The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

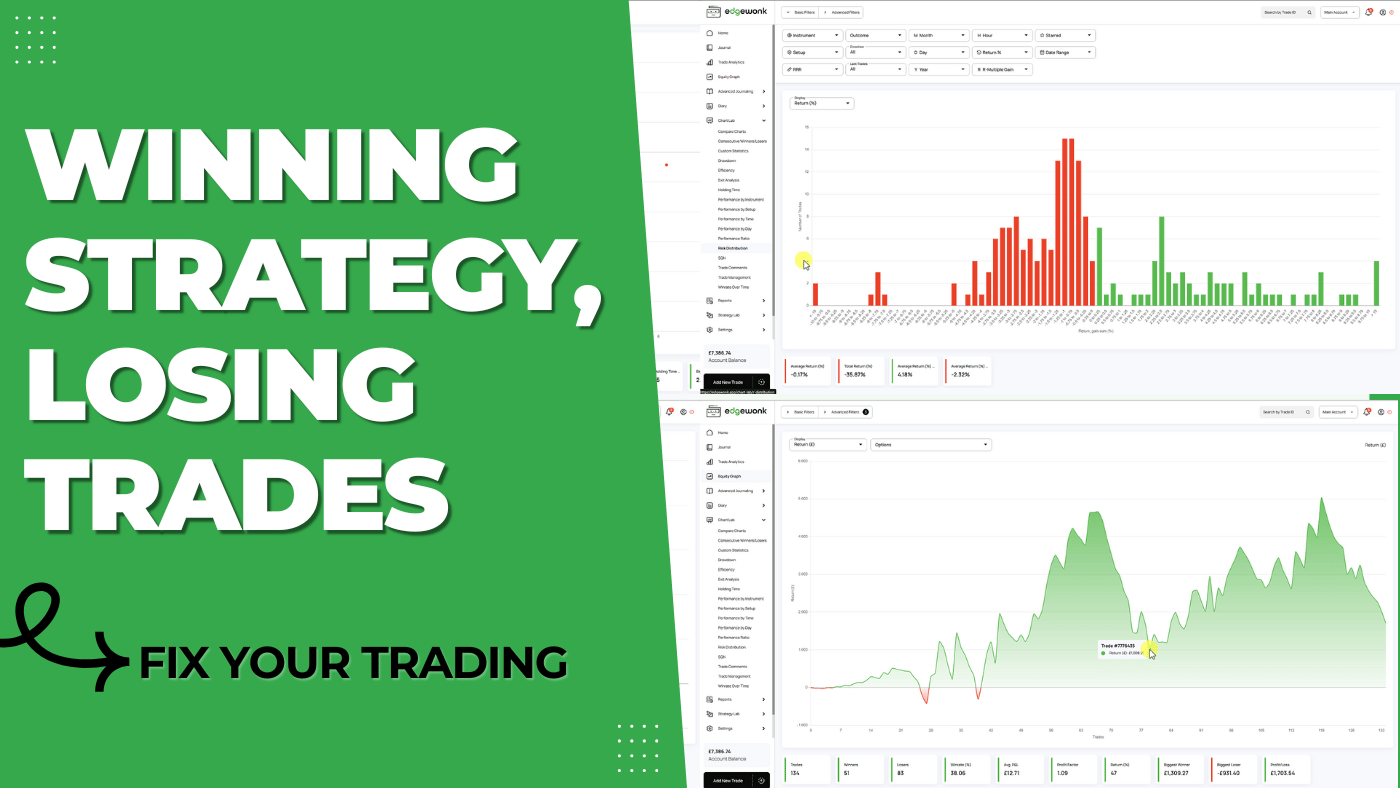

In today's Edgewonk Journal Review, we take a deep dive into the trading records of one of our customers, uncovering key insights that could transform his trading results. The analysis reveals significant patterns, areas of underperformance, and opportunities for improvement that will resonate with many traders who struggle to turn their strategies into profit.

Starting with the overview, we note that this trader’s performance hasn't been great: a win rate of 33% across 209 trades and a net return of -35.8%. While this looks discouraging, a deeper analysis uncovers compelling insights.

