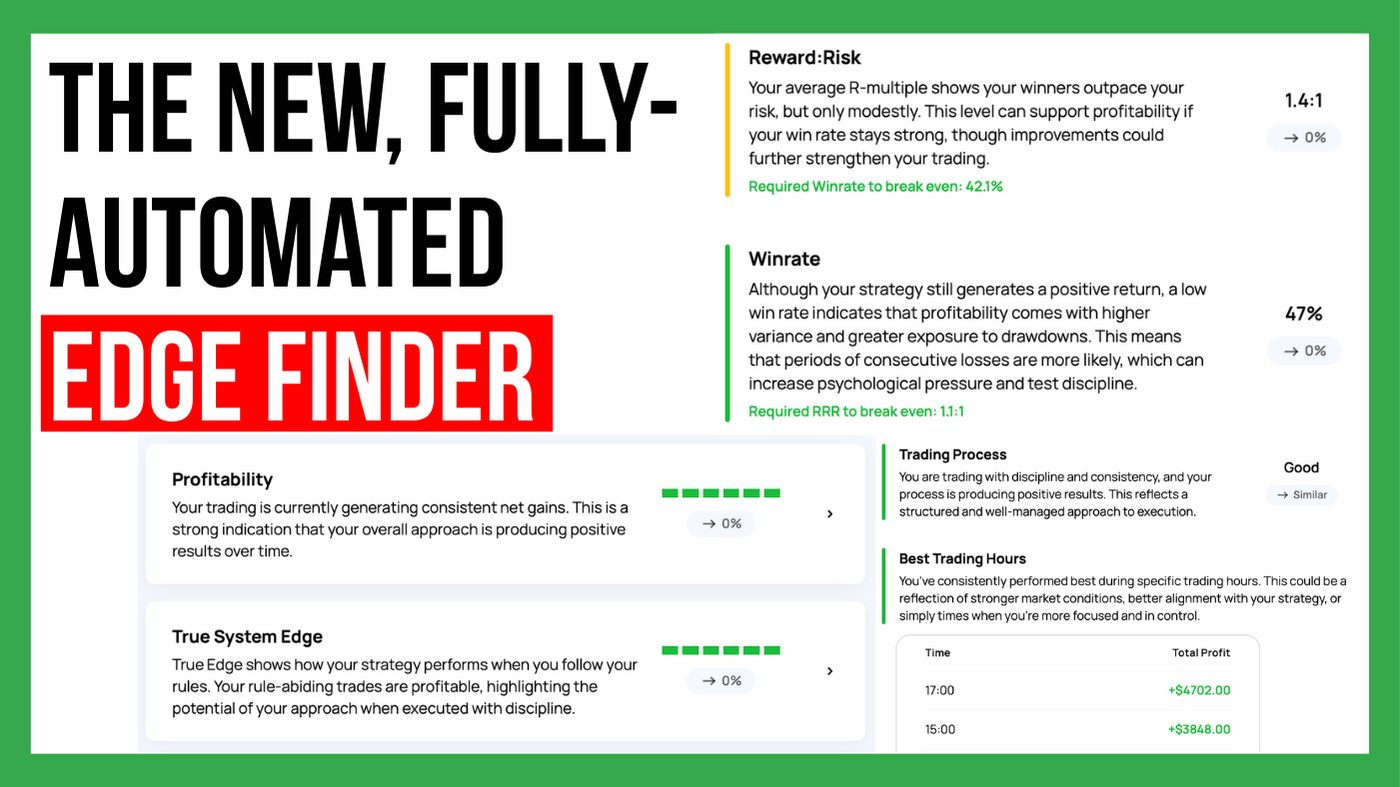

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Achieving long-term success in trading isn’t just about hunting the Holy Grail system that will never lose, or time that one lucky trade that will 10x your trading account —it’s about consistently practicing disciplined, strategic habits. For traders who want to grow their trading capital steadily and manage risk effectively, adopting the right habits can make all the difference. Let’s dive into ten key habits that help build a strong foundation for sustainable, successful trading over the long run.

