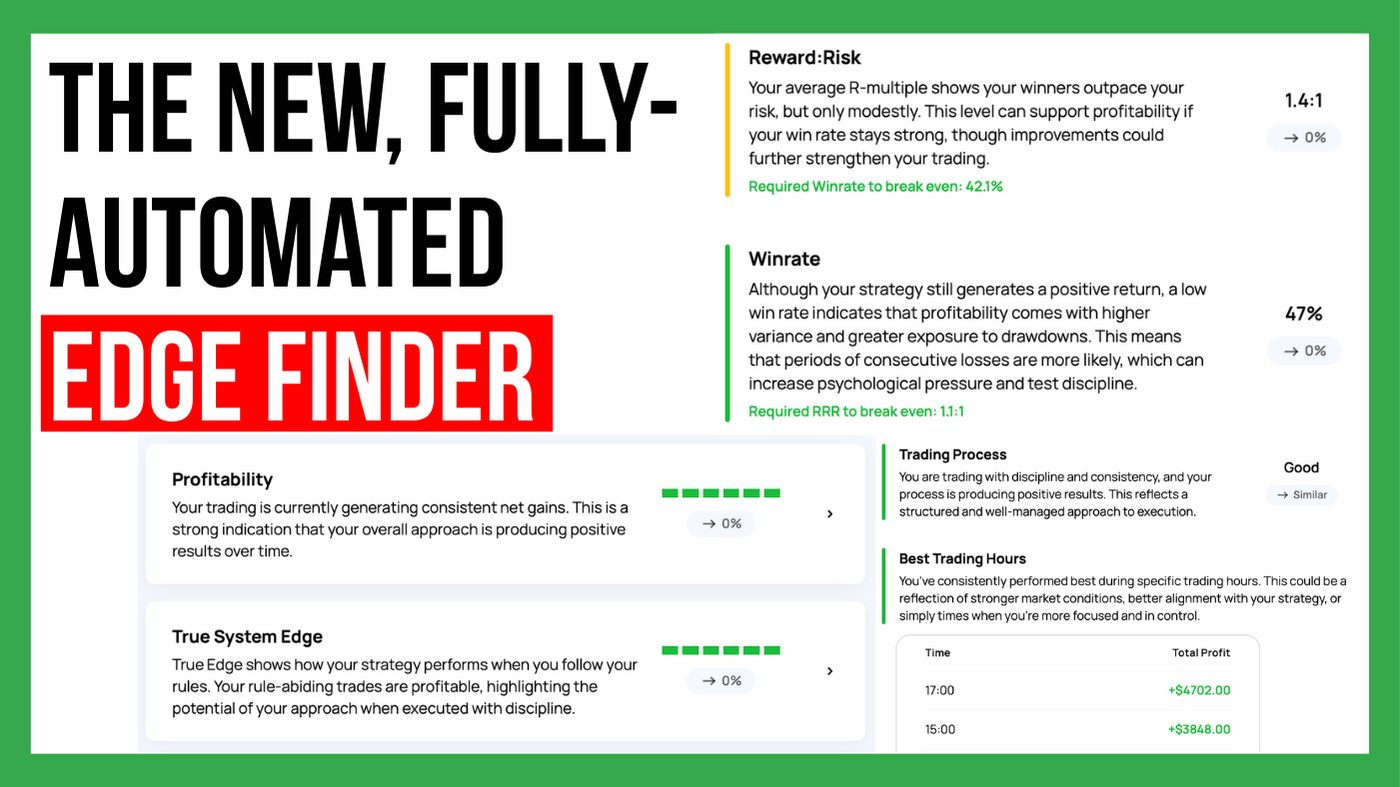

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

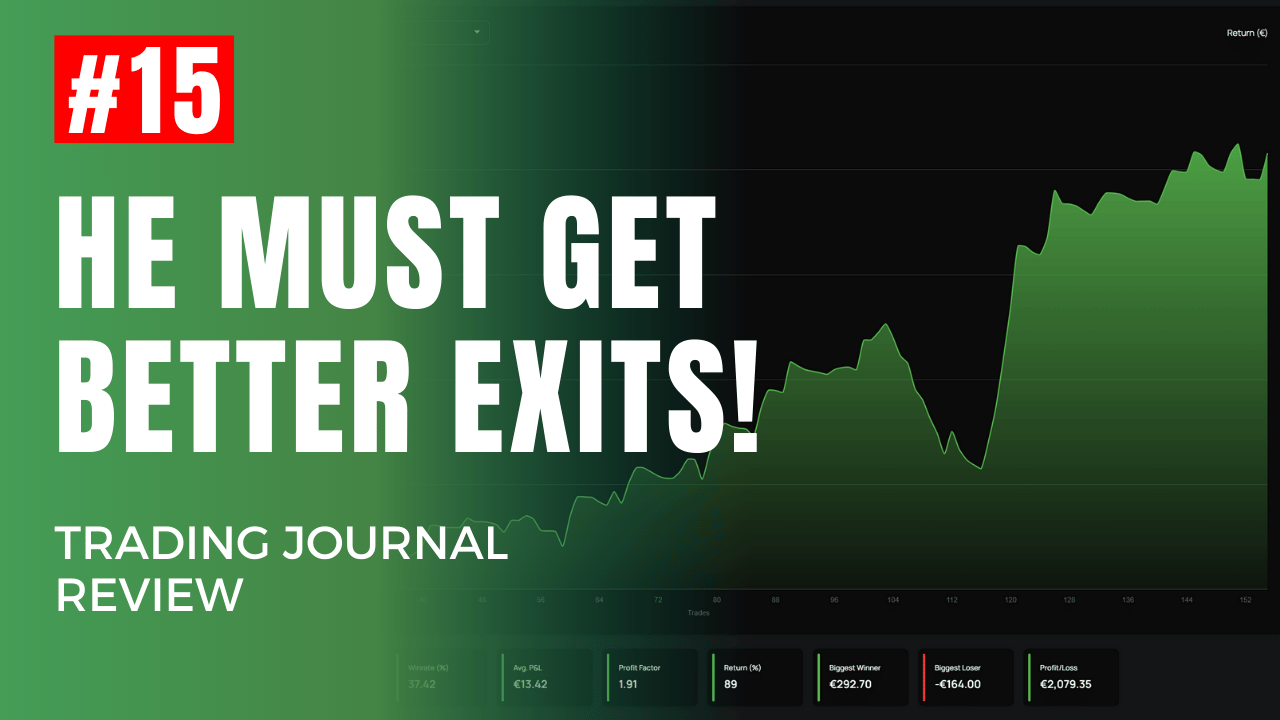

In our latest review video, we reviewed data from a profitable Edgewonk trading journal to help one of our users optimize his strategy. His trading system is working well, but there’s always room for improvement.

This review focused on refining his exit strategies, minimizing bad habits, and making small adjustments to further enhance profitability. Here’s a summary of the most important insights and tips we discussed during the review.

And if you want us to review your journal, take a look at our free review service.

Optimize Stop-Loss for Better Reward-to-Risk Ratio

One of the standout findings was that the user’s stop-loss settings were too generous. His losing trades barely moved in his favor, meaning tighter stops wouldn’t have changed the outome of those.

At the same time, his winning trades had minimal drawdowns, indicating that tighter stops could help boost the reward-to-risk ratio without increasing losses.

A gradual approach to reducing stop distance and scaling up position sizes would likely improve overall profitability.

Avoid Widening Stop-Loss and Revenge Trading

A recurring issue was the trader’s tendency to widen his stop-loss on losing trades, hoping they would recover. This only led to larger losses, as expected. Widening stops often turns into revenge trading, a dangerous habit where emotional decision-making overrides the trading plan. Sticking to pre-set stops is essential for consistent, disciplined trading.

