The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

![7 Steps to a Bulletproof Trading Routine [infographic]](https://edgewonk.com/hubfs/7%20step%20trading%20routine%20thumb.webp)

Want to take your trading to the next level? Imagine a routine that helps you stay disciplined, avoid emotional mistakes, and capitalize on opportunities. This powerful guide unveils a 7-step process for crafting a personalized trading routine that will transform your approach.

Learn how to conduct pre-trading checks to detach from win/loss streaks and identify recurring behavioral patterns. Discover how post-trading journaling helps you relive trades, uncover blind spots, and refine your strategy. Unleash the power of data analysis by pinpointing outliers in your performance and areas for improvement. Finally, we'll show you how to cultivate a growth mindset by setting actionable goals and making small, consistent tweaks that lead to long-term success.

Ready to take control of your trading journey? Dive deeper into this guide and unlock the secrets to a powerful trading routine!

The pre-market check is your daily ritual to step back and assess your trading landscape before starting your actual trading session. It's not just about wins or losses; it's about achieving a clear mind before engaging the market. By reviewing recent decisions and missed opportunities, you can identify emotional biases or recurring behavioral patterns that might cloud your judgment. This awareness helps you detach from recent performance, good or bad, and ensures your trading decisions are based on your strategy, not fleeting emotions or a desire to chase past results.

You can also watch our YouTube video on how to create a good pre-trading routine.

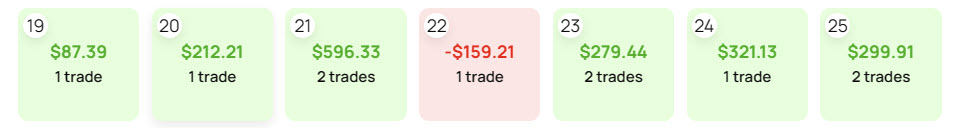

Start by acknowledging your current trading streak, whether winning or losing. Streaks can significantly impact your decision-making.

During losing streaks, traders fall into two traps: paralysis by analysis, where they doubt every opportunity, or trying to catch up, where they irrationally increase position sizes to recoup losses, jeopardizing their risk management.

Conversely, winning streaks can inflate confidence, leading to overtrading and abandoning proven strategies in favor of chasing risky bets.

Recognizing streaks allows you to stay grounded, prioritize your trading plan, and prevent recent performance from clouding your judgment.

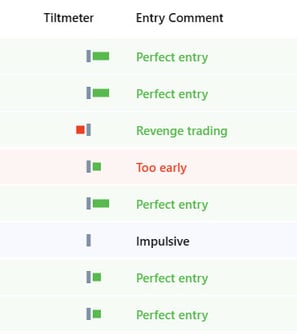

By analyzing your past trading decisions, you can identify recurring patterns in your behavior. Are you exiting winning positions too early, or letting losers run unchecked? Do you chase news headlines or get caught up in emotional buying and selling?

By analyzing your past trading decisions, you can identify recurring patterns in your behavior. Are you exiting winning positions too early, or letting losers run unchecked? Do you chase news headlines or get caught up in emotional buying and selling?

Finding these flaws is crucial. Once you recognize them, you can consciously break the cycle. This self-awareness empowers you to refine your trading strategy and avoid repeating the same mistakes. Remember, the market doesn't care about your feelings or past performance – only disciplined execution based on your plan will lead to consistent success.

In Edgewonk, check your Tiltmeter which is a visual representation of your trading discipline. Make sure to always keep the Tiltmeter green.

Next, review recent trades you skipped. Were they valid setups you simply lacked the confidence to execute, or were they impulsive reactions? Analyze these missed trades. Often, you'll find your initial analysis was correct. This self-reflection builds trust in your strategy and encourages you to act decisively when opportunities arise.

You then also identify missed trades due to faulty processes. Did you miss them due to inattention, inadequate pre-market prep, or being distracted? Fix these process flaws by tightening your pre-trading routine and staying focused during market hours. Remember, a well-defined trading plan is useless if you're not present to execute it.

In Edgewonk, you can easily track your missed trades and assign specific comments to them, tracking reasons for missing trades. This will help you gain a better understanding of emotional flaws or process mistakes.

