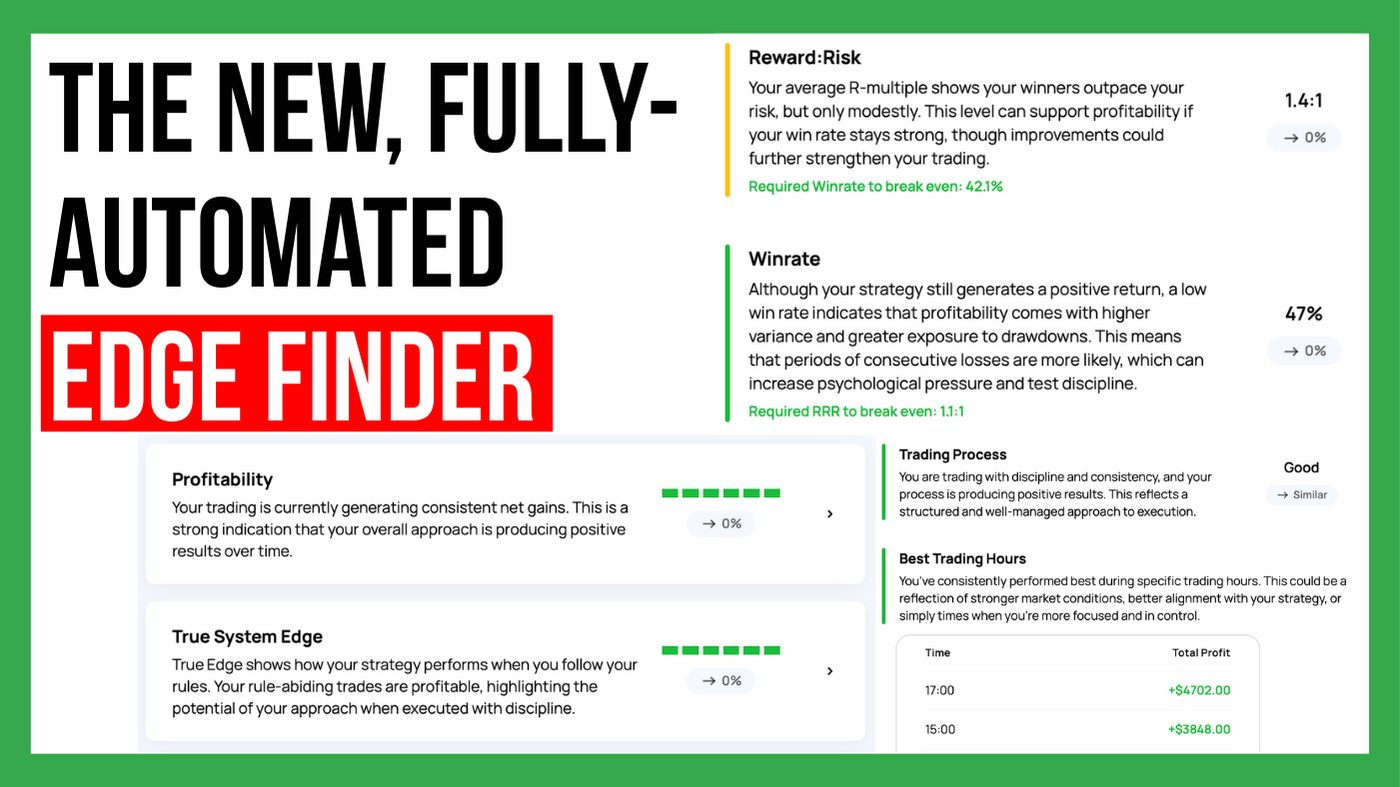

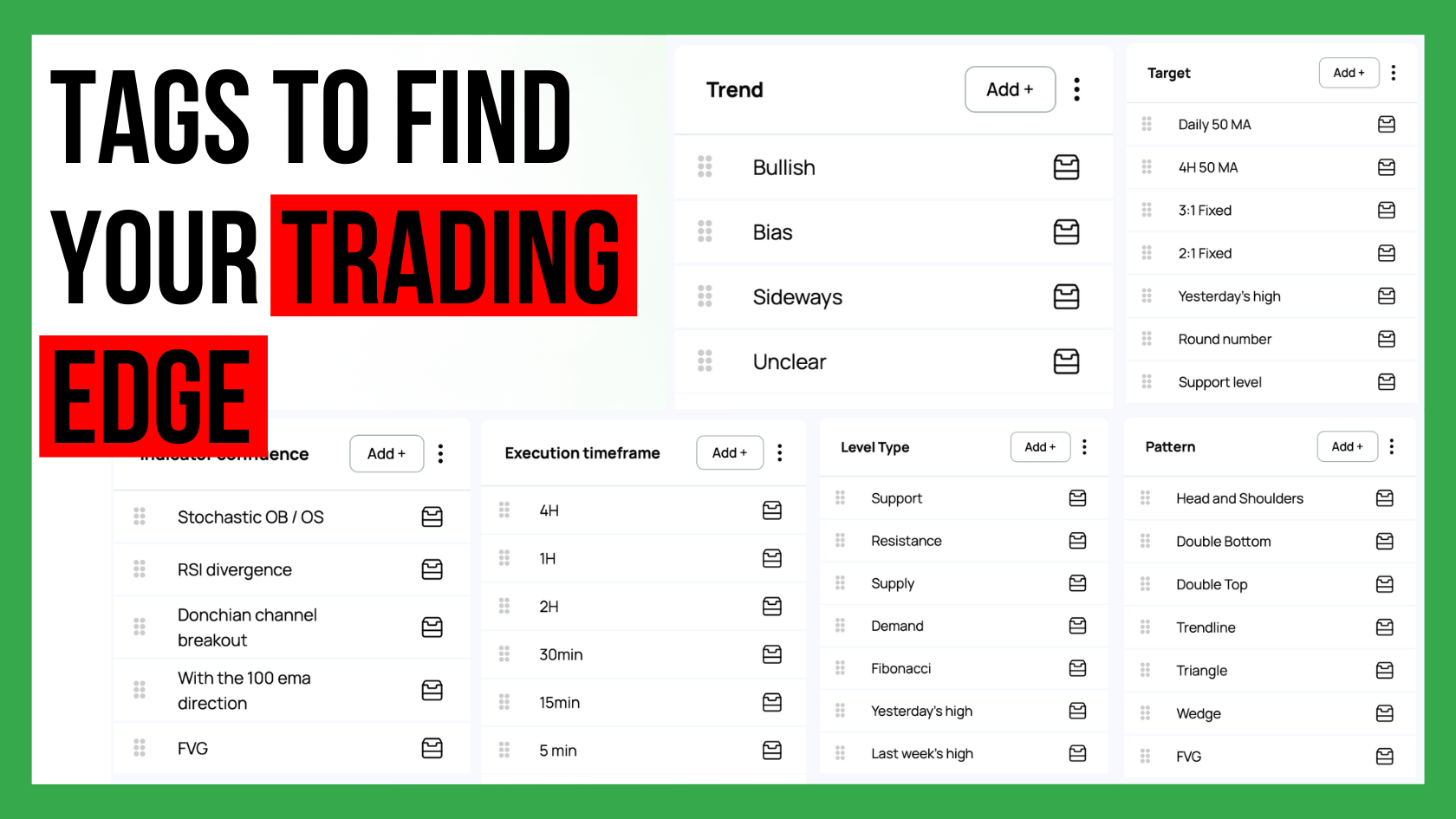

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

As a trader, continual learning is a must for staying sharp, refining your strategies, and developing the psychological resilience necessary to succeed in trading. The market can be unforgiving, and the key to long-term success often lies not just in strategies but in the mindset behind those strategies.

In this article, we’ve compiled five of the must-read trading books that every trader should have in their library. Covering everything from the psychology of trading and risk management to success stories and probabilistic thinking, these books can help you improve your trading approach and better navigate the challenges of the markets.

In "The Hour Between Dog and Wolf", John Coates, a former Wall Street trader turned neuroscientist, delves into the physiological and psychological effects that trading has on the human body and mind. Coates argues that the intense stress and excitement of trading trigger biochemical responses that impact decision-making, sometimes pushing traders to take irrational risks or, conversely, to freeze at crucial moments.

Key Lessons:

Stress and decision-making: Learn how adrenaline and cortisol affect your brain under trading pressure.

Risk and reward: Understand how your body responds to wins and losses and how these responses can lead to overconfidence or fear-driven mistakes.

Why this book stands out: It provides traders with a deeper understanding of how their biology influences their trading decisions, offering insights that can help in developing a more disciplined and emotionally balanced approach.

Ideal for: Traders looking to gain a better understanding of the biological and psychological mechanisms that affect their decision-making during high-stakes trading.

Martin Schwartz’s "Pit Bull" tells the rags-to-riches story of how he transformed from a struggling trader into one of the most successful day traders on Wall Street. His tale is not just a success story, but also a practical guide filled with lessons on trading strategy, discipline, and persistence.