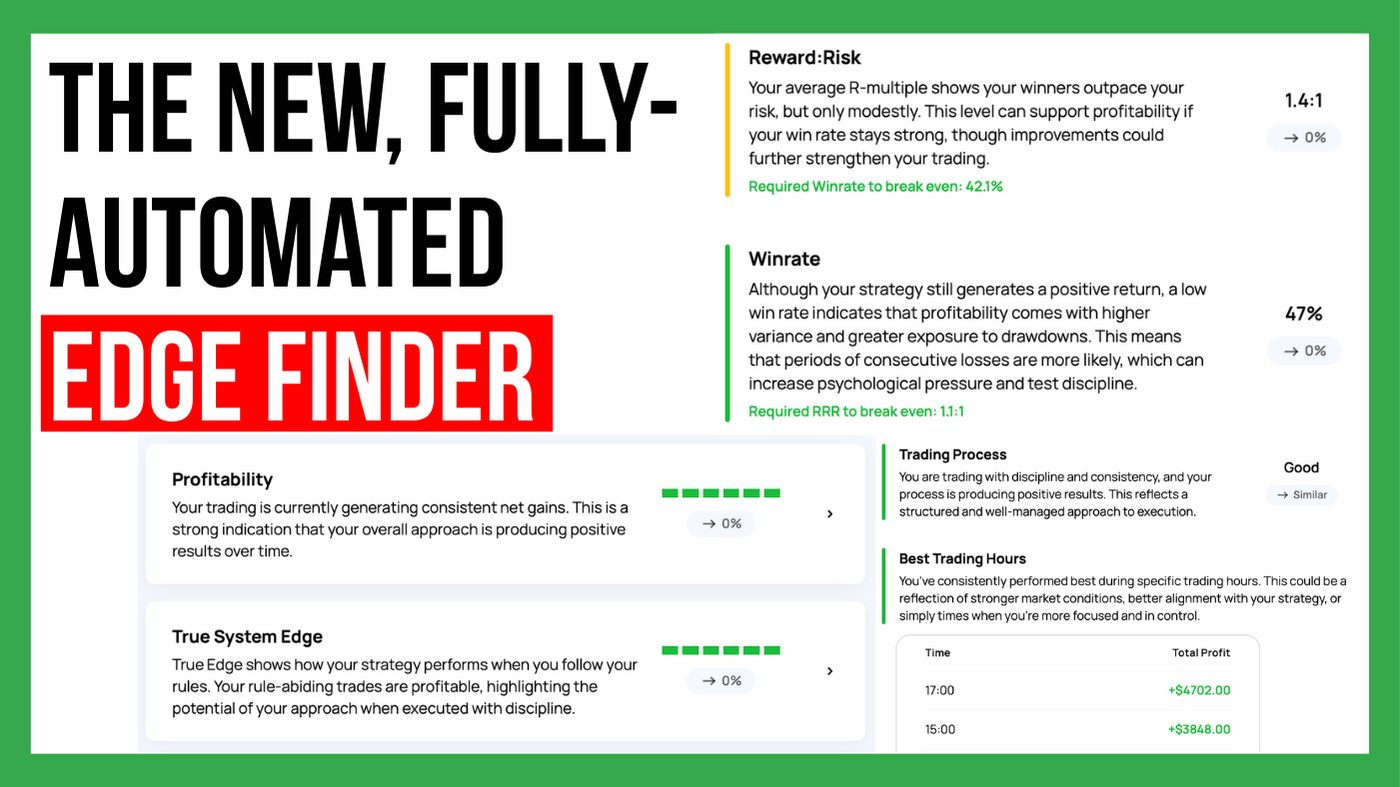

Filtering out trades that were marked as “not in plan” changed the game entirely. By excluding approximately 60 trades, the dataset shrunk to 134 trades, and the net return shifted from -35.8% to a profitable +47%.

This transformation highlights an essential truth: sticking to a plan is vital. Straying from predefined rules can make the difference between success and failure.

For this trader, the finding that the core of his trading is actually profitable should boost his confidence significantly.

Another compelling observation was in the risk distribution chart, revealing two trades with losses greater than 10%. Filtering these two outliers reduced the overall net return loss significantly—from -35.8% to -4%, and an almost break even performance.

This shift underscores a valuable lesson: a handful of trades with substantial losses can skew the entire performance curve. It’s crucial for traders to identify and control these outliers to protect their bottom line.

Examining these specific trades through the journal revealed that the trader had moved their stop-loss further away, hoping for a reversal that never came. This behavior—delaying loss-taking in hopes of a turnaround—is a common pitfall. What starts as a minor setback can snowball into a major loss. Properly adhering to stop-loss strategies could have prevented these detrimental outcomes.

Reviewing some winning trades, the trader had several successful trades that followed the rules meticulously. These winning trades resulted in a collective net return of +67% across only six trades.

This pattern suggests that the trader should invest time in reviewing these successful trades to find out what they have in common and replicate their approach.

For this trader, and any trader in a similar situation, the takeaways are clear:

Stick to the Plan: The review showed that deviating from a well-defined plan led to significant losses. Traders should constantly remind themselves that consistency in following their strategies is key.

Analyze and Reduce Outliers: Identifying trades that significantly skew overall performance and taking steps to avoid or better manage them can result in more consistent profitability.