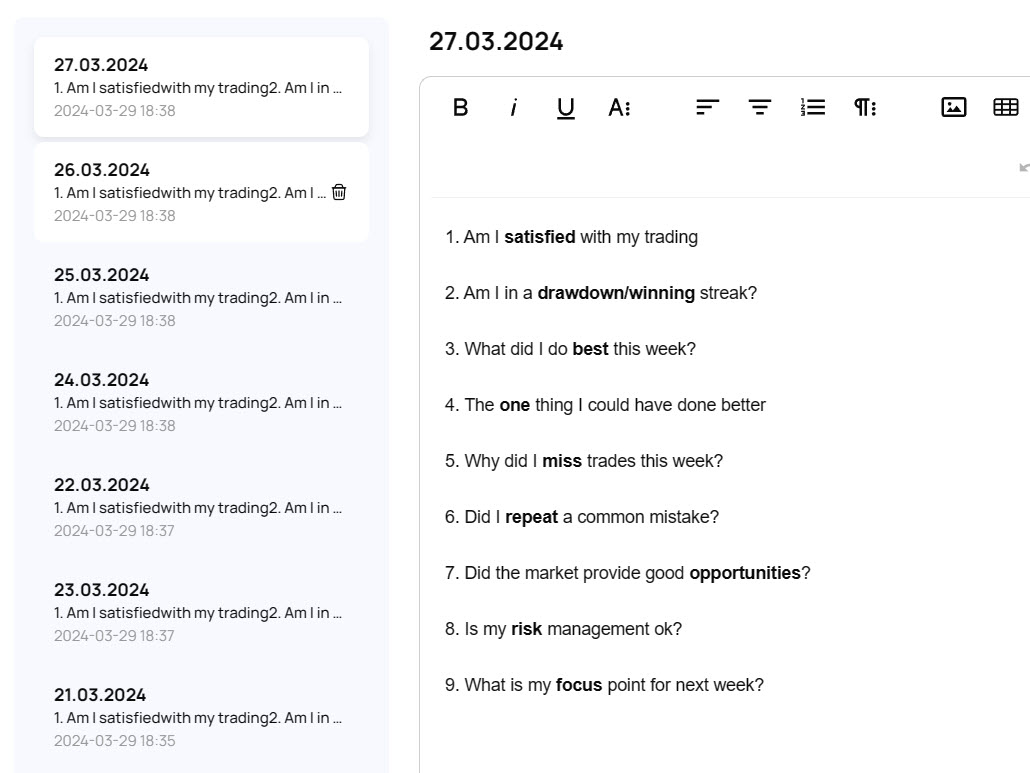

The market may close, but your learning shouldn't. The post-trading check is your chance to debrief and transform every trade into a valuable lesson. Separate the signal from the noise. A win might mask underlying flaws in your execution, while a loss could be due to factors outside your control. Instead, delve deeper using journaling and a qualitative check. Journaling allows you to relive each trade with a clear head, potentially uncovering missed details or emotional biases that affected your decisions. The qualitative check takes it a step further, prompting you to assess the quality of your decision-making process. Did you follow your trading plan? Were you disciplined with risk management? By reflecting on these questions, you gain invaluable self-awareness and identify areas for improvement. This post-trading analysis is the cornerstone of consistent growth, allowing you to refine your strategy and approach the next market session with sharpened skills and a clear mind.

We also have a video on how to craft the optimal post-trading routine.

Ideally, journal your trades immediately after your trading session, while your memory is sharp. This detailed record goes beyond simply noting wins and losses. By reflecting on your actions through Edgewonk’s comments and tags (like "emotional buying" or "exiting too early"), you essentially recreate your trades in a calmer setting. This hindsight is invaluable. You'll often uncover missed details or behavioral flaws that went unnoticed in the heat of the moment. Journaling empowers you to learn from each experience and continuously refine your trading approach. It's like watching replays of your games; you identify areas for improvement and develop a winning strategy over time.

After the market closes, shift your focus from results to process with a qualitative check. This introspective exercise goes beyond simply judging trades as wins or losses. Here, you assess the quality of your decision-making. Remember, good trading decisions, even if they don't always translate to immediate profits, lay the groundwork for long-term success.

Ask yourself key questions:

Honest reflection on these questions fosters self-awareness and empowers you to identify strengths and weaknesses. By constantly refining your process, you position yourself to consistently make better trading decisions, the cornerstone of long-term trading success.

Look for outliers in your data, as these hold the greatest potential for performance improvement. Leverage the power of your Edgewonk journal to identify areas where your strategy might be underperforming. Some key metrics to scrutinize include:

By identifying and addressing these outliers, you can continuously refine your strategy and optimize your trading performance. Remember, consistent improvement comes from learning from both successes and, more importantly, your mistakes.

Cultivate a growth mindset by setting clear, actionable goals. After your trading review, identify a single area for improvement – something specific yet achievable. Don't overwhelm yourself with a complete strategy overhaul. Focus on a manageable tweak, like consistently using a stop-loss order, preparing your chart work every morning, using a 1% position size on each trade, not managing trades emotionally, or refining your entry criteria for a particular trade setup.

Remember, small, consistent improvements compound over time. By addressing one issue each week, you can tackle 50 or more within a year. Imagine the cumulative impact on your trading performance! This incremental approach fosters steady progress and keeps you motivated on your journey towards becoming a successful trader.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...