Key Lessons:

Discipline: Schwartz emphasizes the importance of sticking to a well-defined trading plan and maintaining discipline, even when the market tempts you to stray.

Strategy and persistence: His journey underscores the value of persistence and continually refining your trading strategy to adapt to different market conditions.

Why this book is a favorite: Schwartz’s straightforward, no-nonsense approach resonates with day traders, offering real-world advice from someone who has thrived in the intense world of intraday trading.

Ideal for: Day traders or anyone seeking inspiration from a real-world success story combined with practical, actionable advice.

In "Fooled by Randomness", Nassim Taleb challenges the conventional wisdom surrounding success in financial markets. He argues that much of what we attribute to skill is, in fact, the result of randomness and luck. Taleb explores how traders often fail to recognize the role of chance in their successes and failures, which can lead to overconfidence or flawed risk management.

Key Lessons:

Skill vs. luck: Understand the thin line between genuine skill and random events that drive market outcomes.

Risk management: Taleb emphasizes the importance of preparing for "black swan" events—rare, unpredictable occurrences that can have outsized impacts on the market.

Why it’s essential: Traders often underestimate randomness and overestimate their ability to predict market movements. Taleb’s book is a must-read for anyone looking to refine their approach to risk management.

Ideal for: Traders focused on risk management, probabilistic thinking, or those who want to challenge their assumptions about success in trading.

Jack D. Schwager’s "Market Wizards" series is a collection of interviews with some of the most successful traders in the world, offering readers a rare glimpse into the minds of top-performing traders across different markets and asset classes. Each interview is packed with insights into different trading strategies, mindsets, and techniques that have propelled these traders to success.

Key Lessons:

Diverse strategies: From technical analysis to fundamental approaches, the series highlights the many different paths to trading success.

Mental discipline: Successful traders consistently stress the importance of mental toughness and the ability to handle losses and setbacks.

Why this series is invaluable: Schwager’s interviews provide a treasure trove of knowledge, showing that while their strategies vary, these traders share common traits such as discipline, adaptability, and perseverance.

Ideal for: Traders at all levels who want to learn directly from some of the world’s best traders and gain insight into different trading approaches.

Tom Hougaard’s "Best Loser Wins" takes a unique approach to trading psychology by flipping conventional wisdom on its head. Instead of focusing solely on winning strategies, Hougaard emphasizes the importance of embracing and learning from losses to build mental resilience and ultimately improve as a trader.

Key Lessons:

Embracing losses: Instead of fearing losses, traders should see them as learning opportunities and essential steps toward long-term success.

Mental toughness: The book focuses on building the mental resilience needed to withstand the emotional toll of trading and continue making rational decisions under pressure.

Why it’s impactful: Many traders struggle with the psychological burden of losses, and Hougaard’s book provides a roadmap for turning these struggles into strengths.

Ideal for: Traders who find it challenging to cope with losses and want to develop stronger mental fortitude for long-term success.

With so many excellent trading books available, it can be challenging to decide which one to read first. Here are some practical tips to help you choose the best book based on your individual needs:

Trading psychology vs. strategy: If you’re looking to improve your mental game, "The Hour Between Dog and Wolf" or "Best Loser Wins" are excellent choices. For those focused on refining their trading strategies, "Pit Bull" or the "Market Wizards" series offers a wealth of actionable insights.

Risk management: If managing risk and understanding market unpredictability are your priorities, "Fooled by Randomness" should be at the top of your list.

Experience level: Beginners might want to start with more straightforward, practical advice like in "Pit Bull", while more advanced traders could benefit from the deeper, more philosophical perspectives of "Fooled by Randomness" or "The Hour Between Dog and Wolf".

Practical Tips:

Start by identifying your biggest challenge—whether it’s handling losses, building a better strategy, or managing risk—and choose a book that addresses that area.

Take notes as you read and think about how you can apply the lessons directly to your trading practice.

Continuous education and improvement are your most powerful assets in trading. The books we’ve highlighted here provide unique and invaluable insights into both the psychological and strategic aspects of trading. Whether you’re struggling with the emotional rollercoaster of trading, looking to fine-tune your risk management, or simply seeking inspiration from the pros, these books have something to offer.

Start with the one that resonates most with your current needs and continue building your knowledge base. Over time, you’ll find that the lessons from these books will help sharpen your trading skills, enhance your mindset, and increase your chances of long-term success in the markets.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...