The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

3 min read

Rolf Oct 22, 2024 4:10:57 PM

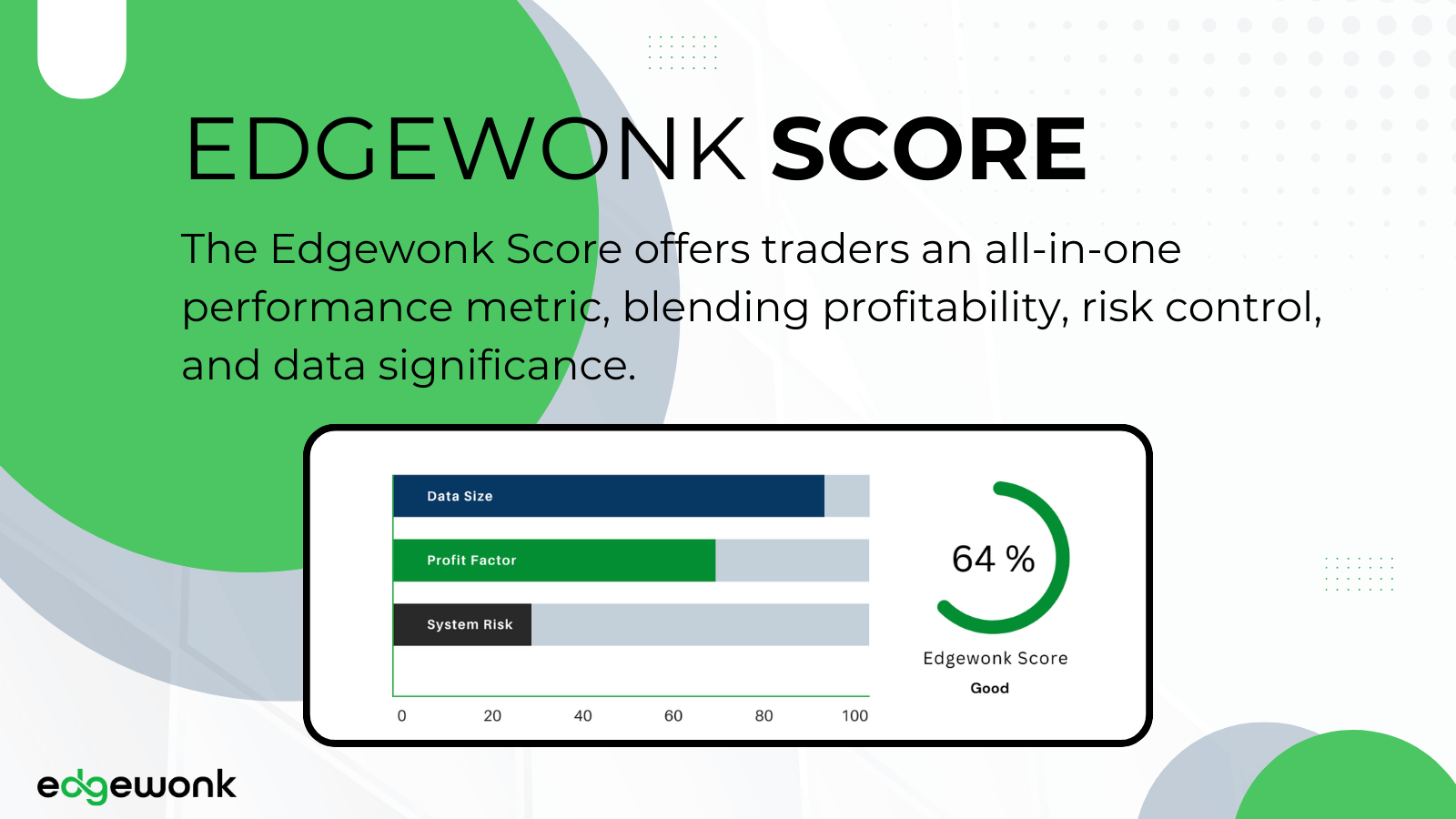

As a trader, it can be challenging to measure the success and profitability of your trading system. While individual metrics like win rate or profit and loss are helpful, they don't always paint a complete picture of your trading performance. That's where the Edgewonk Score (EWS) comes in. Designed to provide an all-in-one performance score, the EWS helps traders evaluate their trading systems more holistically, taking into account three crucial components: sample size, profit factor, and return to drawdown.