Every successful trader starts with a well-structured trading plan. A trading plan acts as a roadmap, outlining entry and exit points, profit targets, and risk management strategies. By creating and sticking to a plan, traders can make informed decisions without falling prey to impulsive reactions. When markets fluctuate, a solid plan keeps traders grounded, helping them stay focused on their long-term goals.

By following a structured trading plan, traders can build confidence and stay on track, even in volatile markets. A trading plan helps traders to trade more consistently, providing consistent trading results without emotionally draining swings.

Risk management is the cornerstone of sustainable trading. Protecting capital is essential, as even a few risky trades can jeopardize a trader's entire portfolio. Effective risk management involves setting stop-loss orders, calculating appropriate position sizes, and adhering to a favorable risk-to-reward ratio.

Experienced traders typically use risk management strategies such as the “1% Rule,” where no single trade risks more than 1% of their account. Consistent application of these principles can minimize losses, allowing traders to continue trading over the long haul.

The risk-to-reward ratio, or RRR, is critical because it helps you evaluate whether a trade is worth taking in the first place. By comparing how much you stand to gain if the trade goes your way versus how much you could lose if it doesn’t, you can be more selective and only take high-probability setups. For example, a 1:3 RRR means you’re aiming to make three times what you’re risking, so even if only one in three trades is profitable, you can still break even or come out ahead. Adopting a consistent RRR helps you focus on trades that have the potential to build long-term growth and avoid those that may lead to short-term losses.

To succeed in the long run, traders need to stay curious and adaptable. Markets change constantly, and strategies that work one year may not be as effective the next. The best traders actively learn from their past trading results, keep up with new market trends, and stay open to evolving their approach. This habit isn’t about endlessly chasing new strategies, but about refining what works and expanding your understanding of market dynamics.

It’s valuable to learn from your own trades—reviewing what went well, what didn’t, and adjusting accordingly. By building knowledge and staying flexible, you equip yourself to make smarter, more confident decisions no matter what’s happening in the market.

In your Edgewonk trading journal, look for your outliers. Negative outliers are parts of your trading that do not perform well – try to get to the core of your losses and find out how you can make changes to improve your approach. Positive outliers, on the other hand, are the trades that make you the most money – find out when your strategy performs best and try to find more such trades.

Emotions can easily cloud judgment in trading. Fear, greed, and overconfidence are common emotions that can lead traders astray. Building discipline means recognizing these emotions without letting them influence trading decisions.

To enhance emotional control, many traders set strict daily or weekly limits on trading activities. Successful traders often focus on process over profit, reminding themselves that consistent effort is more valuable than momentary gains.

In Edgewonk, work with your Tiltmeter. Try to keep the Tiltmeter green at all times which means that you try to make the best trading decisions every day, detaching yourself from the outcome.

A trading journal is one of the most effective tools a trader can use to improve their performance, and Edgewonk makes this process easier and more insightful than ever. By documenting every trade in Edgewonk’s intuitive journal, you’re not just tracking entries and exits—you’re gathering data to understand your trading behavior, identify patterns, and uncover areas for improvement.

Edgewonk’s advanced features allow traders to log not only the details of each trade but also their emotions, motivations, and the conditions surrounding each decision. This level of detail helps traders recognize emotional patterns, such as when they’re prone to impulsive decisions or overconfidence.

Over time, using a tool like Edgewonk can reveal powerful insights: whether you’re consistently profitable in certain market conditions, which setups perform best, and where your biggest risks lie.

Set aside 30 to 60 minutes every weekend to update your trading journal and review your recent trades. This habit will keep you accountable, help you spot valuable trends, and allow you to make continuous, data-driven improvements to your trading approach. With Edgewonk, consistent journaling becomes a straightforward process that can lead to more disciplined and profitable trading over time.

Unrealistic expectations can lead to frustration, burnout, and reckless trading. Long-term trading success isn’t about winning every trade or achieving consistent daily profits. Instead, it’s about aiming for sustainable growth over time.

Realistic expectations in trading mean setting goals that align with your current skill level and experience. For instance, if you’re currently losing consistently, your primary goal shouldn’t be achieving huge profits overnight. Instead, focus on following your trading rules, sticking to a single strategy, and practicing disciplined risk management. Aim to refine your approach rather than “winning big.” This can involve prioritizing position sizing to avoid large, unpredictable winners and instead aiming for steady, manageable gains. As you become more consistent and confident in your trading habits, you can gradually adjust your goals to match your improved skillset.

