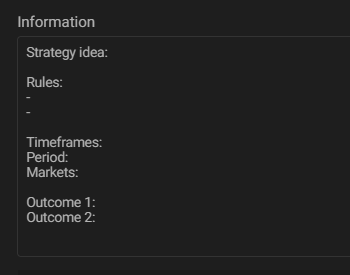

Each backtest has an information field.

We recommend writing down the strategy idea and the rules that you are about to backtest here. This will allow you to easily understand the backtest you performed when you come back to it at a later point in time.

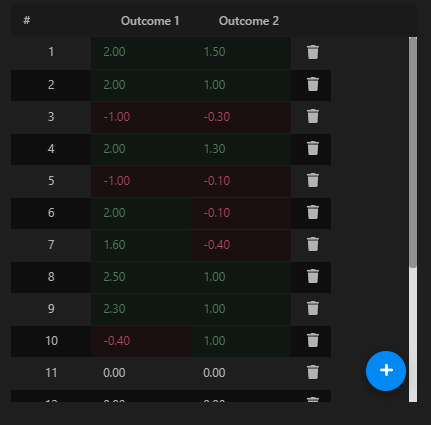

When you create a new backtest, 10 empty trade slots are created. You can add more trade rows by clicking the blue plus icon.

Each row has 2 outcome columns. The idea behind the different outcomes is that you can immediately backtest 2 variations of a strategy.

For example, you can backtest and compare the effectiveness of different stop loss placement techniques, trade management ideas, target placement variations, etc.

The outcome does not require a specific unit. You can enter the theoretical outcome of your backtested trades in terms of R-Multiple, currency profit/loss, or percentage gain.

It’s totally up to you and you can choose the approach that is most intuitive to you.

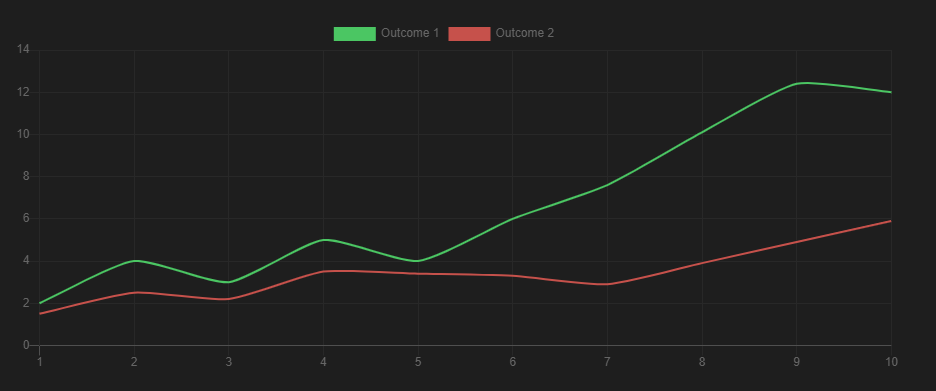

On the right, the two graphs will start updating as soon as you enter your first backtested trades.

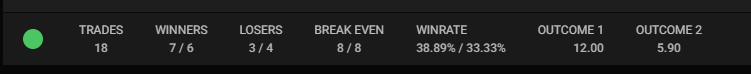

Underneath the backtest you find a brief summary with the most important backtest metrics.

The slash (/) separates the results for outcome 1 and outcome 2.

You can delete backtests in the overview by clicking the trash icon.

We also provide an overview of the ongoing project that we are working on: click here

Happy journaling

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...