The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Creating a personalized trading system is essential for consistent long-term profitability. However, developing a strategy isn’t just about crafting rules—it’s about refining and improving your approach over time.

This is where the Edgewonk trading journal becomes a powerful companion, offering deep insights into the strategy you are designing.

In this guide, you’ll learn how to develop your own trading system step by step, with actionable advice on using Edgewonk to track and optimize your progress.

A trading system is a structured framework of rules for entering, managing, and exiting trades. It’s designed to eliminate emotional decision-making and promote consistency.

Implementing an organized and structured trading system also helps traders find out what works best and identify where their weaknesses are, systemizing their approach to trading.

Your trading system should cover:

Edgewonk helps monitor all these elements, offering tailored feedback to improve them. For instance, our trade management optimization feature identifies areas where you could have managed trades better or simply used a set-and-forget approach.

Your trading goals should align with your financial objectives and risk tolerance. Examples include:

However, in the beginning, traders should focus on process-oriented goals that will help them build better habits and lay a solid foundation:

Your trading style—day trading, swing trading, scalping, or long-term investing—should suit your personality and schedule.

We wrote an extensive trading guide on this topic before: read the trading strategy guide here

Choosing a market (e.g., stocks, Forex, Futures, cryptocurrencies) is a critical step in trading system development. Focused traders often perform better because they develop deep expertise in their chosen instruments.

Edgewonk’s easy-to-use filters can help identify which markets and instruments are most profitable for you, ensuring you direct your energy where it counts.

Markets behave differently based on factors like volatility, liquidity, and trading hours. With Edgewonk, you can track market conditions during each trade to identify patterns in performance under various scenarios.