Let’s break down these components and explore how the EWS can enhance your trading journey by giving you a clear picture of your overall profitability and system stability.

1. Sample Size: The first component of the EWS is the number of trades you’ve journaled. This is essential because the more trades you record, the more reliable your performance statistics become. In trading, small sample sizes can lead to misleading results, since a handful of lucky (or unlucky) trades can heavily skew the data. By emphasizing sample size, the EWS ensures that only traders with a significant amount of data are rewarded.

Why is this important? If you’ve only logged 10 or 20 trades, your system’s performance might look exceptional, but it’s impossible to know if that success is due to skill or luck. A larger sample size provides more confidence in your system’s actual performance, reflecting your long-term profitability potential. The EWS penalizes smaller sample sizes, encouraging traders to collect more data and journal more trades before drawing conclusions about their trading system.

2. Profit Factor (PF): Profit Factor is the performance-centric component of the EWS. It’s calculated by dividing your gross profits by your gross losses. Simply put, the profit factor tells you how much money you make for every dollar you lose. A PF greater than 1 indicates that you are profitable overall. The higher the PF, the more profitable your trading system is.

Why is this important? Profit factor directly correlates to the success of your trades. For example, a PF of 2 means you’re making $2 for every $1 lost, which is a strong sign of a profitable system. However, this metric alone isn't enough to assess a trading system's performance. A system could have a high profit factor but be highly volatile or risky, which brings us to the next key component of the EWS.

3. Return to Drawdown (RtD): Return to Drawdown is a measure of risk. It compares the returns of a system to the drawdowns it experiences. Drawdown refers to the peak-to-trough decline in your trading account balance, essentially showing how much your account loses during a losing streak before bouncing back.

Why is this important? A high RtD means your system is stable, with fewer dramatic losses, and you are recovering quickly from any losing periods. On the other hand, a low RtD means your system is more volatile and experiences larger, more frequent drawdowns. In trading, minimizing drawdowns is crucial because it reduces the emotional stress on the trader and protects capital, ensuring that profits aren't wiped out during downturns. The EWS takes this into account by rewarding systems with a higher RtD, indicating more consistent and stable performance.

The Edgewonk Score offers several significant benefits for traders:

Comprehensive Performance Measurement: Unlike individual metrics like win rate or net profit, the EWS combines performance, risk management, and the significance of your data. This provides a more balanced and realistic view of your trading system’s effectiveness. Instead of focusing solely on profitability, it encourages traders to think about risk and consistency.

Objective System Comparison: With the EWS, you can easily rank and compare multiple trading systems. If you’re using different strategies, the EWS provides an apples-to-apples comparison by evaluating all relevant aspects of performance. This allows you to see which system is genuinely delivering the best results, factoring in profitability, risk, and trade volume.

Encourages Data-Driven Decision-Making: The emphasis on sample size encourages traders to rely on a large set of data before drawing conclusions about their trading performance. This discourages overconfidence from short-term success and helps traders make decisions based on long-term trends, reducing the likelihood of emotional or impulsive decisions.

Reduces Risk of Overfitting: By considering both profit factor and return to drawdown, the EWS reduces the risk of over-optimizing a trading system for short-term gains at the expense of long-term stability. It forces traders to balance high returns with manageable levels of risk.

The Edgewonk Score is a powerful tool that helps traders evaluate their trading systems in a comprehensive, balanced way. By considering sample size, profit factor, and return to drawdown, the EWS provides a clear, actionable performance score that goes beyond superficial metrics like win rate or total profit. Whether you’re a seasoned trader or just starting, the EWS will give you a more holistic view of your system’s profitability, stability, and overall effectiveness, allowing you to make better, data-driven trading decisions.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...