The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

4 min read

Rolf Apr 28, 2024 5:55:00 PM

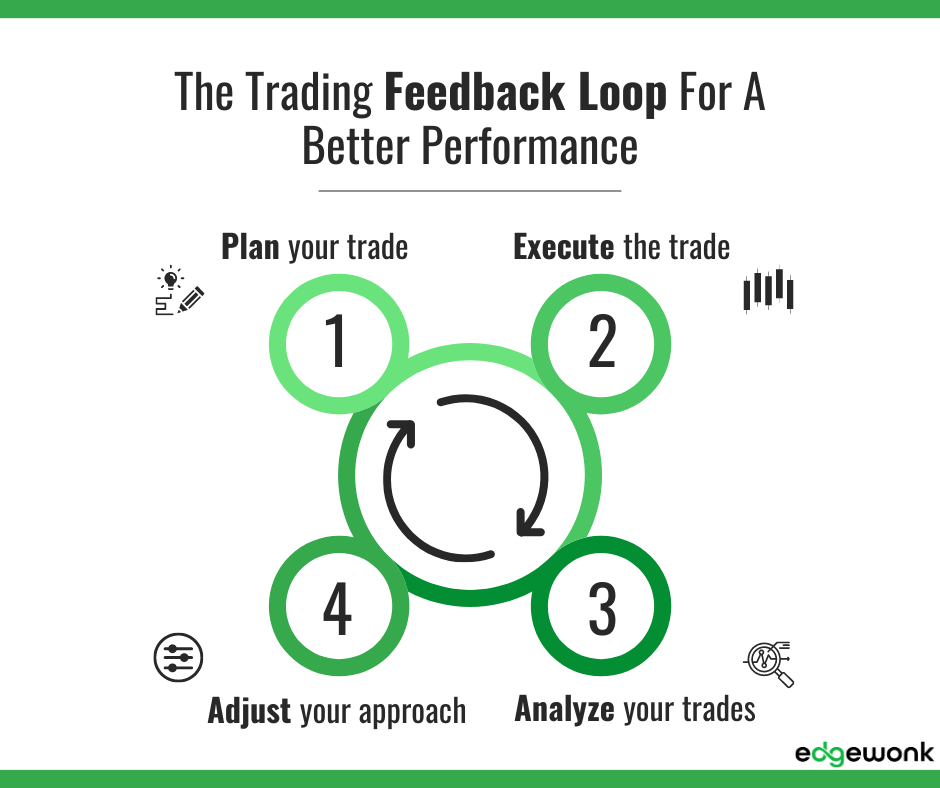

Imagine consistently profiting from the markets, not through luck, but through a method you've developed and continuously improved. That's the power of a feedback loop in trading. A feedback loop is a process where you analyze your actions, learn from them, and adjust your approach to get better results.

Feedback loops exist in many areas, from engineering systems to biological processes. In the world of trading, a well-defined feedback loop is essential for sustained success. While intuition and gut feelings can play a role, a consistent and methodical approach built on a feedback loop separates consistently profitable traders from those who struggle. This article will guide you through creating the perfect feedback loop for your trading journey, helping you refine your strategy, avoid costly mistakes, and ultimately achieve your trading goals.

Without a feedback loop, trading becomes a guessing game. Traders might chase hot trends or jump from strategy to strategy based on recent market movements. This reactive approach lacks a foundation in analysis and often leads to missed opportunities, poorly timed entries and exits, and ultimately, losses.

In contrast, a well-established feedback loop encourages a methodical approach. Traders define clear rules for entry and exit based on their analysis, then wait for the market to present those specific conditions. After each trade, they analyze their performance, not just the outcome (win or loss), but also how well their strategy aligned with market behavior. This analysis allows them to identify areas for improvement and adapt their strategy over time. This cycle of analysis and adaptation is what separates successful traders from those who struggle to find consistency.

This continuous cycle forms the core of successful trading. Let's break it down into four key steps:

Planning and Waiting:

This stage involves defining clear rules for entering and exiting trades. These rules should be based on your chosen trading strategy and technical analysis.

