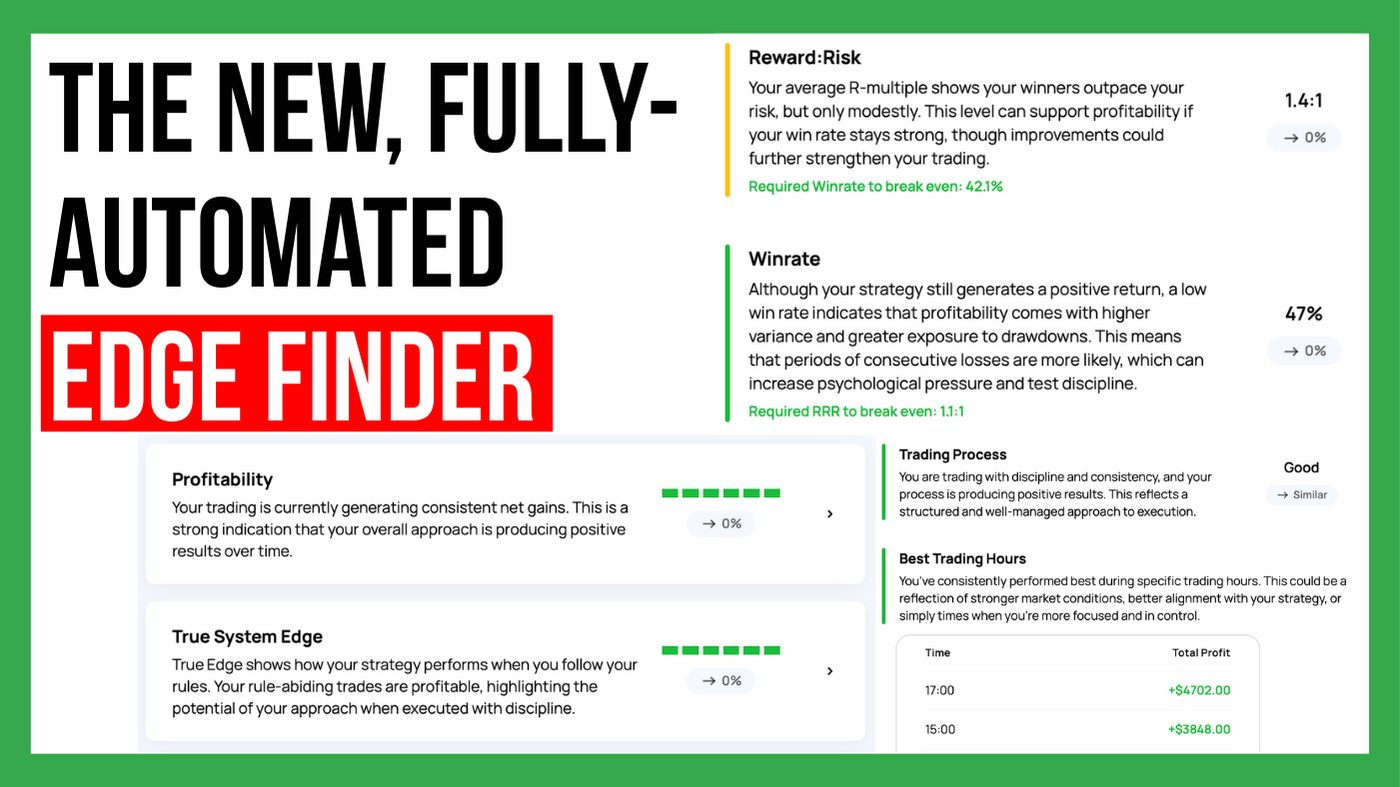

The Edgewonk Edge Finder is here

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Do you ever wonder if your trading journey is on the right track? While every trader's path is unique, clear signs of progress emerge as you hone your skills.

This article reveals 10 signs you're becoming a better trader – and provides actionable tips to accelerate your progress.

Ready to check if your trading is showing these signs of improvement? Dive in and discover whether you're on your way to becoming a confident and successful trader!

The early stages of a trader's journey are often marked by the thrill of immediate action. However, as one progresses, patience emerges as the cornerstone of consistent success. This shift signifies a transition from impulsive reactions to disciplined decision-making based on a well-defined trading strategy.

Instead of chasing every price tick, the improving trader waits for opportunities that align perfectly with their established trading plan, like to a seasoned hunter waiting for the ideal moment to strike. Cultivating patience fosters rational and calculated trade execution, paving the way for a more sustainable and successful trading experience.

Early in their journeys, many traders struggle with the emotional rollercoaster of the market. Losses can trigger intense feelings of anger or frustration, leading to revenge trading and over-trading. This impulsive attempt to recoup losses often results in further losses, creating a vicious cycle.