Review and Reflect: Keeping a detailed journal with personal notes and regular end-of-week or end-of-month reviews is crucial. These reviews help traders track progress, understand recurring mistakes, and reinforce successful behaviors.

Adhere to Stop-Loss Strategies: Holding onto losing trades in the hope of a turnaround is a risky behavior that must be addressed. A strict adherence to stop-loss levels can prevent minor setbacks from becoming catastrophic losses.

This journal review serves as a strong reminder that the core of a trading strategy can be profitable, but discipline and risk management are what transform potential into real results. For this trader, the path forward lies in tightening adherence to rules and focusing on minimizing outliers. With targeted improvements and continued journaling, the shift from underperformance to consistent profitability is within reach.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

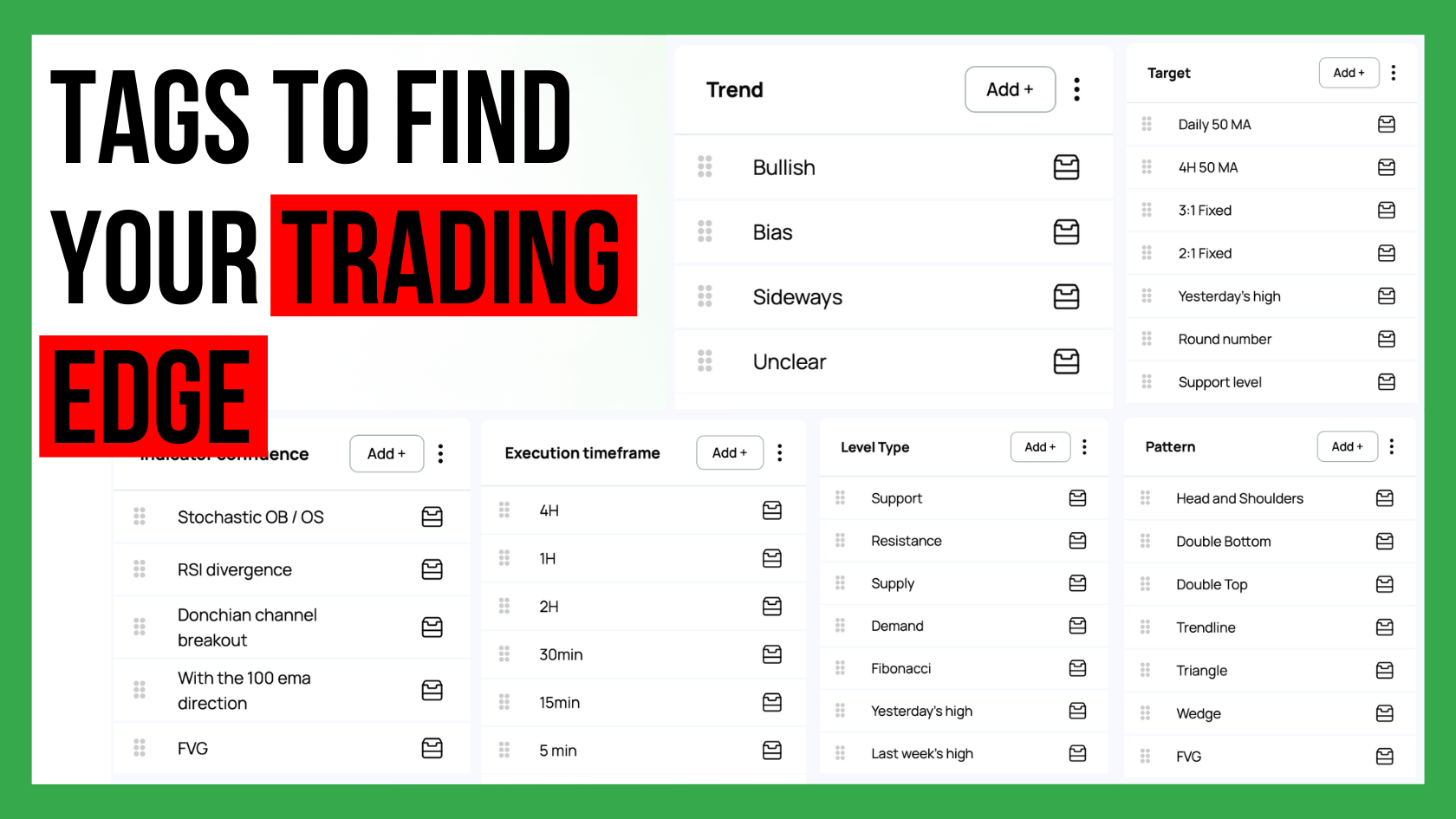

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...