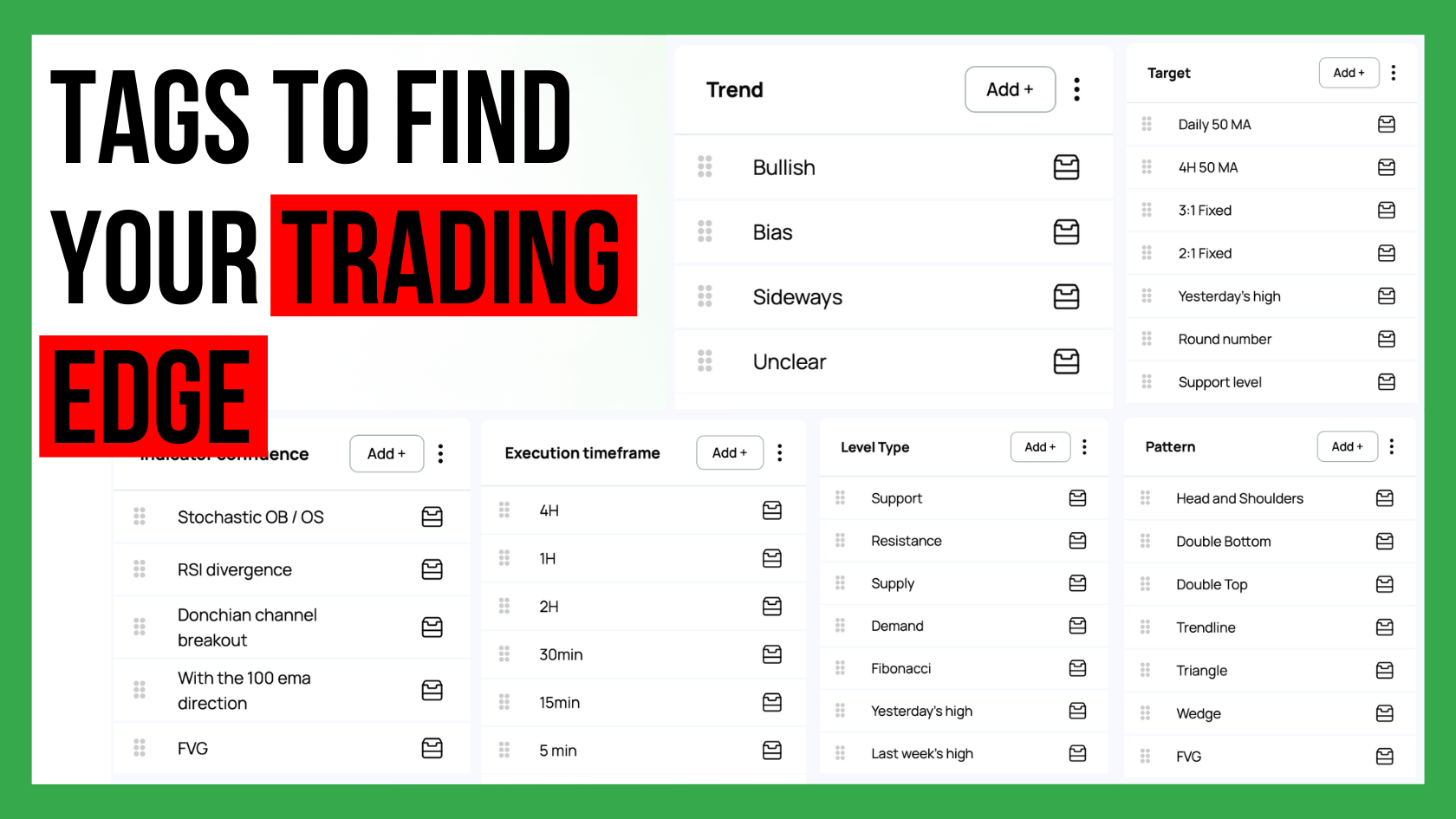

A good trading system has very specific entry conditions, such as “enter when the RSI(14) closes above 80 and price is coming out of a pullback in an uptrend”.