As traders develop, they learn to manage their emotions effectively. They understand that the market is not personal, and losses are simply part of the game. They also don’t see their emotions as an enemy but see them as a helpful indicator that something must have gone wrong in their trading when intense emotions surface. This detachment allows traders to make objective decisions based on strategy, not fleeting emotions.

One of the most crucial improvements for developing traders is reducing the occurrence of large losses. New traders often fall prey to the "hope syndrome", hanging on to losing positions in the unrealistic expectation of a market reversal. This can quickly snowball a small loss into a much larger one, significantly impacting their overall profitability.

Seasoned traders, however, learn to reduce downside risk through effective strategies. They employ stop-loss orders, which automatically exit a trade once the price reaches a predetermined level. This disciplined approach protects their capital and allows them to preserve their hard-earned profits for future opportunities. By letting go of losing positions and focusing on capital preservation, developing traders pave the way for sustainable trading success.

As traders progress, they develop a disciplined approach to risk management, reflected in their consistent position sizing strategy. This practice ensures that each trade carries a predictable level of risk relative to their total account size. By adhering to a predefined percentage, they avoid the temptation to increase the position size on "sure-fire" trades or overcompensate for losses.

This consistency eliminates the risk of outliers, where a single trade disproportionately impacts their account. This measured approach allows traders to focus on strategy execution and trade quality rather than being influenced by emotional impulses or market noise. By maintaining consistent position sizing, developing traders gain greater control over their risk, paving the way for long-term success.

Developing traders recognize the importance of proactive planning. Unlike impulsive entries, they take the time to analyze the market and formulate a specific plan before entering a trade. This plan typically includes entry and exit points, identified using technical analysis or other strategies. Additionally, they consider factors like risk management and potential profit targets.

This structured approach allows traders to approach the market with clarity and purpose, reducing the risk of making emotional or reactive decisions. By planning their trades in advance, developing traders set themselves up for a more disciplined and successful trading journey.

A defining trait of developing traders is the acceptance that losses are an inevitable part of the process. They abandon the pursuit of a mythical "holy grail" trading system with a perfect win rate, recognizing that even the best strategies will experience losses and drawdowns. This realistic outlook reduces frustration and frees traders to focus on the essential aspects of their strategy.

By accepting that losses are a natural part of the game, traders can analyze them objectively, extracting valuable insights rather than dwelling on them emotionally. This shift in perspective allows developing traders to move forward with greater clarity, refining their approach for improved long-term results.