Once your criteria are set, patience becomes crucial. You should wait for the market to present the specific conditions you defined in your plan, rather than forcing trades.

Executing the Trade:

Here, you'll place your order based on the pre-defined entry and exit criteria.

It's important to have a solid execution strategy to ensure you enter and exit trades efficiently and at the desired price points.

Analyzing Your Trades:

This is where the feedback loop truly comes into play. It's essential to record all your trades in a trading journal, including details like entry/exit prices, the rationale behind the trade, and the final outcome.

Analyzing past trades is crucial. Go beyond simply labeling a trade as a win or loss. Dig deeper and assess how well your strategy aligned with market behavior during that trade. Identify areas where your strategy worked as planned and areas where it fell short.

Refining Your Strategy:

Based on your trade analysis, identify areas where your strategy could be improved. Did your entry criteria miss key factors? Were your exit points too tight or too loose?

It's important to make adjustments based on your findings, but avoid overreacting to a single bad trade. Continuous learning and adaptation are key, but so is maintaining a level-headed approach to strategy refinement.

Remember, successful traders constantly adapt their strategies based on market conditions and their own evolving understanding.

Now that you understand the four steps of the feedback loop, let's delve into how to build a system that optimizes your trading journey.

Journaling Best Practices:

Record Key Details: Your trading journal should capture essential information for each trade, including entry and exit price, date and time, trade size and direction (long or short), the reasoning behind the trade (what triggered your entry and exit?), and any relevant market news or events that might have impacted your decision. Most of those data points, you can directly import into Edgewonk from your broker.

Effective Analysis Techniques: Don't just record data; actively analyze it. Look for recurring patterns in your wins and losses. Did certain technical indicators consistently lead to successful trades? Were there specific emotional states that clouded your judgment? Journaling software can help with visual representations of your performance.

Analyze Objectively: Don't let emotions cloud your analysis. Focus on how well your strategy performed, not just the win or loss result. Did the market confirm your entry and exit criteria, or were there unexpected factors that impacted the trade?

Adapting Your Strategy:

Based on your analysis, you might identify areas for improvement in your strategy. Here are some common adjustments:

Risk Management: Perhaps your stop-loss levels were too tight, leading to unnecessary exits during normal market volatility. Alternatively, maybe your position sizing was too large, exposing you to excessive risk. Refine your risk management practices based on your findings.

Entry and Exit Criteria: Your analysis might reveal weaknesses in your entry or exit criteria. Maybe your entry signals were too lagging, causing you to miss good opportunities. Or perhaps your exit criteria were too rigid, leading you to hold onto losing trades for too long. Refine your entry and exit criteria based on your analysis.

Over and Underperformers: There are often certain aspects of one’s trading approach that provide a significant overperformance and are responsible for the majority of the positive returns. Finding such aspects in your journal can help traders shift their focus to the best-performing trades to leverage their strengths.

Remember: Don't chase every perceived weakness and do not change your strategy based on a single trade outcome. Adjust cautiously based on a large enough sample size and test them thoroughly before implementing them in live trading.

Maintaining Discipline:

The feedback loop thrives on discipline. Sticking to your plan and avoiding emotional trading are crucial. Don't let fear or greed cloud your judgment. If the market doesn't present the setup you defined, stay patient and wait for the right opportunity.

Continuous Learning:

The market is constantly evolving. Successful traders are lifelong learners who continuously adapt their strategies based on changing market conditions and their evolving understanding. The more you learn, the better equipped you'll be to refine your feedback loop and achieve consistent success.

The journey to consistent trading success isn't a sprint; it's a marathon. By implementing a well-defined feedback loop, you'll transform your trading from a series of reactive guesses into a methodical approach fueled by continuous learning and adaptation. Remember, even the most experienced traders encounter losses. The key is to analyze those losses objectively, refine your strategy accordingly, and maintain the discipline to stick to your plan. With dedication and a commitment to improvement, your trading feedback loop will become your most valuable tool on the path to achieving your financial goals.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...