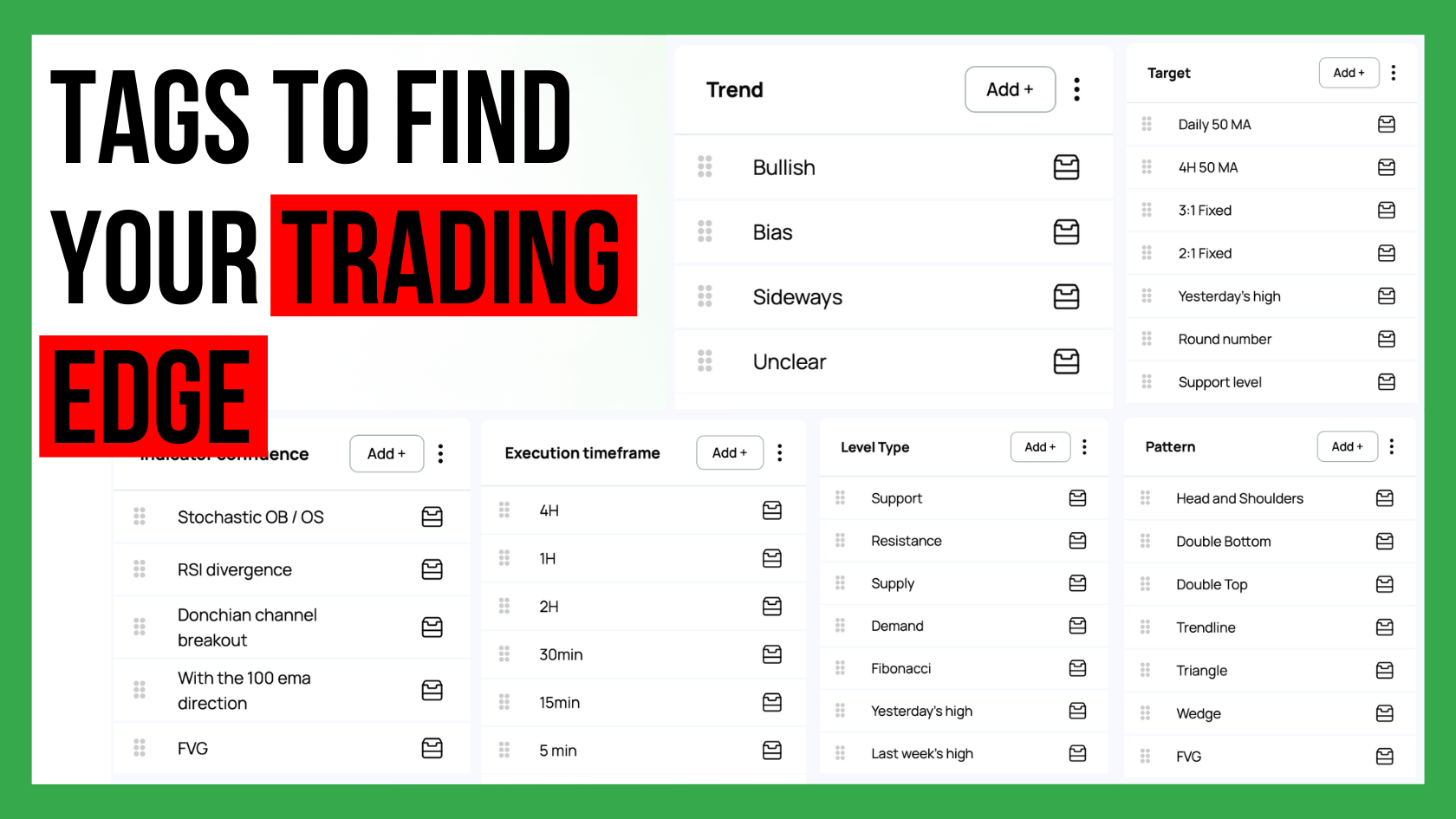

Focus on Profitable Setups, Eliminate Noise

The user had 22 different setups, but the majority of his profits came from just 3-4 key ones. Trades without any setup, marked as "none," were responsible for a significant portion of his losses. By focusing only on the setups that are working and eliminating random trades, he could streamline his strategy and improve performance.

Refine Take-Profit Targets

The review revealed that the user’s trades rarely reached the take-profit levels he set, often exiting around 66-75% of the way to the target. This suggests his targets may be too optimistic. Adjusting them to more realistic levels could help capture more profits before market reversals, reducing the chance of letting winners turn into losses.

Stick to a Successful Time Frame

Interestingly, the user had much better performance on the 1-minute time frame compared to others. The review recommended concentrating exclusively on this time frame for a period of time. This focus would allow him to refine his routines and avoid distractions, ultimately leading to more consistent results.

This review showed how important it is to focus on what works and to eliminate distractions and bad habits. By tweaking his stop-loss, optimizing take-profit levels, and concentrating on his best setups and time frames, the trader has a clear path to improving his already profitable system. Edgewonk’s detailed analytics made it possible to uncover these actionable insights, showing the value of data-driven trading optimization.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...