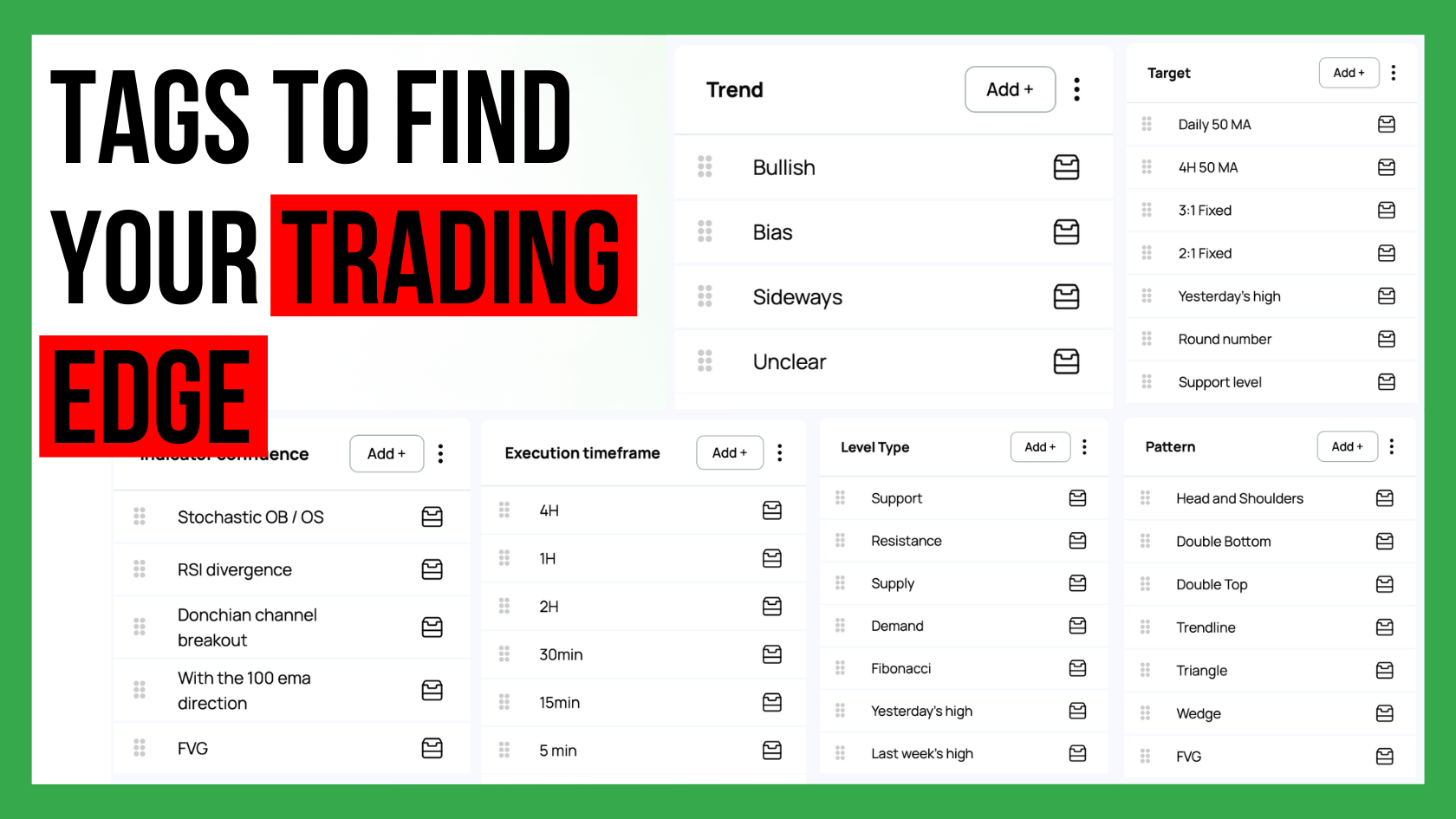

Developing traders understand the crucial role of self-accountability and objective analysis. They maintain a trading journal, like Edgewonk, recording details of each trade.

By diligently reviewing their Edgewonk trading journal, traders can objectively assess their performance, identifying areas for improvement. They refine their strategies and make decisions for future trades using a data-driven approach. This approach is free of emotional bias.

Through consistent journaling and objective analysis, developing traders embark on a path of continuous learning and growth. This commitment to self-improvement sets them apart from those who struggle to take ownership of their performance and remain stagnant in their development.

As developing traders gain experience, they integrate stop-loss (SL) and take-profit (TP) orders into their trading strategy. These automated tools offer significant benefits in managing risk and securing profits.

SL orders are crucial tools to protect your trading capital and prevent emotions from influencing trading decisions. Conversely, TP orders ensure profits are locked in and not left vulnerable to market fluctuations.

By utilizing these tools effectively, developing traders take a disciplined approach to managing both risk and reward. They begin to analyze their order placement, evaluating the effectiveness of their entry and exit points. This analysis allows them to refine their strategy and make informed adjustments for future trades, fostering continuous improvement in their trading journey.

Developing traders discover the power of a consistent routine. This structured approach to their trading day optimizes their performance and promotes a sense of discipline. Their routine typically includes dedicated time slots for:

By adhering to this routine, developing traders minimize distractions and maximize focus during key trading activities. Such a structure promotes mental clarity and emotional control which are crucial for successful trading.

As traders evolve, they recognize the critical role of mental and physical well-being in their overall success. They understand that a healthy mind and body are essential for clear thinking, emotional control, and sustained focus. This commitment to self-care often involves:

By actively investing in their well-being, developing traders cultivate a sustainable and healthy approach to trading. This holistic perspective allows them to approach the markets with greater clarity, resilience, and focus, ultimately paving the path for long-term trading success.

Developing traders often fall into the trap of focusing solely on how much they still must learn, forgetting about the significant progress they've already made. Recognizing how far they have come, however small, is crucial for maintaining motivation and staying on the path to success.

Here's where a trading journal, especially one designed like Edgewonk, becomes invaluable. It allows traders to track their journey, recording not just trades but also their thought processes, emotions, and lessons learned. By revisiting these entries, traders can witness firsthand the improvements they´ve made in areas like:

Taking the time to celebrate these advancements, even seemingly minor ones fuels traders´ intrinsic motivation and reinforces positive trading behavior. Remember, progress rarely happens overnight. Embrace the learning curve, celebrate wins, and utilize a trading journal to track your journey and propel forward with confidence.

Most trading platforms are currently adding AI chatbots that let users interact with their data. The promise sounds great. Ask your journal anything...

Custom statistics can turn a trading journal into a powerful source of insight because they show the specific conditions that shape your performance....

Choosing how many trading strategies you should trade is one of the most important decisions for long term success. Many traders believe that more...