Patience is one of the most crucial qualities for long-term trading success, and it applies across three essential layers in a trader’s journey.

1.Patience in Waiting for the Right Trade

Successful traders know that not every opportunity is worth taking. Practicing patience means waiting for high-confidence setups that align with your trading plan, rather than rushing into trades based on fear of missing out. Holding back until the right conditions appear can be challenging but often leads to higher-quality trades and better results.

2. Patience While in a Trade

Once you’re in a trade, staying patient can be just as important as entering at the right moment. Many traders exit winning trades too early due to fear or a lack of confidence, missing out on larger gains. Practicing patience while in a trade means trusting your plan and resisting the urge to close a position prematurely based on emotions alone. Letting profitable trades run to their targets is often where the greatest rewards are found.

3. Patience in Growing Your Account

Building a trading account takes time, and shortcuts like overleveraging or taking excessive risks often lead to setbacks. Patience here means accepting that consistent growth will come with disciplined trading and time, not by trying to double your account in a few trades. Staying focused on steady progress rather than fast wins helps protect your capital and fosters sustainable growth in the long term.

By developing patience in these three areas, you build a strong foundation for disciplined and resilient trading that can withstand the ups and downs of the market.

Confidence in trading doesn’t come from wishful thinking—it’s built through effort, preparation, and a deep understanding of your strategy. The more you know what to expect from your trading plan, the easier it becomes to execute trades confidently and stay committed to them, even when the market gets volatile. One of the best ways to build this confidence is by thoroughly backtesting your strategy and reviewing past trades to see how they perform over time.

With Edgewonk’s powerful journaling and analysis tools, you can dive deep into your strategy’s strengths and weaknesses.

By analyzing your own trades, you can get a clear picture of how different setups and market conditions affect your results. Edgewonk’s metrics and features, such as “Trade Entry Quality”, “Alternative Strategies” and “Trade Management Evaluation,” allow you to track patterns, test different strategies, and see which approaches yield the most consistent results. This level of insight helps traders develop a realistic understanding of their strategy, making it easier to stick to their plan and avoid impulsive decisions.

By building this solid foundation, you can approach the markets with greater confidence, knowing that your strategy has been tested and refined. This confidence helps you execute trades without hesitation and hold winning positions longer—ultimately leading to more consistent and disciplined trading over the long term.

Physical well-being directly affects mental clarity, which is essential for making sound trading decisions. Trading can be demanding, and it’s easy for traders to neglect their health in the pursuit of profit. Maintaining a balanced lifestyle that includes exercise, proper nutrition, and quality sleep supports mental resilience and helps avoid burnout.

Maintaining a balanced lifestyle with interests outside of trading helps traders keep their performance in perspective. It’s easy for traders to let their mood and self-worth become tied directly to their trading results, with wins boosting confidence and losses bringing frustration or self-doubt. By engaging in other hobbies, social activities, or fitness routines, traders build a fuller sense of self that isn’t solely based on how the market moves each day.

When you have other fulfilling pursuits, trading becomes just one part of your life rather than its defining feature. This broader perspective helps reduce the emotional highs and lows of trading and allows you to approach each session with a clearer, more level-headed mindset. Not only does this improve your overall mental well-being, but it also enables you to make decisions based on strategy rather than emotions, supporting a more consistent and sustainable trading practice.

Trading can be isolating, but it doesn’t have to be. Engaging with a network of like-minded traders can provide valuable insights, emotional support, and accountability. Whether through online forums, social media, or local meetups, a supportive community can be a source of encouragement and shared learning.

Connecting with others helps traders stay motivated, learn new strategies, and maintain perspective during both wins and losses.

Achieving long-term trading success isn’t just about picking the right trades—it’s about developing consistent, disciplined habits that foster resilience, confidence, and steady growth. From creating a clear trading plan and managing risk carefully to cultivating patience, reviewing performance, and maintaining a healthy lifestyle, each of these habits plays a crucial role in shaping a sustainable approach to trading.