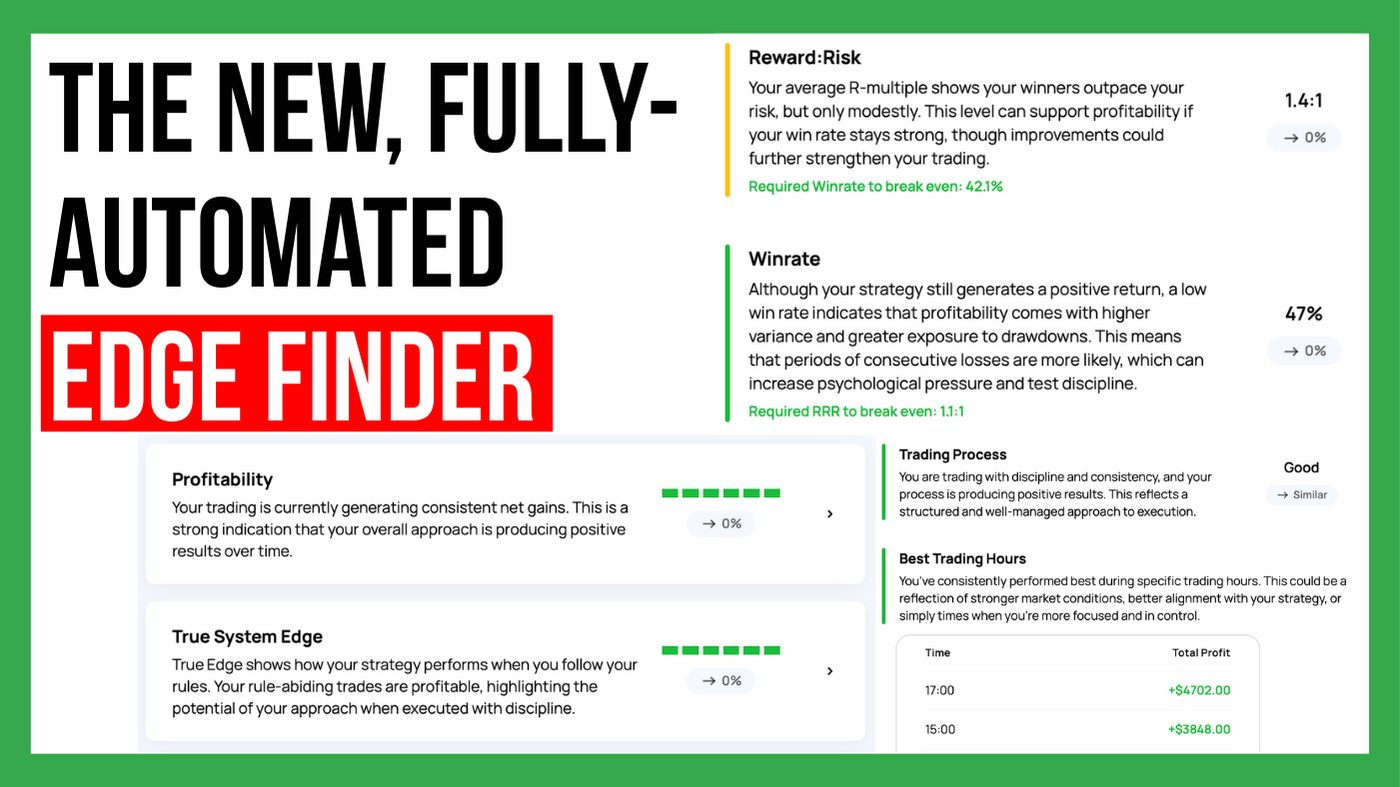

Edgewonk’s custom statistics let you categorize trades by any criteria you want. Over a larger sample size (at least 30 trades), this helps identify which setups and conditions are consistently profitable and which ones underperform.

Exit rules are crucial for locking in profits and minimizing losses. Define:

With Edgewonk, you can evaluate how well your exit strategies work and you can even test alternative stop loss, take profit and trade management techniques for each of your entries.

Backtesting uses historical data to evaluate how your strategy would have performed in the past. Tools like MetaTrader and TradingView are great for this purpose, but integrating Edgewonk afterward is key to refining your approach.

Once backtesting is complete, input the data into Edgewonk to:

Edgewonk’s custom statistics feature allows you to track metrics unique to your strategy, giving deeper insights than generic performance reports from your broker or back testing tool.

Risk management is the backbone of any successful trading system. A common rule is to never risk more than 1-2% of your trading capital on a single trade. This also depends on your historical win rate (which you get from the backtest) and drawdowns plus personal risk tolerance.

Proper use of stop-loss orders and calculated position sizing protect your capital. Define stop-loss levels for each trade based on technical indicators, price action or volatility and use them consistently.

Edgewonk’s tools can help by:

By actively managing risk, you set a foundation for long-term success and minimize the impact of market volatility.

Testing your strategy in a demo account is an essential step before risking real money. Use this phase to:

Edgewonk can still be used during demo trading. Track your trades in the journal to evaluate whether your system performs as expected under real-time conditions.

With Edgewonk, you can document each trade, including the reasoning behind it. Its emotional analytics feature helps you recognize how emotions impact your decisions, even in a risk-free demo environment.

After proving profitability over a sample size of at least 30 trades (the more the better), you can then transition to live trading. Start small to manage psychological pressure.

Trading is a dynamic process. Markets evolve, and so should your system. Edgewonk’s efficient feedback loop helps by:

Highlighting trends and outliers in your performance, so you can make timely adjustments based on data, not based on hunches.

Pinpointing areas that need adjustment, such as overly tight stop-losses, bad trade management, breaking your system’s rules, and so on.

Discipline is crucial for trading success. Edgewonk’s Tiltmeter measures how consistently you follow your system and provides actionable feedback to improve adherence.

Stay engaged with trading communities and educational resources. Edgewonk integrates learning into your workflow by offering automated analysis notifications that encourage reflection and improvement.

Developing your own trading system is a journey of refinement and learning. Building your system step by step is vital, and only with a tool like Edgewonk is it possible to design a profitable system by gaining insights into detailed analytics.

Are you ready to start designing and optimizing your trading system? Try Edgewonk today to supercharge your trading career.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...