Building these habits one step at a time helps create a foundation for lasting success. Start by focusing on one or two habits, gradually incorporating more as you feel comfortable. In time, you’ll see the positive impact these practices have on both your trading results and your overall outlook. Ready to take your trading to the next level? Commit to these habits, and experience the benefits of a more disciplined, confident, and sustainable trading journey.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

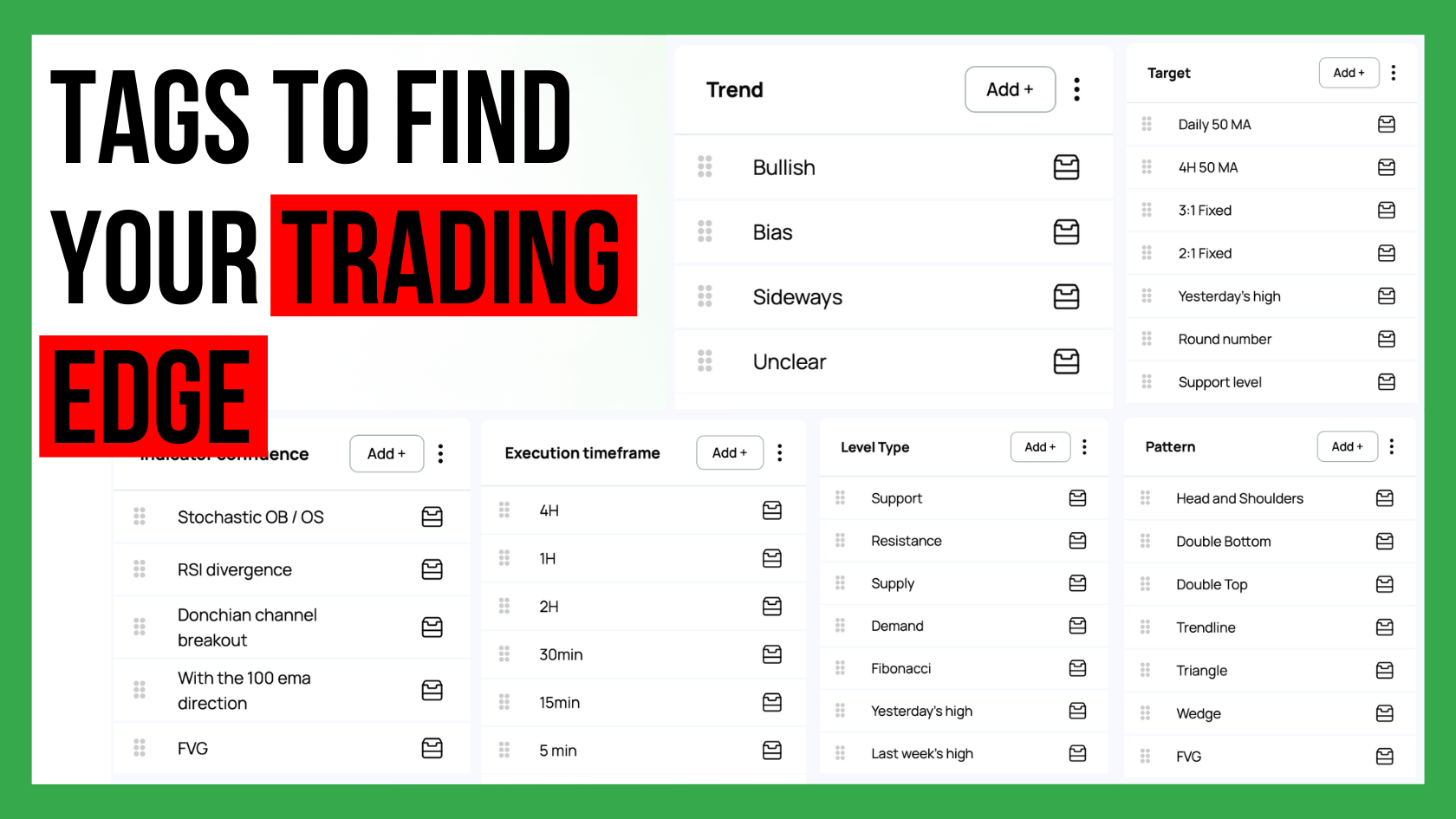

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...